The property market is in a state of limbo, particularly those involved in the selling of new property.

Why? Because the budget statement in relation to helping “reduce pressure on housing affordability” has potentially changed the game and introduced dramatic changes to the way depreciation is claimed on property.

Let’s start with the good news:

1. Any existing investment properties purchased (contract exchange date) prior to 7.30pm on Tuesday, 9 May 2017 are not affected.

2. Commercial, industrial and other non-residential properties are not affected.

3. Capital works deductions have not been affected. This means you will still be able to claim depreciation on the structure of the building, provided it was built after 16 September 1987. You will still need a quantity surveyor’s depreciation schedule in order to do so.

Now that we know what isn’t affected, let’s look at what has changed as a result of the new budget.According to the budget statement:

“From 1 July 2017, the Government will limit plant and equipment depreciation deductions to outlays actually incurred by investors in residential real estate properties. Plant and equipment items are usually mechanical fixtures or those which can be ‘easily’ removed from a property such as dishwashers and ceiling fans.”

"Here’s the uncertainty: Who actually acquired the plant and equipment? Was it the builder/developer, or the initial purchaser of the new property?"

Why is the government making these changes?

According to the budget statement: “This is an integrity measure to address concerns that some plant and equipment items are being depreciated by successive investors in excess of their actual value.

“Acquisitions of existing plant and equipment items will be reflected in the cost base for capital gains tax purposes for subsequent investors.”

In summary: if a residential property was built prior to 1987, depreciation can no longer be claimed – full stop. If built after 1987, only the construction costs can be claimed.

Here’s the uncertainty: Who actually acquired the plant and equipment? Was it the builder/developer? Or was it the

initial purchaser of the brand-new residential property?

This is key – and the answer is up for debate.

The industry needs urgent clarification on this matter as many agents are currently advising potential buyers on the cash flow advantages of new property. These figures may prove to be inflated and put the developer or marketer at risk further down the line.

Investors rely on these figures in assessing the merits of the investment.

Developers, project marketers and property sales agents – if you are selling property and using depreciation numbers that include plant and equipment, you should stop now! This element needs to be removed from the selling equation, at least until the legislation is finalised.

A possible solution

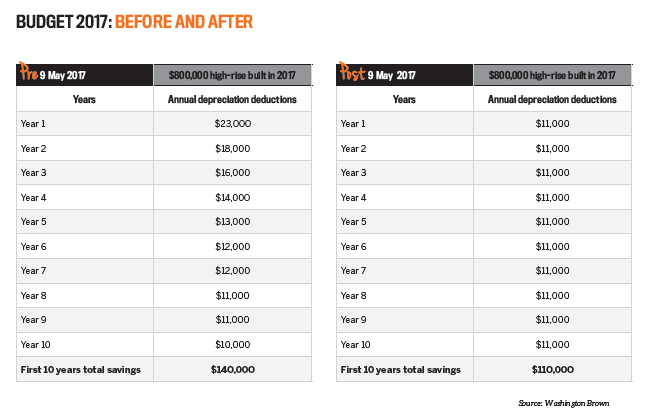

As you can see from the ‘Before and after’ example on the previous page, these changes won’t completely wipe out your depreciation benefits. In our example, an investor buying a brand-new property will still be able to claim $110,000 in depreciation over the first 10 years under the new rules, as opposed to $140,000 in depreciation claims under the previous rules.

The value of depreciation deductions available on any property depends on its size, quality, condition and age, but as a general rule these changes mean buying new property offers a much greater depreciation benefit than buying established properties.

Indeed, properties built prior to 1987 will generate no depreciation benefits whatsoever.

The government’s changes to depreciation are quite drastic change, in my view, and a more suitable solution would be to accept that plant and equipment in residential property needs to run its natural course.

The ability to revalue and reassess the item after its initial effective life has run its course should be squashed.

Put simply, if you a buy a property that is, say, 11 years old, and it has a dishwasher installed that had an initial effective life of 10 years, then you should not be able to claim it, revalue or reassess it.

This would alleviate the government’s concern that “some plant and equipment items are being depreciated by successive investors in excess of their actual value”.

"A more suitable solution would be to accept that plant and equipment in residential property needs to run its natural course"

This would make a lot more sense, in my opinion. I believe housing affordability is a major issue; however, this appears to be ‘policy on the run’, so the government can be seen to be targeting property investors. I look forward to providing a further update once the legislation is finalised and more specifics of these changes come to light.

firm Washington Brown and has over 20 years’

experience in the construction and development industry

WANT MORE TAX ADVICE?

Visit www.yipmag.com.au – or if you have your own taxing question for our panel of property tax experts, email editor.yipmag@keymedia.com.au