We've been experiencing a rental crisis with historically low vacancy rates and skyrocketing rents for some time now, so is there an end in sight?

Well, according to PropTrack's new rental vacancy data for August, markets have tightened further, with vacancy rates falling to a new record low.

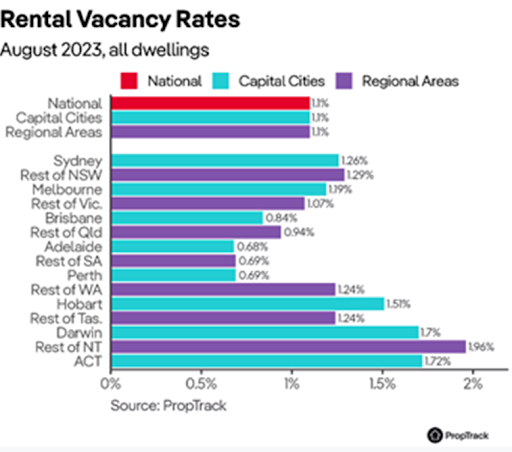

The national rental vacancy rate is now sitting at 1.10%, after falling 0.14 percentage points in August.

In fact, vacancy rates deteriorated in every capital city except Darwin, with Canberra (-0.26 ppt) and Sydney (-0.19 ppt) seeing the sharpest drops over the month and vacancies in Perth hitting a record low.

Furthermore, the supply of vacant rental properties in regional areas has also deteriorated, with the vacancy rate falling to 1.10%.

Regional SA and Queensland are the tightest markets regionally, with the vacancy rate sitting below 1%.

Rental market conditions have tightened considerably since 2021

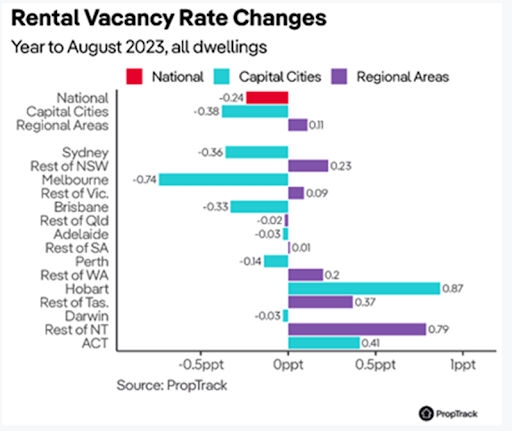

According to Eleanor Creagh, PropTrack's Senior Economist, rental market conditions have tightened considerably in city markets that were hit hardest by the pandemic, spurred by smaller households, cities springing back to life and the return of overseas arrivals.

This is particularly the case in Sydney and Melbourne, where vacancies have more than halved, falling 2.21 and 4.14 percentage points respectively since September 2021.

She further explained:

"Although household sizes have begun to increase again in both capital cities and regional areas — likely because of strong rental price increases and tough conditions — that shift back to larger households (reducing rental demand) is being offset by resurgent population growth which is forecast to continue.

Data released by the Australian Bureau of Statistics this week shows Australia’s population grew by 2.2% in the year to March 2023 – the fastest pace since late 2008.

At the same time, the pipeline of new supply remains constrained, with overall approvals running at near decade lows and construction activity having slowed, worsening the cumulative housing shortfall.

Growth in the supply of new housing is limited at a time when there is already a shortage."

Conditions have tightened significantly over the past year

According to PropTrack, with demand running ahead of supply, conditions tightening significantly over the past year in Sydney and Melbourne, and vacancies remaining below 1% in Brisbane, Adelaide and Perth, there’s little hope of reprieve for renters.

Ms Creagh said that conditions, where most markets remain historically tight, make it extremely difficult for renters to find a home.

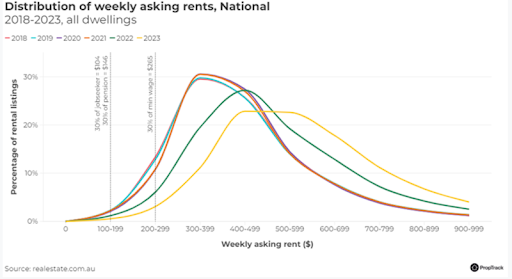

This has caused weekly rents to rise, with advertised rents in the capital cities up by 14.6% over the year to August 2023.

She further said: "With household incomes and wages growth only slowly picking up, rising rents mean tenants are likely to be spending a growing share of their income on housing.

The rental crisis is even more dire for low-income renters and those on welfare benefits, who face a market that has never been less affordable.

Tight rental markets and significant rental price increases have caused rental affordability to dwindle, and the share of affordable” rentals remains at low levels across the country."

PropTrack's data also implies that even with the national minimum wage increasing by 5.75% from 1 July 2023, renters living on the minimum wage can afford just 0.4% of homes listed for rent in Sydney and 0.6% in Melbourne.

The number of affordable rentals has halved in Melbourne and almost halved in Sydney over the past year.

Ms Creagh also noted that the situation is not much better for pensioners and unsurprisingly has also worsened, with the number of affordable rentals falling by 30% since August 2022.

A single-age pensioner looking for an affordable rental faces very limited options, and in some capitals, no properties listed for rent in August 2023 would be deemed affordable.

PropTrack's data highlights that not only is there a shortage of available rentals but also a critical shortage of affordable rentals, demonstrating the urgent need for increased funding and support for affordable and social housing.

Ms Creagh commented that other measures of support also fall short.

She further commented:

"Although the 15% increase to Commonwealth Rent Assistance announced in the 2023 federal budget was the largest in more than 30 years, rent assistance payments have long fallen behind soaring rental prices.

Broad reaching rental price rises across most markets have increased financial stress among renters, with insecure housing tenure compounding the problem."

Investor activity picked up

Well, the good news is investor activity has picked up, and investor lending has returned to comprising around a third of new credit.

But unfortunately, reprieve for renters isn’t in reach.

PropTrack notes that while demand remains well above pre-pandemic levels, vacancies are historically low with available rentals in short supply and properties continuing to lease quickly.

As a result, rents are continuing to climb at a fast pace, with further increases expected.

This is particularly the case in Sydney, Melbourne and Brisbane, where most new arrivals to Australia first land and rental supply is tight.

Renters in Adelaide and Perth also face incredibly tight conditions.