Ian Hosking Richards is a big believer that what you want matters more than what you have, that if you do nothing you will have nothing, and that your resourcefulness is much more important than your resources.

This mindset can apply to many aspects of life, one of which is property investing. For Ian, the key to being a successful investor is to simply set goals, know your numbers and take action.

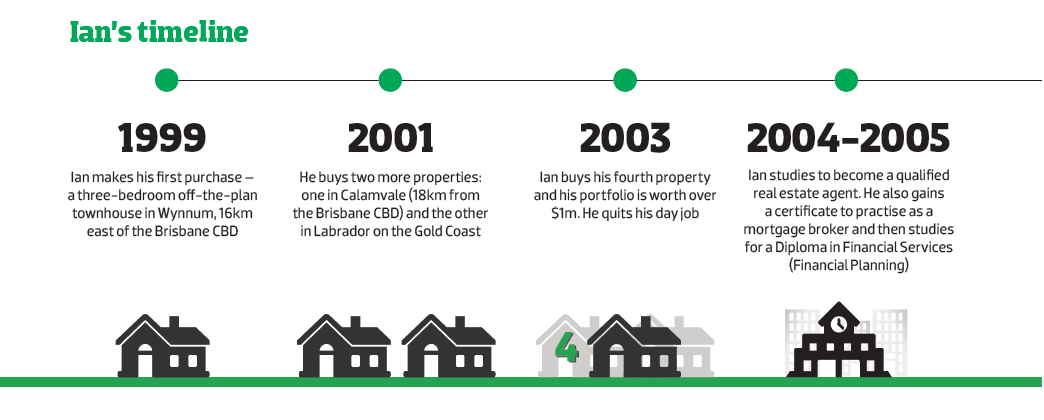

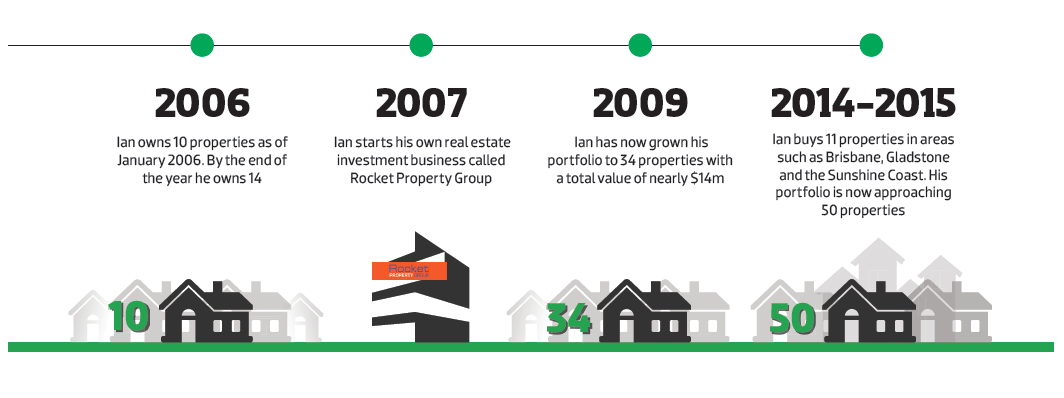

“I started 15 years ago with virtually nothing,” he says. “I was in a low-paying job and I didn’t have much for a deposit.” Indeed, Ian arrived from England in his ’30s, having originally planned to stay in Australia temporarily on a ‘working holiday’.

Fast-forward to 2015 and he is a few properties shy of his goal of 50, which is yet another milestone he can cross off his list.

And in the past 24 months alone he has bought a whopping 11 properties, of which 10 are located in the Queensland suburbs of Milton, Peregian Springs, Gladstone (four properties), Greenslopes,Bowen Hills, West End and Kangaroo Point. Additionally, one is situated in the inner-Sydney suburb of Darlinghurst.

“I see property as the ideal vehicle to create wealth over time so I can live in a nice house and drive the cars I like and take expensive holidays,” he says.

But if you want to create a large asset base over a fairly short amount of time, you really have to rely on leverage, he says.

How does he do this? By targeting affordable properties that are going to pay for themselves, go up in value, and not cause him any problems.

Where Ian is buying now

● Inner-city Brisbane

Over the past 24 months Ian has been targeting inner-city Brisbane, which he believes is at the right stage of the property cycle to buy.

“Brisbane has been fairly subdued for the last few years, and I think it is incredibly undervalued,” he says.

He believes this is particularly true compared to the NSW capital because, if you look back at 2008, the median price difference between Sydney and Brisbane was only about 10%.

These days, the difference seems to be heading towards 40%, and in particular areas the price difference is even higher, Ian says.

“And historically Brisbane tends to follow Sydney,” he adds. “So Sydney goes and then two or three years later Brisbane follows.”

In this area, Ian has been buying a mix of one- and two-bedroom units because that is what his target tenants

(young professionals on good incomes) are looking for.

“I am always looking for a premium tenant who will pay top dollar for the right property in the right location,” he says.

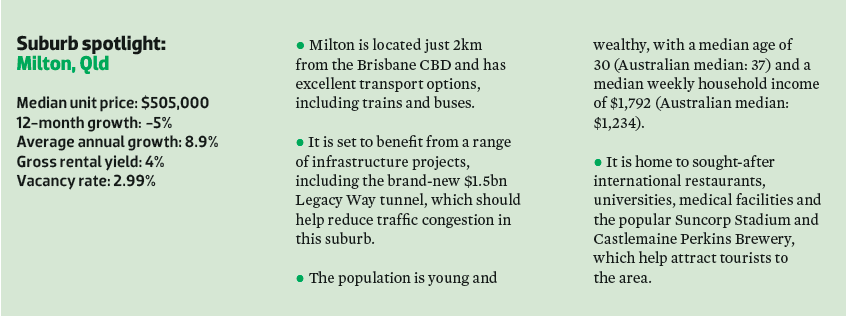

The suburbs he has focused on include Milton, Greenslopes, Bowen Hills, West End and Kangaroo Point. One deal that stands out is an off-the plan two-bedroom, two-bathroom unit he bought in Milton last year for $555,000.

