Once upon a time, Michelle Powys could regularly be spotted with her foot jammed hard on the accelerator, zipping around a racing-car track. Yet these days it’s the speed at which she has implemented an effective property investing strategy that’s impressing judges most.

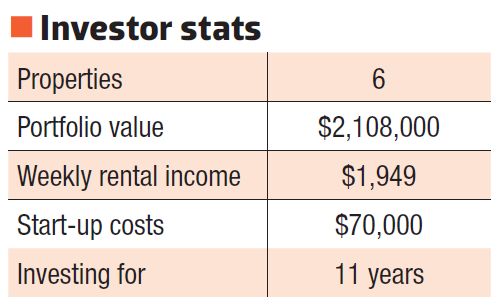

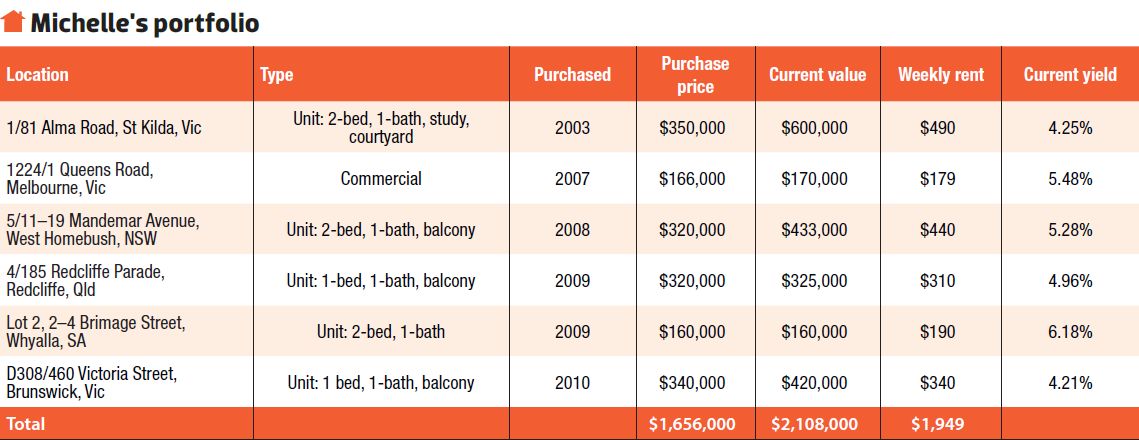

In fact, she has so far amassed a portfolio of six properties valued collectively at $2.1m. Moreover, she is now on track to have her dream home and lifestyle, and to add even more properties to her portfolio.

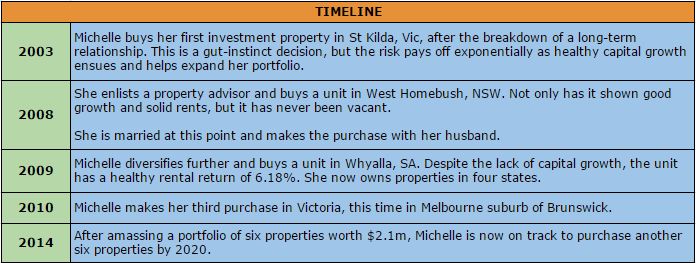

What’s also impressive is that she began this journey as a single woman when her 12-year relationship had just come to an end. This difficult part of her life helped her identify with someone else who had a similar experience. It was a lady she met in Melbourne called Debra Van Ommen, who showed Michelle that all it takes is lots of determination and you can rebound spectacularly from the toughest of life’s challenges.

“She was a little bit older than me and her marriage broke up. She invested in property and had a healthy, growing portfolio. It was from her story that I got inspired,” says Michelle.

By the time Michelle purchased her first property, she had also started a new relationship with her now-husband Mark, who supports her love of property investing but is not as passionate about it as she is.

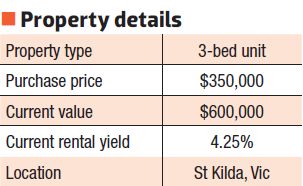

Property highlight 1: Michelle’s best deal

Research

At the time of Michelle’s first purchase she was living in Sydney, but it was her deep affection for St Kilda that drew her to Victoria.

“I loved hanging out in St Kilda when I came to Melbourne, which was every second weekend at the time,” she says. In fact, Michelle saw desirable similarities between St Kilda and Bondi in Sydney. In particular, St Kilda is just 6km from the CBD and close to the beach, great shopping and public transport. “I would have lived there – the fixtures and fittings were great, it had a courtyard, and it had a really good feel to it,” she says.

“When I compared it to all the other potential properties, this particular one stood out because the others were a bit more expensive, and not as close to the beach or Chapel

“When I was trying to negotiate a better price, the owner was in hospital and I was negotiating with him through the agent, which was strange. He drove a hard bargain and I ended up back at the original price and therefore didn’t get a discount,” she says.

Finance

In order to purchase this property, Michelle forked out a 20% deposit and further costs for legal and stamp duty, which amounted to $70,000.

“At the time I was not educated and put in as much as I had because I believed that was the right thing to do,” she says. She also knew somebody quite well who worked at CBA, which was a big factor for her in choosing them as a lender.

These days, Michelle recommends that anyone who doesn’t have a property coach should ask a range of lenders a bunch of questions before committing. She chose a variable loan with an interest-only structure and an offset facility, after following the advice of her accountant.

Happiest and hardest moments

For Michelle, the happiest moment of her property investing journey so far has been the growth of this property, which has gone from $350,000 to $600,000 in value since 2003. This growth has also allowed her to reinvest, which has helped build her portfolio further.

