A sole parent working in a hectic transport industry position, Tanya was struggling to juggle the balance of work and her three children, let alone think about her financial future. But feeling stressed out, snowed under and time-poor – and at the end of a 20-

year marriage – Tanya decided it was time to make some changes.

“I started Googling and looking for those answers, and I came across Helen Collier-Kogtevs’ website and watched some of her success-story videos. I thought to myself, I want one of those success stories to be me,” Tanya says.

After buying one of Helen Collier-Kogtevs’ books, Tanya became a member of Real Wealth Australia and began taking her first steps toward becoming a property investor.

Initially, being a sole parent gave Tanya serious doubts about her ability to qualify for loans. She realised quickly that she needed to develop a strategy that enhanced her borrowing power. She set up a budget, cancelled her credit cards and paid off all her debts, as she knew that lenders wanted to see a history of being responsible with money.

“I looked at all the things that I could cut – whether that was taking the kids out, or getting my nails done, just so that those extra dollars went into my budget to show the banks that I was a responsible person to lend money to,” Tanya says.

It wasn’t an altogether easy process and getting her finances in order didn’t happen overnight.Tanya spent months diligently reviewing her budget every fortnight and managing her expenses, and at times the stress became difficult to manage.

“I suppose it probably took me a good nine or 10 months before I was ready to buy my first property. I remember Helen called me one day and asked how I was going. I’d had a shocking day at work, and so I walked into a meeting room crying my eyes out and talking to her on the phone,” Tanya recalls.

“Helen said, ‘Don’t stress about it, we’ll sort this all out.’ But after getting off the phone, I just thought, I’ve just got to make this happen. So I put my head down and got it all done.” Eventually, with her finances under control, Tanya then moved onto the next phase of her strategy: researching and purchasing properties.

She understood, from evaluating other successful investors, that the key to success was devising a strategy and sticking to it.

“Your strategy is pretty much your road map. It becomes your framework. I’m very risk adverse, so not only do I have an entry strategy, I have an exit strategy,” she says.

“I try to minimise the risk as best I can with safeguards like additional accounts with three months’ mortgage repayments in them just in case something happens.”

What she didn’t understand was why all investors didn’t seek out the Holy Trinity of investments, which is a property that is positively cash flowed, located in a high growth area, and purchased under market value.

Tanya required a property that ticked all three boxes, as she aimed to increase her borrowing power by gaining fast equity in her investment properties – and she was up to the challenge of sorting the lemons from the goldmines.

So, how did this single-income mum do it?

STRATEGY 1: BUYING PROPERTIES AT A DISCOUNT

Buying under market value is Tanya’s primary goal when reviewing any potential property.

“I buy discounted properties in growth areas with positive cash flow. When I’ve talked to people about it, they tell me that it just doesn’t happen, but through my education I realised that there’s so much information at your fingertips,” she says.

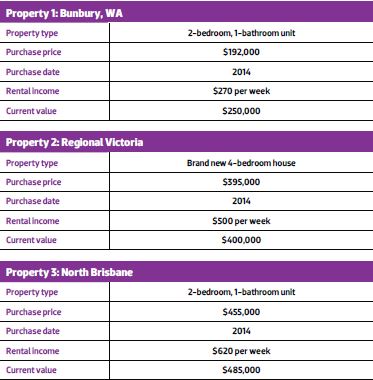

That information led to Tanya uncovering a rare gem of an investment in the west. After reviewing a hotspotting report, Tanya narrowed her search down to a handful of suburbs in regional Western Australia.

“I came across a two-bedroom apartment in Western Australia and discovered it was receiving undervalued rent of $220 per week, when it could have been returning $250 to $270,” she says.

“It was on the market for $225,000 and wasn’t moving. So I asked the questions: why was it so cheap and why hadn’t it sold?”

After some digging, Tanya discovered the agent basically wasn’t doing a good job of marketing the property. For instance, when she contacted them to put in her offer of $210,000, it took the agent a full two weeks later to call back and make the deal.

“When he eventually rang me, he said, ‘They’ll accept your offer.’ I then turned around and said, ‘Look, unfortunately that offer is now off the table. I hadn’t heard from you so my circumstances have

changed. My offer is now $200,000,” Tanya says.

It took another few weeks for the agent to respond to this offer, so Tanya, playing hardball, threatened to walk away. The agent was finally motivated into action and a deal was made.

“He ended up having to completely cut his commission just to talk the owner into accepting my offer, but we ended up getting to a figure of $192,500,” she says. “As soon as I took ownership of it, the rent went up to $250 a week and I’ve had it valued at $250,000. It’s a great result, considering I’ve only owned it since January last year.”

The lower buying price, increased rental income and higher property value not only demonstrated her property savvy, but also meant a boost in the property’s equity, resulting in greater borrowing power for Tanya’s next investment.

.jpg)

STRATEGY 2: HIGH GROWTH WITH POSITIVE CASH FLOW

For her next deal, settled just a few months after her first, Tanya bought a brand new four-bedroom house in a regional town with a big hospital in Victoria. She told the real estate agents that her target rental income was $500 a week, and they effectively told her she was dreaming. “They said, ‘You’re never going to get $500 a week, because the market price for this sort of house is around $420’,” Tanya explains.

Undeterred, and dedicated to achieving her “high growth with positive cash flow” strategy, Tanya advertised by putting a flyer up at the local hospital.

“I ended up getting a bunch of nurses in to rent. There’s one couple in the master bedroom and three other nurses in the other bedrooms, and they all paid me $100 each a week, which means I get my $500 cash flow,” she says.

“That area experienced 8% capital growth last year, and the depreciation I got back at tax time because it was brand new was awesome. So that’s been a really good investment.”

Many would be content with buying two properties in six months, but Tanya was not quite finished. Towards the end of 2014, she settled on her third investment, after using hotspot reports and future development plans to pinpoint an area in Queensland with promising growth potential.

She rang all the property managers in the area and asked what types of properties were in high demand, and then searched diligently until she located a

property that fit the criteria.

“I was lucky enough to come across a four-bedroom, three-bathroom, two car townhouse, and I rang the property managers and asked if it would be popular as a rental. And they said, ‘yes, they are scarce as hen’s teeth’,” says Tanya.

“There were four up for sale and they were going at about the $485,000 mark. I was able to negotiate the purchase price down to $455,000, when the rest of them sold for around the high $400s.”

Tanya is an ideal example of a person who doubted that she could even take a step on the first rung of the property investment ladder on a single income with a family to provide for. However, by educating herself and recruiting experienced mentors, she has secured three properties with plans to add over a dozen more. Tanya’s longterm goal is to own 20 properties in 10 years and see herself retired in the same amount of time.

“I think that if anyone is thinking about finding some financial stability in their life, then working ‘for the man’ with just superannuation is not enough anymore,” Tanya says.

“We need to be looking at other ways that we can sustain our financial future, and the future of our kids. And this, for

me, is certainly the way of doing that.”