Email your tax questions to - editor.yipmag@keymedia.com.au.

Q: Hello, I have a question on CGT. My husband and I are both Australian citizens, but we moved to the UK 8 years ago and are no longer Australian residents for tax purposes. We have a family home in NSW, which we bought before moving to the UK. This was our family home for one year before we migrated.

Since then, my mother has lived in the house rent-free. We are looking at selling this house, but we are unsure how the capital gains will be taxed.

Will we be able to access the 50% discount, and what rate will the gains be taxed? Thanks for your help, Dani

A: For non-residents of Australia, changes were brought into law that date from 8 May 2012. From this date, non-residents can no longer apply the 50% discount to their Australian assets, which is available to residents of Australia.

Non-residents may be entitled to some discount if the CGT event happened after 8 May 2012. A CGT discount is dependent on certain criteria, which can include:

• whether the CGT asset was held before or after 8 May 2012

• the number of days foreign residents had a period of Australian residency

• number of days Australian residents had a period of foreign residency

As you were a non-resident on 8 May 2012, you may obtain a market valuation as at this date. The capital gain up to 8 May 2012 can be calculated using the 50% discount method, whilst the gain from 8 May 2012, does not receive the 50% discount. The discount from the calculation mentioned above is applied.

If the market valuation method is not used, the costs of the property would need to be used and the gain apportioned pre and post 8 May 2012 (using the number of days in each period) to calculate the gain subject to 50% discount and the gain subject to no discount.

Using the actual costs method in calculating the gain to 8 May 2012, a further apportionment issue arises with the time the property was a main residence and the time that it was not.

There are holding costs of the property (such as rates, interest, repairs, etc) and improvements that can form part of the original cost base for the period when it was not a main residence.

“A further apportionment issue arises with the time the property was a main residence, and the time that it was not”

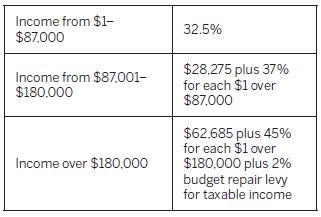

The tax rates for non-residents in the 2016–17 financial year (ending 30 June 2017) are as follows:

The tax rate for incomes above $180,000 start at 32.5% from $1 to $80,000 and then increases progressively to 47%.

A couple of points to remember:

• If there is more than one owner, the capital gain is apportioned in accordance with the title deed of the property.

• For capital gains transactions, it is the contract date that determines when the gain has to be declared in your tax return.

A final word of advice – it is important to seek UK advice on this transaction.

Mike Wilson

is the principal of Wilson Teis Chartered Accountants, and has over 30 years’ experience in commercial accounting and public practice.

While due care is taken, the viewpoints expressed by contributors do not necessarily reflect the opinions of Your Investment Property.