Occupy or sell?

Q: I have an investment property (a two-bedroom unit) which has been rented out for two years since purchase. The tenants are now moving out and although I do have the option of re-letting, I'm considering moving into it myself. I have saved enough in the offset account so that the property is slightly positively geared. The property is also very old and has no depreciation. Question: Would it be best to move into that investment property (where I know the repayments will be non-deductible) or should I rent/purchase elsewhere and keep it as an IP?

A: To occupy or rent an investment property is a decision that requires consideration of your:

• personal situation

• cash flow situation

• strategy with regard to property investment as a class of

asset for creating wealth for the future

Please note that I am not a licensed financial adviser so my comments are based on my experience as well as discussions of my clients’ situations.

Where the investment strategy is to accumulate property assets with a view to eventually deriving retirement income, then keeping the property would be a reasonable decision, assuming this property has capital growth potential or yields high rental returns.

Selling this property would mean some of the proceeds of sale would have to be paid out as capital gains tax (CGT). Getting back into a replacement property would also require additional stamp duty to be paid. By contrast, increased value could be used as security for an additional loan to fund a second property.

Concern that the loan has been reduced to a point where no tax benefits are available as rental loss is eliminated due to a lower interest expense needs more commercial consideration.

The test for deductibility of interest expense is how the loan funds have been applied. Where the loan funds are used to acquire a rental property, the interest expense will be deductible regardless of what security is used to acquire the loan.

To minimise non-deductible interest expense the objective is always to ensure that the loan financing a main residence is at a minimum, whether by using an offset facility or reducing the loan principal.

Where repayments of principal have been deposited into an offset deposit account without reducing the balance, then when these same funds are withdrawn to acquire a main residence the interest arising on the loan supporting the investment property should again become deductible. This means the new property can be the main residence.

Where repayments have reduced the loan principal, occupying the property will minimise the non-deductible interest expense. It will also allow for the maximum interest deduction on the second rental property, providing additional tax benefit.

Some CGT will always be payable on the first property. CGT will always be payable on the second property where it is first established as a rental property. Where the second rental property is established as the main residence it will be exempt from CGT.

This means a trade-off between tax savings now and tax savings when the property is sold.

CASH FLOW

Whether the IP is sold or a second is bought will depend on the cash flow capacity of the investor. Is there enough other income, eg salary, to cover the net rental loss of a second property? Loan repayments can be made from savings on current rentals being paid, which is also non-deductible.

PERSONAL SITUATION

Finally, consideration has to be given to personal preference, including whether or not the location of the existing rental property is desirable. Another factor would be whether the family would like to live there or whether it is suitable for family living as opposed to a single person.

– Shukri Barbara

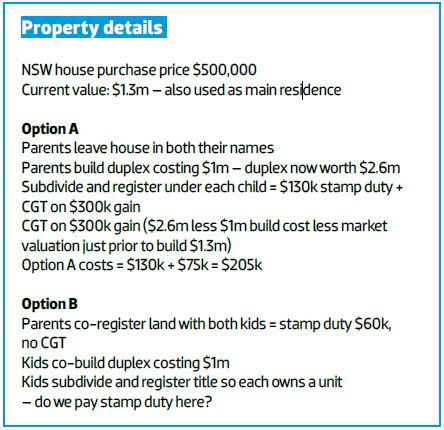

Minimising tax when building a duplex

Q: We’re retiring parents and own our house. We have two kids who have no property. We want to build a duplex and give one to each of the two children. What is the best way to do this while minimising stamp duty and capital gains tax? Here are the two options we’re considering:

A: Provided Option B is chosen, and provided both children (as acquirers of the property as co-owners) enter into a deed of partition, where they agree to each taking a lot of the land after the development in satisfaction of their interest, then there will be no ‘double payment’ of the stamp duty.

Partitioning refers to the situation where land that is held jointly (whether as joint tenants or tenants in common) is transferred to one or more of the co-owners of the land. That is, it is a ‘partition’ of the co-owner’s interests in the land and involves the disposal by each co-owner of their interest in one of the lots to the other co-owner and vice versa.

In NSW, the Duties Act 1997 (NSW) allows for the partitioning of land in Section 30. It states that if the unencumbered value of the undivided share of the co-owner in the original property that is being partitioned is equal to or less than the unencumbered value of the divided part taken by the co-owner, then the total excess value will be nil. As a result, if no consideration is paid for the partition by the parties, the dutiable value will be nil and the partition will be charged with the minimum duty of $50 under Section 30(4) of the NSW Duties Act.

Therefore, if you are planning for both children to individually own one unit each at 50/50 partitioning, then there will be no double payment of stamp duty on subsequent transfers of the properties.

– Angelo Panagopoulos

Tax on inheritance

Q: My wife and I have recently inherited $200k. We don’t own residential property and are currently renting at $650 per week. I’m 53 years old and my wife is 50. We have seven children and five are still living at home and contributing to expenses. We have one child with a mild disability and my wife is currently receiving the disability pension for our disabled child in addition to the carer payment, which is not taxed but the income/asset test applies to this payment.

I am a self-employed courier driver and my average gross income for the last eight years has been $53k. I currently have a mortgage on my van, and after all overheads including depreciation I receive a net income of $33k. I am not splitting my

income with my wife due to the above Centrelink payment and have been paying approximately $2k in tax per annum. I am a bit hesitant to borrow a large amount of money for residential property at our age. We would need to borrow approximately $450k. My intention is to purchase two investment properties for up to $400k with a 20% deposit on each property, therefore making them positively or neutrally geared, and hope to purchase further investment properties with equity down the track.

If we decide to go ahead, will my wife's carer payment be affected? Will I need to purchase properties only in my name to avoid this or do we set up a different structure? Do you think this is the best scenario for our situation or do you suggest some different form of investing?

A: With your inheritance being $200,000, it may be worth seeking expert financial planning advice as to how to best to invest the money.

However, if you are considering investing in property by purchasing two investment properties for up to $400k each and contributing a 20% deposit on each property, this could potentially see you use up all of your $200,000 inheritance because you would also most likely be required to fund the stamp duty payable when you acquire these properties. From a financing perspective, your total loans would most probably be between $600,000 and $650,000.

Your wife’s carer payment benefits will most likely be affected as well, especially as the government has announced that from 1 January 2017 the asset test thresholds will be further reduced.(I would encourage you to seek expert professional advice on this area as well.)

In relation to the best structure for your properties, the options are individual, company, trust or a superannuation fund, and although each different structure has its advantages and disadvantages, I would require further specific information about you and your current structures before I can provide specific advice and recommendations.

I have also noticed that you haven’t provided any details about superannuation, and because of your age I would recommend you seek professional advice about your options regarding superannuation as well.

– Angelo Panagopoulos

.jpg)