“It’s on the seventh fl oor so it is going to have amazing city skyline views and is only 100 metres from Milton train station,” he says.

It’s an especially good deal considering how much the equivalent property would be in Sydney.

“If you try and go 2km from the Sydney CBD and you want a brand-new 100sqm apartment with parking, amazing city views and 100 metres to the train station, I am guessing you would be paying about one and a half million for that,” Ian says.

Construction on the building commenced at Christmas, so it’s only two or three storeys out of the ground, he says.

“I reckon it’s already gone up about $40,000, so that’s pretty good,” he adds.

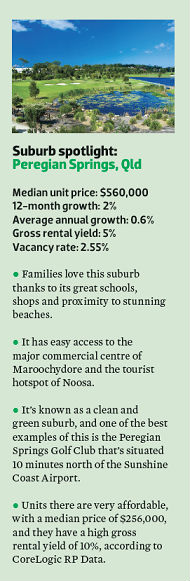

● The Sunshine Coast

In terms of investment potential, it’s wise to follow infrastructure development, says Ian.

And at the moment there is plenty of that happening on the Sunshine  Coast.

Coast.

Projects include:

● The Sunshine Coast Public Hospital, which is expanding to meet the increasing demand for hospital services in the area. The $1.8bn development is the largest infrastructure project that the Sunshine Coast has ever pursued.

● The $347m Sunshine Coast Airport expansion, which is estimated to create more than 2,000 jobs in the community and expected to boost the Sunshine Coast economy by $4.1bn.

● The $350m Sunshine Coast Plaza expansion, which is expected to create thousands of jobs in construction and more than 1,000 retail jobs on completion.

● The new CBD to be built at Maroochydore, where the council has acquired a 53ha golf course so the building of infrastructure can go ahead.

Ian argues that the interesting thing about the Sunshine Coast is that most of the activity is in the south of the area.

“There is a university down there and a huge medical precinct that’s being built, so the main drivers are down in the south,” he says.

He also thinks the Noosa area is an aspirational and blue-chip section of the Sunshine Coast that’s definitely good value.

“You have got a lot of owner occupiers up there,” Ian says. “There are not a lot of properties out there to rent, so they are very easy to rent out.”

Ian believes that landlords who own property in this area should target the doctors or professionals who are working in one

of the activity centres in the south.

In particular, he thinks three- or four-bedroom stand-alone houses on parkland or conservation land are appealing to tenants.

In fact, just recently, he bought a property in Peregian Springs that he believes is going to be cash flow positive and easy to rent out. It is a three-bedroom house that he bought for $489,000.

“In the next two or three years I am going to get really good growth from that one,” he says. “On the estate they have a smart school, which is a huge drawcard for families.

“It’s also got a really nice clubhouse, pool, tennis court, gym and shopping facilities, so it’s a really nice community and you can walk to everything.”

Where Ian is looking for the future

One aspect of his portfolio Ian wants to improve on is its geographic diversity. This is because most of his properties are in Queensland, with a few in NSW.

“I don’t own many properties in Sydney, but I do have one which is worth around 10 properties in Queensland because of the capital growth that Sydney has had,” he says.

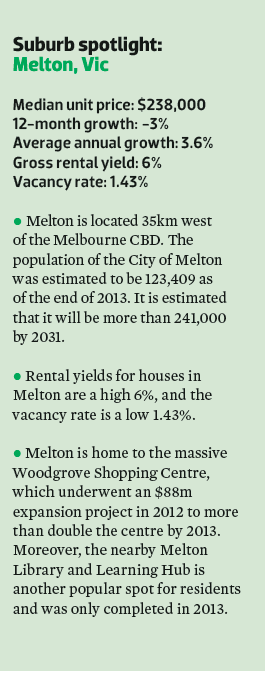

Ian especially likes the western growth corridor of Melbourne, which he believes is affordable and underrated.

Indeed, he says you can buy a brand new house in a master planned community for under $400,000.

“You are 30km from the Melbourne CBD – you have got train links; you have got the motorway; you have got local employment,” he says.

“You try going 30km out from the Sydney CBD and fi nd the same kind of thing – you would be up in the $1m mark.”

Ian says one of the interesting things about Melbourne is that while lots of people like the southeast bluechip area, it is unaffordable for many.

He says if you actually go to the outer western suburbs it’s a nice place to live and not as bad as people think. And the other great thing is that the area provides employment for many people too, he says.

“It’s not like there’s lots of people living there and commuting to the Melbourne CBD,” he says. “It’s all about lifestyle, convenience and living close to where you work.”

Moreover, one area where there is plenty happening is Melton, where he believes there is a master planned community that’s going to set a benchmark for that particular area.

Getting the finance right

“You just get so busy that you let it drift.”

These days, Ian makes sure that his stamp duty and legal goes on his line of credit, so he is effectively borrowing 105%.

“If I borrow 105% from the bank and the total cost of holding that asset is being paid for by the tenant and the taxman, it’s costing me nothing to own,” he says.

“If it’s going up by 10% a year, why wouldn’t you do it?”