“The hardest part is the opposite end of that when over the years there is an increase of new stock in the area and the property drops in value until the new stock is absorbed,” says Michelle. “It’s just how it works, and you either know that going in or you learn quickly and need to understand to keep your emotions in check, as investing is ultimately a business decision.

“You talk to your mentors or like-minded people around you, which helps, and you read and educate yourself, because in the majority of cases it all works out in the end.” Michelle aims to hold this property at least for the next few market cycles, as it is in a good location and she can only see the strong demand for this area continuing.

Research

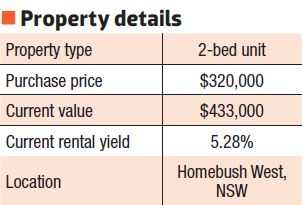

By the time Michelle’s second purchase came around, she was far more educated, having joined Positive Real Estate and worked with a property coach. Sydney was then in the right stage of the property cycle, and the property she was looking at in Homebush West, NSW, was close to the CBD.

“We were completely divorced from emotion this time. The numbers stacked up – it was feasible, and so we proceeded with confidence,” says Michelle. “It fit perfectly with our strategy for the amount we wanted to spend and the location. It was new, it helped reduce my tax, and we were very confident Sydney was the right place to invest in the medium to long term.”

Finance

At this stage, Michelle was married, and tax reduction was the couple’s strategy. Now that she was working with a property coach, they came up with a plan to put down a 10% deposit and get a loan for the rest at an interest-only variable rate. This was structured as 99% from Michelle and 1% from Mark, to reduce Michelle’s tax.

However, they ran into a few snags during the lending process. Consequently, Michelle was advised to complete the paperwork and go into the bank herself. She did this and was approved there and then.

Performance

It’s fair to say that Michelle has been delighted with this property. Just last year, she decided to get it revalued and refinanced with another provider. She was then able to access $90,000 in equity.

“This property has been a dream. It has never been vacant, and the managing agents are wonderful,” she says.

Michelle believes that undersupply in the area will continue to put pressure on the market, which means the good rental returns should persist. It’s no wonder she wants to hold this property for a few more cycles.

In fact, her only regret is that she did not buy more in the area at the time.

Michelle’s goal is to purchase another six properties by 2020 and build the value of her portfolio up to around $8m. She also plans to buy at least one property in the near future through her SMSF. She also hopes to diversify her portfolio by adding some houses to the mix, as her properties are currently all units.

“We are planning on purchasing a property in regional Victoria within the next three years, and will look to sell down some of our existing properties to do this and then start to build back up again,” she says. “We currently rent because we live in Melbourne, and as investors it’s hard to justify paying $800,000 on our residential property which becomes bad debt. So we are therefore planning to embark on a green/sea change and buy something on a couple of acres around 100km from the CBD,” Michelle says.

Her aim is to become more self-sufficient, with chickens, goats, a pot-bellied pig, and a decent vegetable garden they can live off with their dogs.

In the next three to five years she hopes to spend three months per year travelling overseas. Moreover, her long-term goal is to retire on her own terms, or continue working for pleasure, instead of having no choice but to work until retirement. “We are still very young – in our early forties with no children – so it’s all about freedom, and financial security providing that choice,” says Michelle.

1. Start investing as soon as possible. I should have started investing at 18 instead of 31.

2. I should have sacrificed more early on and made better financial decisions, knowing the financial gain and freedom it would offer me.

3. Investing more time earlier on property education would have been a big help.

4. Ignore emotional attachment to certain suburbs. I got lucky with my first investment, which was more of a gut-instinct decision, but it’s always better to look hard at the numbers and consult widely.

5. As was the case with the Redcliffe property in Queensland, it’s difficult when you have purchased a unit that’s surrounded by a high number of other units in the development. The area is slow to realise growth, the current yield is average, and I know our money could work harder for us elsewhere. Hopefully, the Brisbane market will have its anticipated rise in 2015 and the property will start pulling its weight.

6. Don’t get discouraged throughout the holding period. Property prices might go up and down, but if you talk to like-minded people and educate yourself, things usually work out in the end.

7. Ask lots of different questions of a range of experts, including different lenders.

Judges’ comments

“Michelle made the decision to become financially independent. She dug her heels in (pun intended) and got busy with the job of education, research and action. She possesses great tenacity. She also understands that not all of her portfolio is perfect and is prepared to sell some to change the asset type to something that performs better, like dual occupancies. The fact she is utilising her SMSF as a vehicle is commendable as well.”

–Ed Nixon, CEO, Trilogy Funding

“Michelle has a clear plan in mind to achieve financial independence right through to retirement. Her property investment strategies are proven methods and will undoubtedly help secure her dream.”

– John Kovacs, managing director, NMD Data

For winning the first runner-up ranking in Your Investment Property’s 2014 Investor of the Year Awards, Michelle receives a prize pack worth $5,123, including:

1. A preloaded $500 eftpos® card from DHA Australia

2. $500 cash from Trilogy

3. A 6-month Real Estate Investar 'Portfolio Builder' membership, valued at $1,494

4. Two residential depreciation reports from Washington Brown, valued at $1,320

5. A 12-month NMD Data 'Platinum' membership, valued at $199

6. A 12-month subscription to Your Investment Property magazine, including an exclusive report pack compiled by Your Investment Property and RP Data, valued at $1,010

.jpg)

.jpg)

.jpg)

.jpg)