As Australia’s population ages, more and more older-generation Aussies could be looking to downsize their home, and it could reshape Australia’s property market.

After all, a flood of larger available properties would help to ease the pressure for larger houses, create more demand for low-rise, medium-density luxury apartments and accelerate the shift away from major capitals.

But how big can we expect a downsizer wave to be?

Australia’s population is ageing

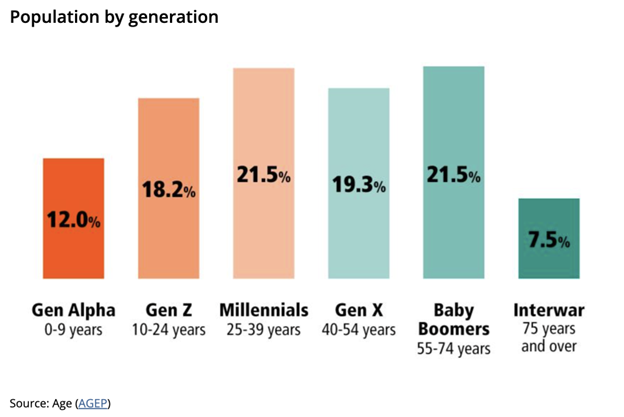

The 2021 Census counted 25,422,788 people in Australia - and older generations dominate the figures.

Currently, 19.3% of our population is Gen X, 21.5% are Baby Boomers and another 7.5% are older than the Inter-war generation.

Going forward our population is going to age.

Australia's population aged 65 and over is projected to grow to 6.66 million by 2041, from an estimated 4.31 million in 2021, an increase of 54%.

And population estimates suggest that the largest proportional growth is expected in the oldest age brackets.

In fact, the number of Australians aged 65 years and over is expected to grow another 50% in the next 20 years, according to data from the ARC Centre of Excellence in Population Aging Research.

Australia's population aged 85 and above is projected to increase in number from 534,000 in 2021 to 1.28 million by 2041 – an increase of 140%.

And the research shows that the centenarian population, which means those aged 100 and over, will grow at an even faster rate – increasing by 200% from 5,300 in 2021 to 15,900 by 2041.

Why is this happening?

There are a couple of reasons - firstly, there was a dropoff in the birth rate during the Covid-19 pandemic years, and secondly, modern medicine means people are living longer

Older generation Aussies dominate home ownership

At the same time, ABS home ownership data shows that there were 10,852,208 private dwellings counted in the 2021 Census and just under a third are owned outright – in other words with no mortgage.

The data also showed that while most people live in a family situation, nearly 900,000 live together in a group, while 2.5 million Aussies live alone.

The large majority of homes are detached, and 3.2 million dwellings have four bedrooms or more.

What does all this mean?

It shows that Australia’s downsizer cohort - likely the same cohort that owns the majority of detached homes with no mortgage - is set to surge.

And this could create a dynamic shift in the distribution of our property markets - it could even go some way to help solve our crisis of undersupply.

Shift ahead: How downsizing will reshape Australia’s housing market

Many older generation Aussies who own large houses may now find that since the kids have left home, they’re left with space surplus to requirements.

It is estimated that there were around 13 million spare bedrooms in Australia with many older people living in homes with several spare bedrooms.

And during a time when the cost of living is surging, it makes no sense to run a 4- or 5-bedroom house that there is no need for.

Think of the added energy bills!

In other words, older Australians are sitting in large homes that the younger generations need for their larger families.

And not surprisingly, some sources are now urging older Australians to downsize in the face of Australia’s nationwide housing crisis.

Last year, Labour even introduced legislation designed to encourage Aussies to sell their current home and use the proceeds to purchase a smaller one, then contribute the difference into their super account.

New rules starting 1 January 2023 have lowered the minimum eligibility age to allow people aged 55 and over to access downsizer contributions.

Reducing the financial burden of downsizing could see an uptick in the supply of new family properties for sale, particularly in areas where the population of over 65's is the highest.

But there’s a problem…

Baby Boomers don’t really want to downsize.

Sure traditional thinking said that once the kids move out, parents will sell their spacious family home with a front and backyard and move into a smaller 2-bedroom apartment.

But, as I said, that’s not happening.

Instead of downsizing, or “right-sizing” as it is being fashionably called nowadays, older couples and even singles choose to stay put in their big homes.

Here are 6 reasons why:

- Rather than see change or tree change, many Baby Boomers want to stay in the same neighbourhood - in proximity to the facilities they are familiar with, the same hairdresser, the same dentist, and where their friends and family are. Boomers today prefer to retire in the comfort of their family and friends.

- Lack of suitable accommodation in locations where they want to live - developers are generally not building large enough apartments for downsizers.

- Wealth Preservation - many Boomers feel safe parking their wealth in real estate.

- Support their Children - with the cost of buying a new home increasing, some baby boomers help their children by encouraging them to move back home so they can save the deposit faster.

- Many are still working - with the rise of the knowledge economy, more Baby Boomers are still in the workforce even if it is only part-time.

