For most teenagers the focus is on partying and having fun, with thoughts of the future firmly in a different realm. But when they were teenage sweethearts, Darius and Dorothy Darisman had a different focus.

They knew they wanted to get married and spend their lives together, so their focus was on owning their own home. Every weekend they would drive to different attractive suburbs in their native Perth and look at the type of waterside houses they wanted to live in.

At 21, with a deposit made up of $7,500 savings plus $7,600 borrowed from Dorothy’s parents, they purchased their first home in St. James in Perth. It cost $151,000 and they viewed it as the start of their portfolio.

Unfortunately, just two years later, the company Darius worked for closed down and he lost his job. After several months of job – and soul – searching, the young couple decided to rent their house and move to Sydney.

This proved to be a great decision as it led to the true start of their property investment adventure, Darius says.

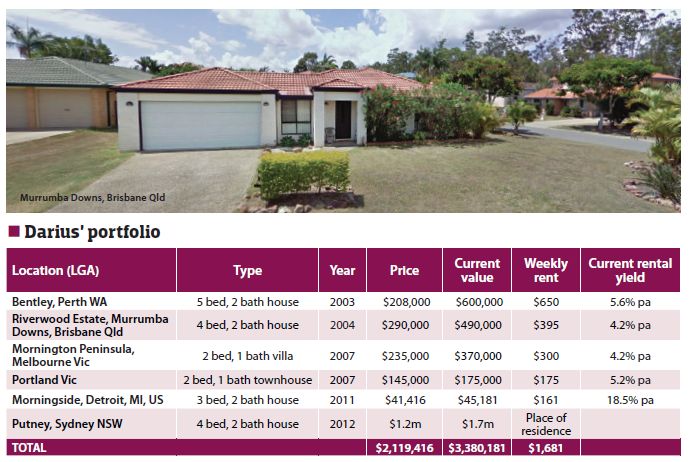

Now, 12 years later, the couple own six properties (including their place of residence) which are worth $3.3m. At one stage they owned 16 properties, but two years ago they sold off a few to consolidate their equity and buy their dream home.

Moment of clarity

Not long after arriving in Sydney, he noticed that the wife of one of his new workmates was buying a lot of investment properties. When he asked his friend how she managed it, his friend recommended he attend a seminar.

That seminar was run by the now discredited spruiker Henry Kaye. Darius says he quickly realised that Kaye was trying to sell his own developments, but he thought the actual material he was teaching was inspirational.

When Kaye warned there would be no pension by the time of retirement so it was necessary to do something now or die poor, it triggered a light-bulb moment for Darius. “Dying poor or living poor was never an option for how I wanted to live my life! It was the fear of living poor, and just slugging away in a nine-to-five job, that was initially my biggest driver for success.”

Not only did he want to live well but he and Dorothy wanted to be able to purchase their dream waterfront mansion in a good area of Sydney. Kaye’s seminar pushed those goals to the forefront of his mind.

It was a three-day seminar and on the second day he was inspired to go out and buy the couple’s second

property. This property, which is in Bentley in Perth, has proved to be one of their best investments.

Property focus:

THE GREAT DEAL

Property type: 5 bed, 2 bath house

Purchase price: $208,000

Current value: $600,000

Current rental yield: 5.6%

Location: Bentley, Perth WA

Darius says that, over a period of months, he had noticed the property kept turning up in sales brochures he was sent by a local agent. On day two of the Kaye seminar, they were taught about spotting discounted properties and buying from desperate vendors.

He immediately thought of the Bentley property. He knew it was a four-bedroom, two-bathroom house about seven kilometres south of the Perth CBD. But he found out more.

“It turned out the house was a newlybuilt brick house – with an aluminium steel frame, so termites would never be a threat. Plus it was just five minutes from Curtin University and a TAFE campus, so it had a ready tenant pool.”

The vendor had moved to Singapore and left the house completely empty, which was the main reason it wasn’t selling. By the time Darius became interested, the property had been on the market for about a year, with an asking price of $245,000.

After a rapid visit to a bank to get a pre-approved loan of $200,000 with 80% LVR, he put in an offer of $200,000. He told the agent, who was the principal, that he would be better off selling the home to him rather than to a family. “I said that as I was an investor, I would hand the property back to his office for leasing - and his business would benefit more."

This tactic worked and he managed to buy the property for $208,000. Several years later, he and Dorothy decided to convert it to a five-bedroom house and rent it to students.

Darius says it has turned out to be the couple’s most successful investment overall. “It is now worth $600,000, earns $650 per week in rent and we have never had any problems with it.”

- Don’t just consider the price of a property. You need to look further. If a property is going cheap, always look into why it is so cheap.

- Always go to the property that you are buying to check it out yourself – and have a chat to the neighbours while you are there.

- It is not enough for there to be some amenities or a nice beach near a property you are interested in. Thoroughly research the diversity and state of the local economy.

- Don't blindly trust your money with someone else. It is better to do your own research and make your own purchasing decisions.

- Don’t give in to the hype and buy in a boom because you are less likely to make a profit down the track.

- If you don’t put what you learn into action, you won’t make a profit.

- Stick to what works for you and don’t experiment with too manyother things which could end up wasting your time and money.

