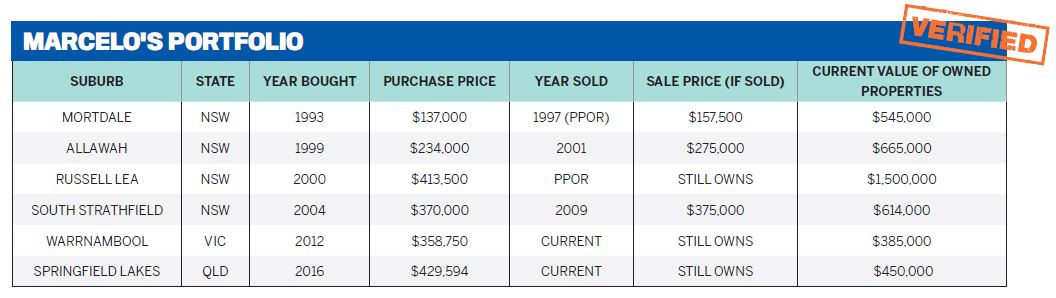

Marcelo and Louise Lecuna fell into the real estate scene by accident in 1999, after following the advice of an investment firm that had encouraged them to put their money into a managed fund and buy one of its listed properties.

The couple invested in the managed fund but went out on their own in search of a property. Without any understanding of the market, they used the savings they had accumulated while living in London for 18 months to put a deposit on an apartment.

Thinking back, Marcelo says it was “pure luck” that their first naive property purchase wasn’t a complete disaster, considering they unwittingly broke some of the industry’s most golden rules.

“We had this money and knew that we had to do something with it, but we weren’t sure exactly what. Very strategic investing!” he laughs.

“We had no idea what sort of research we needed to do, so it was bought as something that we personally would consider renting. We actually bought it near a suburb where we had bought our first house when we got married,” Marcelo says.

The property, a two-bedroom apartment in Allawah in NSW, fortunately performed well for the Lecunas, who went on to buy and sell several more properties over the next 16 years.

Now, in 2016, Marcelo has his sights set on finding another home

to add to the couple’s portfolio. He happily shares not just the inside information on areas that are catching his experienced eye, but also the hard-earned lessons he’s learned along the way.

Focusing his strategy to eliminate regions

Marcelo and his wife plan to pursue capital growth and then sell down

to pay off the debt on their other properties. For that reason, Marcelo has no plans to buy in Sydney any time soon, even though it’s currently his home town.

“The yields here are too low, and the potential for capital growth is lower than other areas which better match my buying criteria,” he explains.

When considering his long-term profit target, Marcelo believes houses and terraces are a safer option for capital growth than units, given the current uncertainty in the unit market.

“I prefer not to buy units, but I wouldn’t discount them altogether,” Marcelo explains. “The capital growth is not there right now for units, so I’ll keep on buying my preferred stock.”

Ideally, Marcelo’s preferred stock would be a property in a metropolitan area, in close proximity to a city. While he says yield is definitely a consideration in his research, he’s looking for factors that drive growth in the area, which will then allow him and his wife to achieve their ultimate goal – to replace his income with cash flow from their rental properties.

Through meticulous planning and using research strategies learnt through a mentoring program with Real Wealth Australia, the couple

got the best of both worlds with their Springfield Lakes purchase, secured earlier this year.

Located 35 minutes’ drive from Brisbane and 25 minutes from regional centre Ipswich, it has already surpassed his expectations.

“I paid $429,000 for it, and a week and a half after settling it had already increased in value by over $20k,” a happy Marcelo says. Even better, their rental return has been a surprising $30 per week higher than anticipated, which Marcelo credits to the skill of his property manager.

“We advertised the property for $420 per week but ended up getting $450, thanks to Dana from Purple Cow Real Estate,” he says.

“We bought it with capital growth in mind – it’s expected to grow 8% annually for the next eight years – but it is positively geared due to the great yield and depreciation.”

Pinpointing the perfect investment location

Knee-deep in statistics on historical performance, future predictions and yield prospects, Marcelo reveals that all signs are pointing to Queensland as the best bet for his next purchase.

From there, he is looking closely at the performance of the Sunshine State’s suburbs before even beginning to consider listings that tick the boxes for his strategy.

“There are certain criteria that must be met in order to rule a suburb in

or out, that help to mitigate risk and actually invest and not speculate,” Marcelo explains.

“I can tell you that I have discounted 39 suburbs already!”While he hasn’t yet pinpointed a winning suburb, Marcelo has his sights set on neighbourhoods closer to the CBD than Springfield Lakes this time.

When asked why Brisbane holds his attention, Marcelo explains that considering it is one of the top three strongest Australian cities, Brisbane’s median house price, rental yields and capital growth prospects “are still quite good”.

“The median price of houses, which I prefer to buy, is also in the bracket that attracts the largest population of renters and buyers,” he adds.

“Vacancy rates are a key factor, as this can highly impact your cash flow. As an investor, I want my property rented 365 days a year.”

The hard-won lessons that led to success

Marcelo knows hindsight is a powerful thing. When he and his wife began investing, they had “no strategy,

no idea that we even needed to do research, and entrusted some of our money with someone else”, he says.

“I wish that we had been more patient, gotten some education and taken control of our own money.”

As for their first “lucky” investment, Marcelo says he regrets that they sold it on the poor advice of an accountant, since it had excellent potential for growth.

“The decision to sell was made prematurely and without any real knowledge of the property market and the cycles that it goes through,” says Marcelo.

Although the couple have made some mistakes, Marcelo is satisfied that their portfolio has excellent potential thanks to their diligent research.

“Now I can sleep at night with peace of mind that I’ve made the right purchases.”

MARCELO’S HARD-EARNED ADVICE TO INVESTORS

• Having a strategy is imperative

“It will drive your research and help you pinpoint the right suburb and type of property for you. If you have no idea what your strategy should be, then you will be potentially doing pointless research and wasting your money.”

• Don’t sell if you can avoid it

Having his own regrets about buying and selling previous properties, Marcelo believes you should think long and hard before selling a property asset.

• Do extensive due diligence

Every element of research is “a key factor in successful property investing”, Marcelo believes. “I can’t stress enough that you must do your due diligence, [including] analysing specific property reports that are in line with your strategy, calling councils and interviewing property managers. That’s what you need to do if you are truly going to be a property investor.”