“Like anyone who has been forced to hit the reset button for one reason or another, I had to make a deliberate decision to either fall back into the herd, or work and do whatever it took, no matter how hard it was going to be, to secure a better financial future for myself and my children,” says Paul.

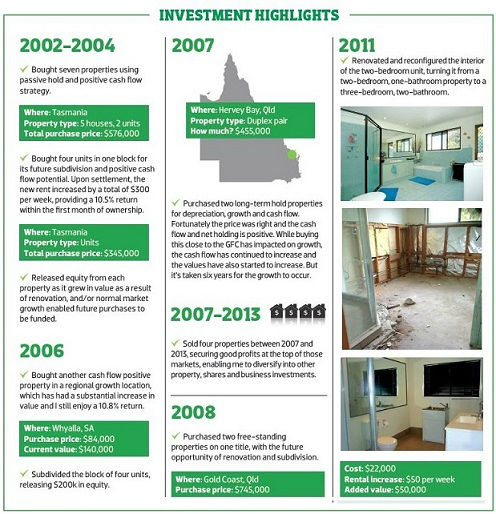

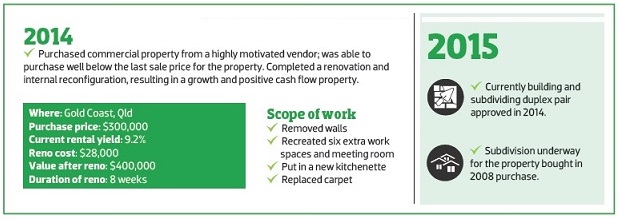

The fresh start involved Paul moving from Tasmania to the Gold Coast. In 2007, he packed his bags and took his new wife Linda and their two children, as well as Paul’s three children from his previous marriage and his ex-wife, to start a new life in Queensland.

“I want to be with my kids so I took them with me. It meant I had to subsidise my ex’s moving and some other living expenses, but this was a small price to pay for being close with my children,” he says.

Having to support both families did have a massive impact on Paul’s ability to rebuild his finances. Fortunately, this happened before the GFC, which meant getting a loan was easier then.

“As I was just starting all over again after the divorce, it wasn’t easy to get the finance together. It was tough as I was also trying to build and grow my business. I had to start the second time around as a single father with zero assets, huge legal bills, and trying to settle into a new and unfamiliar location.

“Fortunately, this was before the GFC, and I was fortunate enough to get my first deposit together using some very creative means. I then focused on buying very well-priced properties in a fast-rising market, enabling me to be quite aggressive in my approach,” Paul says.

Rising above the ashes

Like many people going through a relationship break-up, Paul’s personal upheaval impacted not just on his finances but also his psyche.

“Like many young and ambitious people, I started strong. I bought my first property that I identified as being ripe to construct a duplex pair so I could live in one and rent out the other. The development application was initially rejected by the council, but I took them to court and won. Eventually I had three properties in my portfolio and had established a strong foundation compared to other people my age.

“However, after going through an emotionally low period following my divorce, I found myself lowering my dreams to my position in life instead of elevating my circumstances to match the dreams I set for myself earlier on,” recalls Paul. “I ended up losing all three properties in the course of the divorce settlement.”

Fortunately, Paul didn’t stay low for long. He had an epiphany.

“I was resigned to stay broke and not to aim high anymore, but then I realised that this was not going to serve my children or myself well. So I made a decision to not wallow in my circumstances. I have a large sense of responsibility and it would not have sat comfortably with me knowing I didn’t do my best,” he says.

After making the emotional decision to rise above his circumstances, Paul developed a plan, starting with gathering his deposit for his fi rst investment as a single parent. He also decided to get a secure job so that he would have a reliable income, and worked after-hours and in any spare time he had to build his finances.

The skills and knowledge Paul had accumulated through his earlier investment forays also came in handy when he decided to start a business, We Find Houses, to help other investors who were ready to invest but didn’t have the time or knowledge to do all the work themselves.

“I found great satisfaction in assisting other property investors and in seeing the success they were achieving. This in turn motivated me to keep going personally also,” he says.

Lessons learned

Paul admits that his life and investment journey has been a series of learning experiences. Here are some of the biggest lessons he learned along the way and that helped him get back up on his feet:

1. It takes dedication, focus and action to build a successful property portfolio. “This current portfolio is my second attempt at building one. My first was when I was only in my early twenties, but life happens and I had to start again. I’ve gone through a divorce, have an amazing wife, five children, and all the financial and emotional hurdles and challenges that come with that,” says Paul.

2. The true nature of property investing is about being able to make the best informed decisions in line with your budget and risk profile at the time. You do your research; you crunch your numbers, remove the emotion and make sure you focus only on the tangible pros and cons of a deal.

3. You should be adaptable and not have a static strategy. “You need to constantly review and adjust your strategy based on your budget and life circumstances. Many investors like to do their purchases one at a time – wait six months or a year and then think about doing another one. I felt the need to make up for lost time and to take the opportunity that was in front of me. All of the properties at least doubled in value and some significantly more than that,” Paul says.

4. Where you start does not need to be where you finish. While you can’t change the past, you can learn from it. You just need to keep your focus on maximising your future potential.

My biggest achievement

While Paul has every right to be proud of his financial achievements, it’s overcoming and rising above his personal struggle at the same time as raising five amazing children that makes him beam with pride.

“I’ve successfully overcome emotional and fi nancial setbacks that caused me to hit the reset button and start all over again. In spite of this I have been able to successfully provide for my children and have helped hundreds of clients to achieve their own levels of success along the way.

“I’m sharing this because I want to encourage everyone, regardless of age or life circumstances, that they don’t have to be trapped in their adversity. Often, that means taking action when life isn’t ideal.”

Q&A with Paul Wilson

Where are you buying now and why?

Paul Wilson:

What are your investment and buying strategies for this market?

PW:

How are you managing your cash flow?

PW:

How are you balancing your portfolio?

PW:

What’s on your shopping list at the moment in terms of property?

PW: