While other teenagers were considering university options, Brenton Tidow’s ambition was to take his first step onto the property ladder. His long-term goal was to pursue property as a means of achieving future financial security – something he never lost sight of, even after he was initially denied finance.

“When I was 17, I looked at many options to try and find a way to finance a property purchase, but having just finished high school, it was out of my reach at the time,” Brenton explains.

“Having no substantial savings, I was never going to get funding. So I set my mind to being a little more realistic.”

Now aged 28, Brenton’s determination and ambition have taken him from those humble beginnings to being a self-funded entrepreneur with an enviable portfolio worth more than $2m.

Believing that rent money is dead money, Brenton says he “always wanted to get into the property market from a young age”.

“I never wanted to rent,” he explains. “I had my mind set on purchasing my first house and growing my property portfolio from there, so I saved as much money as I could while studying.”

Brenton’s determination paid off, and four years on he broke ground on his first home in 2011. He had decided he was ready to dive into the real estate market as an investor, and targeted properties near capital cities, looking for solid equity and strong capital growth prospects.

“The location of my first property was somewhat dictated by my budget – I bought as close to Perth city as I could afford, and ended up finding a great location that has served me well, both in equity and growth,” he says.

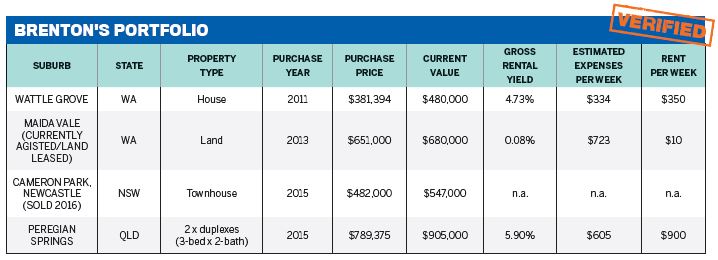

The numbers speak for themselves: since he purchased his Wattle Grove property, it has grown in value by $100,000 and maintains a very healthy 4.73% rental yield.

But Brenton says the property has been successful for another reason, as it was the cornerstone of starting his journey into investing.

“I was able to leverage and draw equity from it to buy my second property and start my portfolio,” he says.

Focus on diversity

Although he originally based his purchases on budget, Brenton explains that as his knowledge of the Australian market and its growth cycles developed, his strategy also evolved.

Therefore his portfolio is now a diverse one, comprising land, new builds, existing houses, and duplexes.

In 2013 he purchased a 2.5-acre block in Maida Vale, 15km from Perth, saying the opportunity was “just too good not to buy”. He plans to build a house on the vacant lot, which features views of Perth city. At present, the land is being leased for agistment.

To spread his risk, he then moved his attention to other states.

“I joined a property mentoring group and started to become far more educated on the best opportunities and ways to purchase interstate,” Brenton says.

“I started looking for properties that were cash flow positive or neutral, with great capital gains potential. ‘Buy and hold’ was my plan.”

Brenton upped the ante in 2015, adding three properties to his portfolio in 12 months. Targeting NSW first, he purchased an off-the-plan townhouse in Newcastle for $482,000.

“Properties four and five were a house-and-land duplex in Queensland that had subdivision approval already in place,” he says. “The duplex consisted of two townhouses, both containing three bedrooms and two bathrooms.”

The duplexes currently have a combined value of $905,000 – a $116,000 increase since Brenton purchased them for $789,000.

“It was a great year,” he laughs.

Leveraging property to achieve other goals

To date, Brenton’s investing strategy has been clear and has yielded excellent results. When considering potential purchases, he says he weighs up the property against his current buying strategy and long-term goals, and he also keeps emotion well out of the picture.

“I look at the numbers, the location and what’s going to make the area grow,” he explains.

He doesn’t allow himself to get hung up on a particular property either.

“If it gets purchased by someone else, I move on to the next deal,” he says.

It’s this pragmatic and unemotional approach that allowed him to offload his Newcastle property earlier this year, even though it meant deviating from his plan.

He netted approximately $65,000 profit following the sale of the property, which he sold around 12 months after purchase. The lucrative sale provided him with the finances to develop his own property tax management company, ABAKUS apps, which he created after recognising the challenges landlords faced when managing their taxes.

Focusing on his business ventures hasn’t slowed his property buying momentum down – he’s currently on the lookout for his next property to replace the one he recently sold. He plans to use the equity in his current properties to grow his portfolio further.

“I’ll continue to purchase properties within major capitals and cities around Australia, with the same strategy of finding deals that suit my long-term goals,” Brenton says.

“The market is continuously changing, so the strategy may change over time in order to maximise equity and rental returns.”

Challenges along the way

The journey hasn’t all been smooth sailing for Brenton. In 2015, he juggled settlement on two properties simultaneously with approved finance – until a call from the bank dealt him an unexpected blow.

Property type: 2 x duplexes

Purchase price: $789,375

Purchase year: 2015

Current value: $905,000

Current rental return: $900

- I have achieved my portfolio on my own single wage.

- Though it involves some sacrifices, property investing hasn’t held me back from living a normal life, travelling and pursuing other interests at the same time.

- I grew up in farming then turned to pipeline surveying, and now I’m a self-funded entrepreneur and an active property investor.

“The loan had been reassessed and would be dropped to 80% LVR with 10 days to settlement,” he explains. “It was a mad 10 days to find a way to fill the gap. It was a fairly stressful time.”

The learning curve was steep, but Brenton says he learnt a lot from the experience.

“You need to ensure you plan for the worst and have funds available if you need them,” he says. “Next time, I would only do one deal at a time and accept that I could miss a great deal [as a result]. There are always more just around the corner.”

Looking back, Brenton says he wishes he had started his property education earlier – particularly by finding seasoned investors to learn from.

“There is so much useful information out there. Do your due diligence, but join a mentoring group with other investors, as this gives you a way to learn from others already in the game,” he says.

At just 28, and having been an investor for only five years, Brenton adds that his properties have already enriched his life.

“Property has already helped develop and grow my personal finances and it has definitely opened doors to achieve other goals too. I enjoy finding great deals and purchasing properties to fund my future and my retirement.”