30/08/2018

Q: I purchased and lived in my unit from 2008 to 2016. I purchased a house in 2016, which was my residential property, but I kept my unit and rented it out. I now intend to rent my house out for the next five years whilst I work interstate.

I have not decided yet if I will buy another property or just rent for the next five years. If I decide to sell my unit now, after two years of renting it out, can I please have clarification on the capital gains tax implications?

Thanks, Darren

A: If a dwelling that was your main residence stops being your main residence and is then used for incomeproducing purposes, the maximum period the dwelling can be treated as a main residence is six years from first renting it out.

However, you can only have one main residence at any one time. Should you elect to nominate your unit as your main residence until you sell it, then no CGT will apply on the sale as you will be able to claim main residence exemption on that property.

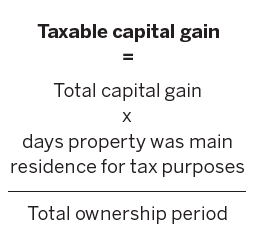

However, that will mean your current home will be subject to pro rata CGT when you sell. The future capital gain on the home will be calculated as follows:

Should you choose to nominate your current home as your main residence, then the unit will be subject to capital gain.

"Obtain a valuation of the unit at the date it first earned rental income. That becomes the reset cost base for CGT purposes"

You should obtain a valuation of the unit at the date it first earned rental income. That valuation amount now becomes the reset cost base for CGT purposes. The capital gain for tax purposes will then be calculated based on the reset cost base, ie the valuation amount.

Any costs you incurred prior to that first rental date are ignored, and any capital improvements to the unit once rented out can be added to the cost base for CGT purposes, as well as any costs you incurred and were not able to claim as a tax deduction against your rental income.

The reset cost base will, however, be reduced by the depreciation claimed in relation to the property. As you have rented it out for more than 12 months, the capital gain will be discounted by 50% for tax purposes.

In this instance, you can keep your current home as your main residence from when you acquired it in 2016 until now. If you choose to rent it out and move interstate, then you can still elect to have it as your main residence for up to six years this will only apply if you continue to live in Australia and not overseas, as the rules have changed from 9 May 2017 and foreign residents are not able to claim the temporary absence rule of up to six years on a main residence if they sell the family home while overseas as non-tax residents.

The exception to this is if you acquired the property before 9 May 2017 and then sold it prior to 30 June 2019; in this case, the main residence exemption could still apply. However, if you acquired your home after 9 May 2017, then no exemption will apply for non-residents, even if you lived in the property.

- You can only have one main residence at a time.

- No CGT applies under the six-year main residence exemption.

- Exemptions apply only in domestic cases and not to residents overseas.

is partner at

Chan & Naylor Perth

If you would like your tax question answered in our magazine or on our website, please email your question to: editor.yipmag@keymedia.com.au