‘Grey nomads’ Vicky and John Heathcote always knew investing in property was a sensible option. Two decades after their first purchase, they are now living their dream, Vicky tells Miriam Bell

When Vicky and John Heathcote first decided to invest in property, their friends thought they were mad. It was the early 1990s and views on investment were very different. The couple’s friends equated property with risk.

Twenty years later, it is Vicky and John who are having the last laugh. John has been retired for four years, while Vicky only works part-time to keep her mind active. Rather than being chained to the 9–5 grindstone, they spend a good chunk of each year travelling.

Their semi-nomadic lifestyle is all thanks to their property investments, Vicky says. “Our net property worth is now approximately $2.4m. This allows us to live our dream, while we are still young enough to enjoy it.”

Assessing investment options

Both Vicky and John are accountants and, as such, were always aware of the potential value in property. When they decided to start investing they used their professional expertise to weigh up the options. Property, rather than shares or funds, seemed the best bet to them.

They have always felt that property is safer than shares, although they did dabble in shares briefly. “We were always nervous about our shares, whereas we have never lost sleep over our property investments,” Vicky says. “Plus there is greater borrowing potential with property than there is with shares.”

All of the couple’s properties have doubled in value since they first bought them. Their rental returns also continue to go up. This reinforces their belief that – given market fluctuations – they would not have done as well if they had retained their share portfolio.

The difficult first move

Taking the first step into the property market was the hardest part of building their portfolio, according to Vicky. Initial trepidation meant the Melbourne-based couple did a lot of research into their own locality before making their first purchase.

Attending seminars and reading relevant books gave them a better idea of how to invest in property wisely. Once they were ready, they bought a display house close to their own home in a leaseback arrangement. “It was so long ago that I’m not sure what we paid, but I know we certainly didn’t venture far from home at first,” Vicky laughs.

To make that first purchase, they withdrew approximately $20,000 from equity in their family home via their home mortgage and used it for the deposit on the investment property. The success of this model led them to stick with it for all their subsequent investments.

“We tried to buy every two years,” Vicky says. “Basically, we just kept buying property when we had enough equity in a house. We have sold some properties over the years, but we have held on to most of them.”

Simple strategy

Initially, they had planned to buy just one investment property. However, when that worked out well, they decided it might be a good idea to get another one.

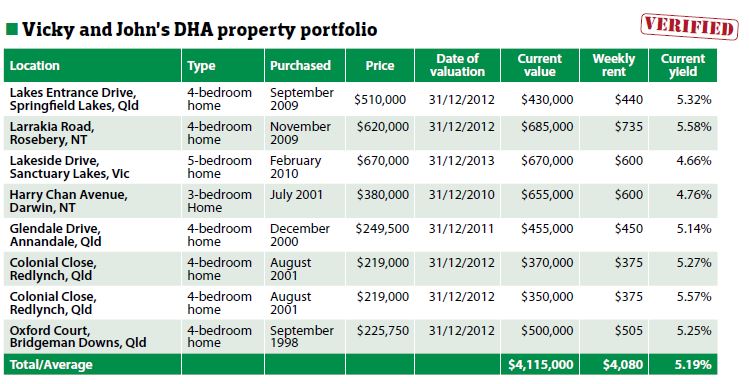

After that purchase, they realised they might be able to retire early if their investments continued to be successful, Vicky continues. “That was all we aimed for, all we wanted to achieve. So our strategy was just to continue buying properties whenever we had built up enough equity to do so – which we did. And we have achieved our dream.” The couple now own nine properties around Australia; most are in Queensland but two are in Victoria and two in Darwin.

Working with a ‘partner’

Not long into their property investment career, the couple saw an ad for Defence Housing Australia (DHA) and its property investment program. They liked the sound of guaranteed rental income and no tenanting obligations through DHA.

After further investigation they bit the bullet and started buying with DHA. It was a decision they have never regretted. Most of their properties have been purchased with DHA. All but two of their current properties are DHA properties.

