Our tax experts are on hand to answer any tax queries you may have regarding your property investments and wealth creation strategies.

Email - editor@yipmag.com.au.

Q: I lived in my principal place of residence (PPOR) in Sydney for 25 years and I intend to rent or sell it and move interstate in July 2017. I will move into a property that is currently an investment property; it was bought as an investment property and has been rented out for the past seven years.

I am trying to decide if I need to sell or rent out my current PPOR in Sydney before or at a similar time to when we move to our investment property.

If I rent out the PPOR in Sydney, should I have the place valued when I move out in 2017? And if CGT applies, will it be calculated from its value at the time the property was rented out in 2017? Or would I be better off selling within six months and not renting out, so there are no blurred lines?

Best regards, Sandra

A: To begin with, given this question is discussing an asset that has been held for a lengthy amount of time, I will briefly note by way of background that the capital gains tax regime was introduced by the government in 20 September 1985. If an asset was purchased pre-CGT then that asset is not subject to CGT until a change in ownership occurs, in which case the new owner will potentially have CGT implications when they dispose of the asset at a later date.

If the Sydney property asset was originally purchased pre-CGT (ie more than 32 years ago) you could convert it to an investment property and elect to make your existing investment property your principal place of residence fairly easily with no CGT repercussions on the pre-CGT property.

Alternatively, and the more likely scenario, when you purchase a post-CGT asset (on or after 20 September 1985) as your PPOR, if you later move out of the property but do not immediately sell the asset, from a CGT perspective there are a few exemptions and options available.

If this property is used to produce income (for example, as an investment property) you can choose to continue to treat it as your main residence for up to six years after you cease living in it. In this case you can dispose of the property during this six-year absence rule window and still be able to utilise the main residence exemption to exempt the capital gain from CGT – meaning you pay no CGT when it is sold.

If the property was rented out for more than six years and then later sold, the ‘home fi rst used to produce income’ rule would instead apply. In this scenario the property cost base used for CGT purposes would be the market value of the dwelling at the time you fi rst used it to produce income. For this reason, you should have the property valued when you move out in 2017.

“The property cost base used for CGT purposes would be the market value of the dwelling at the time you first used it to produce income”

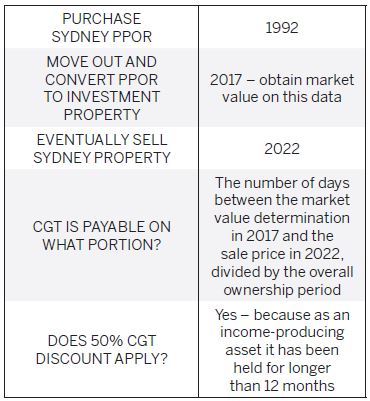

A further apportionment of any capital gain would then apply based on the number of non-main-residence days (after the six-year maximum absence period is fully used) divided by the number of days owned from the market value date (when the property was first used to produce income) up to its subsequent disposal date.

For example, if you rent the property out for six years and six months, you would have to pay CGT for six months’ worth of that 6.5-year period. This roughly translates to 182 days out of 2‚372 days, or 7.6%.

The 50% discount method can then further apply to this gain, as the above ‘days owned’ apportionment period would be greater than 12 months. This means you would have to pay tax of 3.8% on the gain.

Please be aware that, with respect to the six-year absence rule, if you choose to treat a property as your main residence after you move out, you cannot treat any other property as your main residence for that same period of time. This means that when you move into your interstate property, you can’t claim it as your PPOR from a CGT perspective during this six-year period when you sell it.

Instead, you may elect to cease treating the Sydney property as your PPOR from the date of moving out, and start to treat the old investment property as your new PPOR from that date. This is quite straightforward.

Your previous Sydney PPOR, now rented out as an investment property, will be subject to a partial CGT exemption for the period it was your PPOR. The market value from the date the home was first used to produce income will be used as the starting cost base for the property.

This date is also the deemed acquisition date for determining if the asset has been held for greater than 12 months, and whether you can use the discount method when calculating any future net capital gain on disposal of the property.

As a broad example:

Note that with the investment property now treated as your new PPOR (either from when the six-year temporary absence rule window ceases on the old PPOR, or from the date when you move into the investment property) it will always have some CGT implications associated with it, as it was originally an investment property.

