and Kerry Bishop can recall the exact moment they decided to invest in property.

and Kerry Bishop can recall the exact moment they decided to invest in property. It was a “very subtle trigger” that prompted them to take action, Kerry admits, but she says she can still recall the moment as clear as if it were yesterday.

We were watching a finance item on the news, and a money expert – I think it was Ross Greenwood – was talking about the fact that it would be very difficult to live off the pension in the future and have a decent standard of living,” Kerry explains.

“He said something along the lines of, ‘In 20 years’ time, to have around $80,000 in retirement income, you’re going to have to own four houses’. That was the trigger 20 years ago that drew us towards housing.”

Starting slow

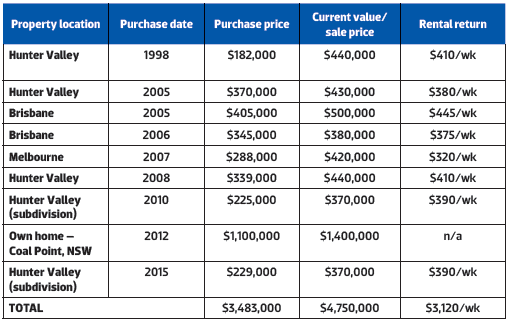

For their first investment in 1998, they opted for what they felt was a safe option by purchasing a property through Defence Housing Australia. Located in Thornton in the Hunter Valley, NSW, it was a four-bedroom house for which they paid $182,000.

It was close to where they were living at the time, and the property, located on a big block of land, was locked into a lease with the DHA for 12 years.

“We talked to a banker and he was the one who actually said, ‘why don’t you buy your first investment in Defence Housing?’ It was protected income and it gave us the confidence to spread our wings a little further with the next property,” Kerry says.

Little did they realise at the time just what a great choice their first investment would become. While the Bishops admit that they first invested with no clear strategy in mind, they inadvertently stumbled on a good thing, as they were able to eventually develop that property by constructing another house on the block.

“We didn’t have any goals on the very first purchase. It was just a matter of thinking, let’s buy a house. It did well, but we didn’t really understand how to leverage off that growth and buy again until we started working with a property investment company a couple of years down the track,” Stephen says.

“We went to a number of seminars. One of the recommendations is to write down your absolutely audacious goals. The ones that are so big you think you’re not going to ever be able to achieve them. He said, ‘Think big and you’ll find a way to get as close to that goal as possible’. So that’s what we did.”

“A waterfront home and 12 investment properties” was the Bishop’s goal.

It’s been 17 years since then, and to date they’ve achieved the construction of their beautiful waterfront home and have eight properties in their investment portfolio, and growing.

Becoming accidental developers

The Bishops continued learning from other experts and after going through a renovation course, in the early 2000s, they decided to become developers.

The couple recalled rushing back to their investment property at Thornton after the seminar and measuring it up – and were disappointed to discover the land didn’t meet council criteria.

“A little while later, the local council changed their minimum allotment rules, which we took advantage of pretty much as soon as the property came out of lease with the DHA,” Stephen says.

“We hadn’t really planned ahead to do a subdivision, until we did that course and realised what was possible. Because it happened to be on a corner block, we now have one house that faces into one street, and the other house faces onto another street.”

They invested around $225,000 into the subdivision and build, which resulted in two standalone homes: the existing four-bedroom property, and

a brand new three-bedroom home. Today, the properties are worth around $440,000 (four-bed) and $370,000(three-bed) respectively.

Overcoming newbie challenges

The process of developing the land was “frustrating”, says Stephen, but they dealt with it as they always have: by recognising it as a process they have to work through in order to build up their wealth.

“The nature of the subdivision and development meant that it had to comply with so many council regulations, so we had to get a one-off design created. We engaged a small company of architects and they not only did the design, but they also helped us manage it through the DA process and to get a construction certificate,” Stephen explains.

“They did all the micromanaging on our behalf and once we had an approved DA, we took over and negotiated with builders to get the actual home built. They were enormously helpful and their influence helped us through that entire process.”

There were definitely challenges along the way, he says – including a town planner at the local council who flat out told them at the start, “You won’t get that approved.”

The town planner advised that the DA wouldn’t be approved because of a covenant that had been placed on the estate when it was originally developed decades earlier, which prevented people from subdividing or building two houses on one allotment.

“We went to our lawyer, and he said to hang on as the NSW government has brought out a new state Environmental Planning Assessment Act, and they want to encourage high density development to stop the urban sprawl. Provided your local council has adopted the state government’s new regulations, it would override any covenants from 20 years ago,” Stephen says. “When our lawyer looked into it, he discovered that Maitland Council had adopted it. It was another example of someone saying‘Stop, you can’t move forwards,’ and of us having to persevere to find a way around it.”

“Many times, people just don’t realise that they have the option to fight back,” Kerry adds.

“You’re talking to someone who you think knows all of the ins and outs, because they’ve been in the job for years, but that town planner was set in his ways and didn’t want to know about change. It was great that we had a young, proactive lawyer on our side,” she says.

Replicating a winning strategy

Ultimately, their development project was so successful that they decided to do it all over again this year.

