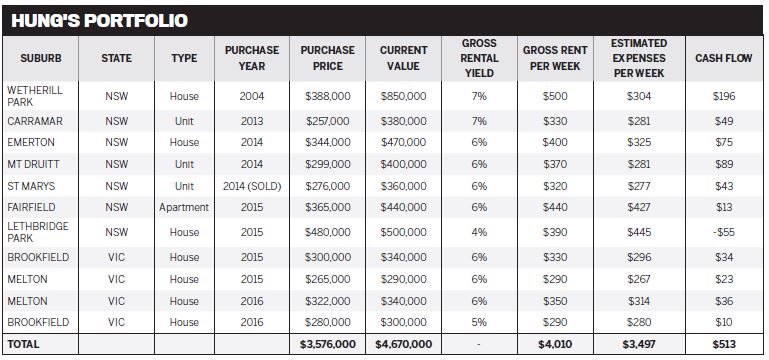

His portfolio may be more than 10 years in the making, but for property investor Hung (Ethan) Xuan Trinh, once he got started in 2014 there was no slowing down. As one of our two Highly Commended nominations in Your Investment Property’s Investor of the Year Awards 2016, Hung tells us about the strategies he’s employed to create $1m in net wealth.

HUNG (ETHAN) Xuan Trinh has a clear and straightforward property goal: to eventually own 20 properties.

“It is a large number and whether I can achieve this or not, only time will tell!” he says.

However, at the current rate that I’m going, if I can purchase two properties a year, within the next five years I will buy another 10 properties. In order for me to achieve this goal, I will need to be careful with my purchases andbuy wisely.”

Buying wisely, of course, is the secret to wealth creation success that property investors Australia-wide are continually striving for.

Hung made the decision to seek out expert help to assist him in finding the right property locations and then negotiating hard for the best price.

Having accumulated a few properties, Hung started to attend property seminars, including a Stuart Zadel seminar that “taught me so much that I didn’t know before about investing”. There were also a number of other people who helped him reach his goals, including his biggest supporters: his dad, Trinh Xuan Tai; his mum, Nguyen Hoa Le; and his four sisters, Hoa, Thuy, Quyen and Diem.

He now knows how to assess the investment potential of a property by comparing the price of the property to the number of bedrooms and bathrooms it has.

“For example, an average house with three bedrooms and one bathroom would have, say, an average price range, whereas a house with four or five bedrooms with two bathrooms should obviously command a high price,” Hung says.

“I didn’t proceed with any purchases, and later I realised my mistake. I should have been looking at cheaper properties that were within my borrowing capacity”

“So what I look for is a house with four or fi ve bedrooms and two bathrooms, but that I can purchase in the average to low price range. If I find a property like this, then I know it has investment potential.”

Going back to go forward

Hung’s property journey actually began back in 2002, when he made the commitment to buy his fi rst property. Earning an average income, it wasn’t going to be an easy journey, but Hung worked two jobs and sacrifi ced many personal luxuries to be able to build his first property deposit.

“I bought my first property in 2004, not with the intention of becoming an investor, but with the intention of settling there as my home. Two years later, I mentored and helped my partner at the age of 21 to save and purchase her first property, and she could not have been happier with her achievement,” Hung explains.

Unfortunately, the relationship didn’t work out, but Hung’s passion for property investing remained.

A few years later, with a little equity in his first property, he approached a number of banks for a loan to purchase his second property.

This was right after the GFC had hit, and Hung, who had a minimal deposit and was earning an average income, had limited borrowing power in a mortgage environment in which the interest rate on loans was above 8%.

“I didn’t proceed with any purchases, and later I realised my mistake. I should have been looking at cheaper properties that were within my borrowing capacity,” he says.

At the time, he had other things on his mind. As many property investors have learnt the hard way, sometimes ‘life happens’, which can derail the plans of even the most organised and proactive investor.

"The year 2012 was not a good year for me. My job at the Defence Gymnasium fi nished, I broke up with my new partner, and my property was flooded!” Hung says.

“I took on casual employment doing odd jobs here and there, and along with a small amount of money I was awarded in an out-of-settlement, I was then cashed up and prepared to invest in 2013. In September that year, my good mate Bobby Tepsa took me with him to a job interview, and Dennis Fantov gave me a job at Barrangaroo, and I am eternally grateful to both of them for this opportunity.”

Three months later, Hung bought his second property at Carramar by leveraging the equity in his first property.

Then, over the next 12 months, he was able to purchase more properties and build the bedrock of his investment portfolio.

“I began to realise there was a pattern developing, which allowed me to make purchases one after another. I thought: why not buy as much as possible to establish my wealth, because I knew that if I bought in the right area, eventually it would go up in value,” Hung says.

Investing for the future

Throughout his property journey Hung has learn many lessons, including the impact that your salary can have on your borrowing power.

“One thing that makes it easy to borrow money from the bank is having a high, steady salary, and also a decent amount of cash for a deposit,” he says.

“It’s no good going to a bank and asking for a loan when you don’t have any cash in the bank to purchase a property, as the bank sees having little cash in your account as not having a commitment to save, hence little commitment to a loan repayment.”

It’s also essential to have a clear goal that will help you persevere through the challenging times, he adds.

“I have set a goal to acquire at least two to three properties each year, and I have been able to achieve this goal in the last few years,” Hung says. “I invest in properties so that they can provide me with a source of income to be able to have an early retirement, and also so that in the future I can leave something to my kids when I eventually have them!”

– Philippe Brach, Multifocus Properties & Finance

.JPG)

– Elvio Bechelli, Defence Housing Australia

.JPG)

– Clint Greaves, Real Estate Investar

HUNG (ETHAN) XUAN TRINH’S $2,000 PRIZE HAUL

- $100 eftpos® card from DHA Australia

- A full 4-month membership of Real Estate Investar’s Portfolio Builder, allowing subscribers to manage, track and optimise their portfolios' performance with powerful and easy-to-use tools. Valued at $996

- A platinum 12-month membership of NMD Data, the online property listing website that exclusively lists mortgagee foreclosure, deceased estate and housing authority properties. The only comprehensive national database of its kind in Australia, valued at $199

- A 12-month subscription to Your Investment Property, and a selection of our bestselling special reports and e-books, valued together at $889.85

- A copy of the bestselling book, The Armchair Guide to Property Investing, by Ben Kingsley and Bryce Holdaway