- The mental roadblock - many of these potential downsizers have lived in their large homes for all, or most, of their lives. They’ve raised families, they’ve worked hard, and so for many the emotional attachment is too strong and overwhelming to overcome.

Downsizing - the pros and cons

Many Aussies are at, or are approaching, that stage in their lives when it’s time to consider downsizing to a smaller home.

Australia’s supply shortage aside, this important decision point can arise for a number of financial or personal reasons.

More often than not, it’s because we’re heading towards retirement or the kids have moved out and the idea of moving into something smaller seems to make sense.

Whatever the reason it’s important to weigh up the pros and cons of downsizing before you make such an important and significant decision.

With this in mind, I’ve listed the 5 pros and 5 cons for downsizers to consider before making the leap.

Advantages of downsizing

- Financial benefits

In simple terms, the larger your home, the higher your household costs.

Specifically, it costs a lot more to heat or cool a large home than it does a smaller one - and at a time when energy bills are about to jump significantly, this could be a significant cost.

And the same principle applies when it comes to other things like watering and maintaining a larger garden or running those electronic devices that seem to multiply when you have more rooms or spaces to fill.

So by downsizing, you can significantly reduce your overall household expenses.

- Less maintenance

Most of us hate doing household work like vacuuming, cleaning, gardening and everyday maintenance, all of which eat into our personal and leisure time and these physical tasks get even harder the older we get.

While moving into a smaller home won’t eliminate these chores entirely, it will reduce the amount of time needed, and therefore free up time to spend doing things we enjoy the most.

- Togetherness and community

Larger homes with multiple inside and outside living areas can provide mini sanctuaries that help us get away from life’s stresses, but they can also act to separate and segregate families while a smaller home can help rebuild or strengthen the family bond by bringing everyone closer together.

Also, single dwellings can be lonely, but moving to a more structured living environment within a community-style property can help to foster social connections and a sense of belonging.

- Increased mobility and accessibility

Smaller homes are generally easier to navigate, especially for individuals with mobility challenges or disabilities.

Fewer stairs, smaller floor plans, and more accessible features can make daily living easier and more comfortable.

- A fresh start, with better location and amenities

Downsizing can give you the opportunity to move to a property with closer and better amenities on your doorstep.

Moving to a new property and location can be a bit daunting, but it can also be a great opportunity to start a new and exciting chapter in your life.

New neighbours, new sights, new friends and new experiences could be just what you need to reinvigorate and re-energise your life and your relationship.

If downsizing is viewed positively it can reap many long lasting rewards.

Disadvantages of downsizing

- Cost of moving

While there will be financial savings, there’ll also be financial costs associated with the move, such as agents fees, marketing costs, legal costs, stamp duty, legal costs and even physical moving costs which need to be taken into account.

- It can be difficult to find what you want

Conceptually downsizing can make sense but practically it can cause problems.

It may not be a simple case of trading big for small because you may not be able to find the right type of accommodation (including aged care if that’s what you’re after), the right location or even an alternative that’s affordable.

With more and more people likely to downsize over the next ten years or so, demand for smaller properties in sought-after locations can push the price up to prohibitive levels.

Furthermore, when you go small you may have to compromise.

For instance, the downsized property may not be as “nice” as the family home and may not have the features you want, like having no garden as opposed to a smaller one.

- You might need to move to a new location

Downsizing often means moving to a new location due to property affordability and availability.

This can be hard especially if you’ve lived in your current home for a long time and have made life-long friends who you may not see as much because of the tyranny of distance.

It can also be hard to move if you’ve currently got access to great amenities like transport, shops and recreation facilities which may not be to the same standard where you’re planning to go.

- Stress, and the emotional strain

One of the biggest challenges of downsizing is breaking the emotional connection with the family home.

There’s no doubt you may have spent many happy years and created some great memories, especially when kids are involved.

The fear for many is that these memories may fade or not be reinforced if you move.

- Unwanted lifestyle changes

When you downsize you may have to compromise on your lifestyle.

For instance, you may lose the family pool, home theatre or a big backyard, and this can have a negative impact on your ability to entertain and do the things you enjoy doing.

In addition, you may find you need to move to higher-density living meaning you’re closer to your neighbours and/or are sharing common facilities (like a driveway or garden).

And assuming you downsize the number of bedrooms, it makes it tougher to receive overnight visitors or welcome the kids back if they need to return to the family home for an extended period.

A final note…

At Metropole, we always advise, whether you’re looking to downsize or buy your next property, on the importance of investment-grade properties and locations.

That’s areas and properties which hold their value over the long term, rather than benefit from an uptick in demand.

But even before looking for the right location, make sure you have a Strategic Property Plan to steer you through the upcoming challenging times our property markets will encounter.

Because aside from remembering that you should focus your efforts on investment-grade properties and locations, you also need to remember that property investing is a process, not an event.

That means that things have to be done in the right order – and selecting the location and the right property in that location comes right at the end of the process.

And that’s because what makes a great investment property for me, is not likely to be the same as what would suit your investment needs.