With this property, in respect of any future disposal, you would pro-rata the calculated capital gain based on its non-main-residence days, divided by the days in the entire ownership period.

As illustrated above, there can be several CGT scenarios to consider in these matters, and the above advice is intended to only be general in nature. It is advised as always that you seek further professional advice tailored to your circumstances.

- DAVID SHAW

Q: I inherited a house from my mother, who inherited the house from my dad, her husband. Dad bought the house in 1974. The house was only in Dad’s name until he passed away and left it to Mum in 2003.

Mum passed away in 2012 and left the house to me. It has never been my main residence or rented out, and I now wish to sell it.

I’m confused about which year I need to use for the ‘base amount’ to calculate my capital gains tax; is it 2003 or 2012?

Many thanks, Sheridden

A: As your dad originally acquired the house before the introduction of capital gains inherited the house from your dad in 2003 she would have been treated as if she had acquired the house at its market value on your dad’s date of death. No CGT would have been payable by your mum or your dad’s estate at the time your mum inherited the house.

When your mum passed away in 2012 and you inherited the house, and assuming that the house had always been her main residence, you were deemed to have acquired the house on her date of death.

“If the house was not always your mum’s main residence, complex rules may apply”

The cost base of the house in your hands is the same cost base of the house that was previously in your mum’s hands, which was the market value of the house on your dad’s date of death in 2003. No tax would have been payable by you or your mum’s estate at the time you inherited the house.

Provided that the house was your mum’s main residence for the whole time she owned it, if you had sold the house within two years from when you inherited it, any capital gain would have been tax-free on its sale. This two-year limit can be extended in certain circumstances, but assuming there were been no extenuating circumstances that prevented you from selling the house within that timeframe, the tax office would have been unlikely to grant you a longer exemption period beyond the original two years.

Accordingly, if the house was always your mum’s main residence before she passed away, you may derive a capital gain or incur a capital loss upon your future sale of the house. As mentioned above, the cost base to use for this CGT calculation would be the market value of the house on your dad’s date of death in 2003.

If the house was not always your mum’s main residence, complex rules may apply, which would warrant the assistance of a professional tax advisor.

- EDDIE CHUNG

Q: I have a question about my investment property and bank loans.

I have been living in my principal place of residence, a unit, for the last 14 years. Last year I started to look for a house and found one that I wanted to make my future place of residence.

I took out an investment loan to buy the house and was intending to rent it out for a few years until I was ready to move in, but after settlement and having seen the house empty, I changed my mind and moved into the house straight away.

I then decided to sell the unit. After selling the unit, I had enough money to pay for the house outright. However, I was advised not to pay it off and to leave the money in an off set account, so it is sitting in the off set account linked to the house I now live in.

My question is: if I use this money that is in the off set linked to the house to buy an investment property, will the ATO view this as me using the money to buy an investment property, and will I get full tax advantages (ie negative gearing) when using this money?

Thanks, Tim

A: At present, you have your cash deposited in your bank account that is also linked to an offset account. This arrangement is perfectly fine and it also allows you to pay less interest on your home loan. You may call this an investment loan; however, it is not an investment loan, and as long as you are not claiming any of the interest expense on the loan as an income tax deduction, this is all perfectly fine.

If you now wish to use your cash to purchase an investment property, the benefit and impact of the offset account will be minimised, due to the lower amount of cash that you would now have in your bank account. This would also mean that the interest expense on your existing mortgage/home loan would increase as well.

Where income tax deductibility on your current mortgage/home loan is concerned, you will not be eligible to claim the interest expense on the loan as an income tax deduction because the purpose of the current mortgage/loan was to fund your new principal place of residence.

Even though your original intention was to purchase the property as an investment property, the fact remains that this was not an investment property, therefore there was a change of intention. This means the current loan is not tax deductible.

The income tax deductibility of the interest expense on a mortgage/home loan all comes down to the original purpose of the loan, irrespective of what security you offer the lender in order to secure the loan.

If you obtain a loan to purchase an income-producing asset (such as property, shares, a business, etc), then the interest on the loan is tax deductible. This loan may be secured, for example, by your principal place of residence. But it all comes down to the purpose of the loan.

If you use your money from your offset account to purchase an investment property, you will not be obtaining a loan and therefore no tax deductibility on loan interest will exist. If you obtain a loan to purchase your investment property, then the interest on that loan may be tax deductible.

- ANGELO PANAGOPOULOS