“We set out to purchase a property on a corner block, without a garage or swimming pool taking up the backyard so we could do the same development that we’d done earlier. I came across this house, an ex–DHA home, in the right price bracket, and we realised it was just across the road from the one we already owned!” Kerry says.

In 2009, they paid $339,000 for the property – which was purchased through their self-managed super fund – and it’s already grown in value to a healthy looking $440,000.

“We’re spending about $229,000 cash to subdivide and construct a new home in the backyard of this one, and the new property will be worth $370,000 upon completion,” Kerry says.

Their developments weren’t their only property projects over the years. Along the way, they’ve also purchased another property in the Hunter Valley and two investments in Brisbane, and another in Melbourne. They have plans to purchase further assets in South-East Queensland.

“Brisbane is just starting to move, and our next purchase will probably be on the Gold Coast, which has got the Commonwealth Games in 2018. That says to me that there will be jobs, and people with jobs need somewhere to live,” Stephen says.

Looking forward to an early retirement

Looking forward to an early retirement

The couple, who both work in the mining industry in the Hunter Valley of NSW, near Newcastle, are thrilled with the results of their developments and the capital growth they’ve achieved in their portfolio, particularly as they’re planning to retire and live off their real estate income within the next few years.

“We currently work 12.5 hour rostered shifts, working 15 days a month – half on, half off. I operate mining equipment and Kerry does the same,” Stephen says.

“I’ve been in mining my whole life, since I was 19, and I’m 57 now – so there’s a few years behind me! Kerry was a gym instructor for a while, and then she worked in medical reception. She was a department manager at Maitland Private Hospital for a while when I said, why don’t you come and drive the mining trucks in the pit? She said, ‘why not?’ and we’ve both been working for Rio Tinto ever since.”

Their investment portfolio is currently worth $ $4,750,000 and when they ease out of the workforce, they plan to sell down part of their portfolio so that they will own four properties outright and then live off the rental income. They also intend to extinguish the debt on their own home.

While they’ve made plenty of sacrifices along the way to reach this point, they feel it’s all been worth it.

“Some people spend $200 a week eating out, or $15,000 on an overseas trip every year – we just don’t do that.

Our contemporaries have travelled the world and they have an overseas holiday every year, and that’s fine; a lot of people in Australia do have those tastes and budgets,” Kerry says.

“But we’ve made the decision to be careful with our money and focus on what we’re aiming to achieve. We do have stay-cations and day trips or weekends in Melbourne and Sydney, staying in nice 5-star hotels every now and then, but we prefer to minimise our discretionary spending so we can stay focused on our journey. Dave Shaw, through WSC Group Accountants (WSC), has helped us to develop a financial plan that will allow us to retire on a really nice income, and have a wonderful standard of living with lots of travel in retirement. I hope that we will be inspiring for our kids and grandkids and we’ll still be indulging our passion for sports cars, travelling and enjoying life in our 80s!”

“But we’ve made the decision to be careful with our money and focus on what we’re aiming to achieve. We do have stay-cations and day trips or weekends in Melbourne and Sydney, staying in nice 5-star hotels every now and then, but we prefer to minimise our discretionary spending so we can stay focused on our journey. Dave Shaw, through WSC Group Accountants (WSC), has helped us to develop a financial plan that will allow us to retire on a really nice income, and have a wonderful standard of living with lots of travel in retirement. I hope that we will be inspiring for our kids and grandkids and we’ll still be indulging our passion for sports cars, travelling and enjoying life in our 80s!”

Reality check

"One of our advisors showed us an article from a newspaper a little while ago, and it really brings clarity to the negative reports you can see in the media. It was saying that Sydney houses prices were disturbingly high; investors are driving prices up and the great Australian dream of property ownership was over, with property now completely out of reach of ordinary Australians. And this was from 1962! The houses prices were around $16,000. It just goes to show you that some views are very short-sighted."

Stephen and Kerry’s top 5 tips for investors

1. Don’t rely on luck – rely on hardwork

There’s no silver bullet – all of our success has come down to hard work. You have to stay focused on the bigger picture all the time.

2. Feel the fear, and do it anyway

You have to feel the fear and do it anyhow. You have to jump off that cliff

and the only way to do that is to buy your first house. After you’ve done it

once, it gives you the courage to do it again and again.

3. Treat property investing as a job

It is a job. It’s very rewarding, but it is a lot of work and like all jobs, it has its complications. We’re forever dealing with tenants and property management. But it becomes easier to handle the next time, and tenancy problems become less of a drama, because it’s just part of the job and part of what happens as a landlord.

4. Set long-term goals that seem ‘unachievable’.

I remember going to an event many years ago, and there was a woman speaking who shared that she had 10 properties. I was aghast; I couldn’t believe one person could own so many properties. Afterwards, we got to chatting and she said that when she started out, the thought of owning 10 properties would have seemed unachievable, too. The thing you have to remember is that you don’t start out as the CEO; you start at the bottom and work your way up.

5. Check your emotions at the door.

You have to take emotion out of the equation and realise it’s an investment, you’re not going to live in it, so you have to be unattached to it.