They would not have done as well as they have without DHA, Vicky says. “It means we don’t need to worry about things like rent, because it is guaranteed. If the lease expires and they still want the property, they will pay to upgrade the property. They even pay for maintenance and cleaning. It just makes everything very easy.”

Doing your homework

The couple trust DHA to the point that they have never even visited two of their properties. However, they believe in doing their homework properly before any purchase. Vicky says their research always follows the same process. They:

- investigate the area the property is in thoroughly

- ascertain what potentially attractive features the property might be close to, eg schools, parks, public transport

- look at pictures of the property online

- Google the street the property is on and assess its condition as best as possible

- research the value of the property, and comparative properties, on various real estate websites

- visit the property itself if they get the chance

Knowing what you want

Strict selection criteria informs their research process. A preference for buying houses, as opposed to apartments, is a central component of these criteria.

They have just one apartment (in Darwin) in their property portfolio. Houses are easier to sell and, although apartments can be great to rent, they are a more limited market, Vicky explains.

Connected to this is another of their criteria: how quickly a property could be sold, if it had to be sold urgently. When making a decision on a property they figure out whether it would sell easily, and work with their conclusion.

For their purposes, it is good for a property to be close to a school or a park, Vicky says. “We want a property to be a family home. And, if a renter family has kids, there are certain things they look for – about four bedrooms, maybe two bathrooms, a garage. It doesn’t have to be state of the art. But it should be liveable and have proximity to relevant amenities.”

Finally, they like to buy properties that are not more than 12 months old. This is because they try to avoid, as much as possible, repair costs. They also like the fact that newer properties have a greater depreciation rate than older ones do.

Avoiding problems

Vicky and John have had a remarkably trouble-free run with their property portfolio. They were untouched by the GFC and they have encountered no major problems.

Working with DHA on most of their properties has helped them avoid many difficulties, Vicky says. “ DHA manages our properties and the bulk of our risk. We don’t have to hassle tenants or deal with agents. We know the rent is coming in. So all we do is collect it, and pay the mortgages and rates.”

Despite their easy ride, Vicky says they do regret the gaps in time between some of their purchases. “In hindsight, we should have purchased some properties earlier, and then we could have had more. But you get caught up with life. That would be the one thing we would do differently now.”

Benefiting from investments

In their eyes, the couple’s most successful transaction was the first property they invested in. This is because the experience enabled them to see the benefits of property investment.

It gave them a clear view of where they could go and what they could achieve, Vicky says. “Property has given us financial security and allows us to lead a better lifestyle than we could otherwise. There is no pressure.” The income from their portfolio also means they no longer have to work.

When John was 56 he decided he had had enough of the rat race. On doing the sums to see if they could afford for him not to work, they realised that neither of them needed to.

Vicky decided to keep working part-time because she still enjoys it, although these days she often works remotely as the couple spend several months each year touring Australia in their caravan. They also go on big overseas trips most years.

“We’re working on the ‘SKI’ policy – we’re Spending our Kids Inheritance,” Vicky says. “We’re heading off, leaving the family and the house, and living our dream. Our investments have given us the chance to do what we want to do. Who could ask for more than that?”

Funding the future

However, they have no idea exactly how much they make from their property investments each week. They have never sat down and worked it out. “We are more interested in building our net worth rather than how much we are making weekly,” Vicky adds.

“We don’t make much per week from the investments, but our intention has always been to build up capital growth, which is what we have done. And then to sell to fund our retirement.” At this stage, the couple is not planning to do much more investing. They intend to live off their portfolio, although they may borrow or sell a property if they need to.

Property investment has worked for this early retiree couple, which is why they want to encourage others to give it a go, too. It is easier for the average person to make money long term with property than it is with shares, Vicky says. “Anyone thinking about it should just take the plunge. They need to look past all those negative possibilities, find the right properties, and get started as soon as they can.”