Property focus:

THE DISAPPOINTMENT

Property type: 2 bed, 1 bath

townhouse

Purchase price: $145,000

Current value: $175,000

Current rental yield: 5.2%

Location: Portland, Victoria

Over the course of any property investment journey, there are bound to be ups and downs. For Darius and Dorothy, there have been a few disappointments – including a Melbourne subdivision project and a SA beachside property.

But it is their townhouse in Portland, Victoria, which rankles most. This is not just because it has been a negligible performer, but because they let their usual practices slip and went with a buyers group for the investment.

The two-bedroom, one-bathroom townhouse is in a group of 12. It is located in a coastal part of Portland, just five minutes from the beach. It cost the couple $145,000 (with 80% LVR) in 2007. Not long after the purchase, the body corporate decided to do a renovation job on the group. This added a further $10,000 in value to each townhouse.

On paper this all looks positive, Darius says. “But, in reality, it was not a good investment. The performance has been very average. And we consider it a bit of a mistake.”

They had become a bit too relaxed and comfortable, he says. They put their confidence in a buyers group and didn't do their own research or personally view the property, both of which they had always done previously.

It turned out there was an oversupply of that type of housing in the area and the local economy was a bit slow. As a result, the property is now worth just $175,000 and attracts only $175 per week in rent.

They made a few mistakes that they won't be making again, he reflects. “The wisdom of our usual practices was reinforced. We won’t go with a buyersgroup or agent again and, as we did prior, we will always do our own research and check out the property ourselves.”

Property focus:

THE US VENTURE

Property type: 3 bed, 2 bath,

2 storey house

Purchase price: $41, 416

Current value: $45,181

Current rental yield: 18.5%

Location: Morningside, Detroit,

Michigan, US

A few years ago, when the US property market was full of bargains for overseas investors, the couple decided to brave the US market. They knew there were risks, but they were willing to give it a go for the returns that were being reported.

After some rigorous research, largely using online tools – in particular, a website that provided the detailed sales history of properties - Darius identified an attractive prospect in Detroit. The two-storey, three-bedroom, two-bathroom brick house was in a affluent suburb right next to Lake Michigan.

It was going for US$38,500 (A$41,416) and it seemed like good value for a cheap price, he says. “The sales history told me that it had sold for US$150,000 in 2008, so we are hopeful that it could accumulate value to that point again sometime in the future.”

So far that has not proved to be the case. The property is currently worth US$42,000 (A$45,181) and gets US$150 (A$161) per week in rent. Darius says it turned out that, in Detroit, house values are volatile and can vary hugely from street to street.

Further, there have been some challenges with the property. At one point, they had a tenant who refused to pay the rent and had to be evicted. Their original property management company did not perform well and they had to change companies.

Selling the property isn’t realistic, Darius says. “At this point, agents say we would have to sell for less than we bought it for. But we bought it through our SMSF [self-managed super fund] and planned to buy and hold anyway. So we’ll just have to see what happens with the market in future.”

Property focus:

THE DREAM HOME

Property type: 4 bed, 2 bath

riverside house

Purchase price: $1.2m

Current value: $1.7m

Current rental yield: principal

place of residence

Location: Putney, Sydney NSW

In the first 10 years of their investment journey, the couple acquired 16 properties. But they always held true to the dream of a waterfront mansion for their family home. In 2012, with a baby on the way,they decided to consolidate their holdings in order to buy that home.

After selling a number of their properties, including their very first in St. James (which sold for $480,000), they had enough equity for a significant purchase. Using a 20% deposit, they bought a four-bedroom, two-bathroom riverside home in Putney in Sydney for $1.2m.

The house ticked all the boxes they had dreamt of for years, while Putney itself was a location that met their usual selection criteria. Darius says they look for properties near public transport, school, local shops, business parks or employment hubs and, if the budget allows, near parks and water and within a 15km radius of the CBD.

"Our home is 10 kilometres north-west of the Sydney CBD, on the banks of the Parramatta River, is well served by public transport and has a range of decent amenities nearby. So it’s perfect and – given the state of the market – should see good capital growth in future.”

Since they purchased the property, they have done some renovations which have helped boost its value to $1.7m. The cosmetic renovatioons have included redoing the bathroom and kitchen and repainting, but they are planning some more extensive renovations. They expect the next stage of renovations to increase the value of their home further.

Building on the dream

Darius – who now works as an investment property consultant himself – says buying more property is on the cards. When doing so, they will continue to pursue the strategies that have worked for them so far.

This can be summed up as buying the right type of house, within budget, in the right location, doing some renovations if worthwhile, and holding while watching the compounding growth over time. “Then, if necessary or to gain some funds, sell during a boom time.”

As for personal goals, the couple’s driving motivation was always getting their dream home in Sydney. Now they have achieved that they are happy and feel financially secure, he says.

“But we are keen on selfimprovement and growth… So we do still have financial goals for our family's future, which we are committed to working towards.

“For example, we aim to bring down our personal home mortgage until it’s paid off and have some investment properties which are positive at the end,” he adds.

This feature is from the September issue of Your Investment Property Magazine. Download the issue to read more.