Australia’s property market is suffering a supply shortage, with high-interest rates and tighter rules seeing many property investors succumbing to fear-mongering and selling up… but it hasn’t dampened the property portfolios of our federal politicians.

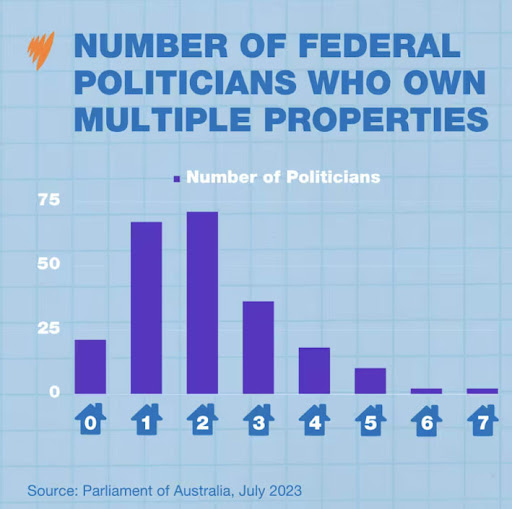

The 2021 Census data shows that 86% of federal politicians own at least one residential property with most owning an average of 2 properties each.

That’s significantly higher than the 67% of average Australians who own an investment property.

In 2017, during the Turnbull government, data shows there was an average of 2.3 properties per politician and an average of 1 investment per average person.

It also shows that many politicians also own a second property in Canberra - whether that’s a holiday home or an investment, which makes sense given they are expected to be there for around 20 weeks per year.

Under parliamentary expense rules, MPs and Senators can claim a $299 travel allowance, per night - even if they stay in a Canberra property that they own.

Source: Parliament of Australia/SBS

The percentage of politicians with at least one investment property (44%) is higher than the 15% of Australians who own an investment dwelling.

About 44% of federal politicians own at least one investment property, 20% own at least two investment properties, and about 8% own at least three investment properties.

Top 4 politicians who own the most properties

- Karen Andrews: Opposition home affairs spokesperson Karen Andrews owns 7 properties with her husband - 1 residence and 6 investment properties.

- Tony Burke: Leader of the House and Employment Minister Tony Burke has 6 properties - 2 residential properties (1 in Sydney and 1 in Canberra) and 4 investment properties.

- Anthony Albanese: Prime Minister Anthony Albanese owns 3 properties - 2 residential properties (1 in Sydney and 1 in Canberra) and 1 investment property in Dulwich Hill.

- Peter Dutton: The Opposition leader owns 3 properties - residential property in rural Dayboro, QLD, 1 investment in Brisbane, and joint ownership of 1 Brisbane investment property.

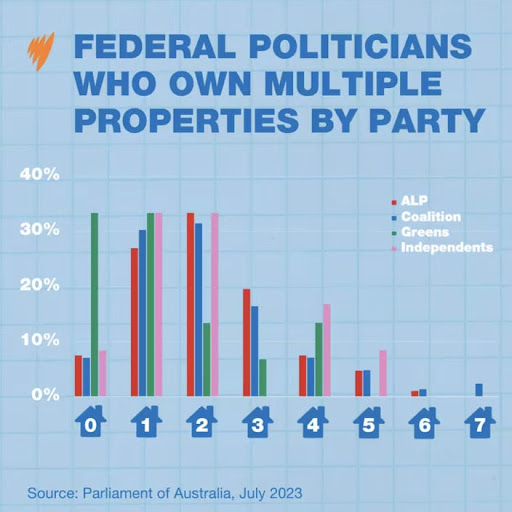

Ownership rates remain steady across all parties

The data also reveals that ownership rates are steady across all parties, and yes, even politicians in the Greens party who seem to want to make it harder for property investors.

Source: Parliament of Australia/SBS

The professions which own the most properties

While the number and percentages of politicians who own investment properties might seem high versus the remainder of the population, when compared to other professions in the same salary bracket they are investing at similar rates.

On average MPs own about 1.34 investment properties per person.

In the 2021 financial year, people with a similar salary ($200,000 to $250,000) had about 1.46 investments per person.

In fact, politicians don’t even make it into the top 20 professions for Aussie property investors.

Out on top, with 43% of 4,159 workers, surgeons are the most prolific property investors.

Second and third on the property investment list are anaesthetists and internal medicine specialists, with around 40% having declared rental income from property investment in 2019-20.

And this lineup makes sense because these professions are also the top 3 highest earners.

According to the ATO, MPs rank 30th on the list of professions most likely to be property investors, with medical specialists making up most of the top ten professions.

How many property investors are in Australia?

According to CoreLogic and ABS:

- The number of residential dwellings in Australia has boomed to 10.9 million

- The total value of Australia’s residential market rose to $9.9 trillion at the end of July 2023, up from $9.8 trillion at the end of June and $9.6 trillion the month before.

- There is a total of $2.2 trillion in outstanding mortgage debt for these properties,

- And 56% of Australian household wealth is held in housing.

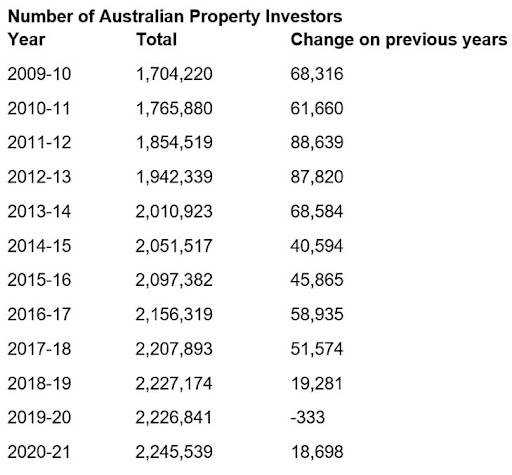

The latest data from the ATO reveals that 2,245,539 Australians or around 20% of Australia’s 11.4 million taxpayers owned an investment property in 2020-21 – this is the latest data available at the time of writing and was released in June 2023.

Here’s how many properties investors held in Australia in the 2020-21 financial year:

- 48% of investors hold 1 investment property

- 86% of investors hold 2 investment properties

- 81% of investors own 3 investment properties

- 11% of investors own 4 investment properties

- 87% of investors own 5 investment properties

- 89% (or 19,920) of investors hold 6 or more investment properties

Yes, fewer Aussies are getting into property investment

While the number of property investors actually rose a little (there were 18,698 more investors than the previous financial year) it's likely this number will be much lower over the next few years as investors fled the market.

Looking at a back series of these ATO stats shows that a decade ago 60,000 to 70,000 new investors entered the property market each year, but this number has fallen significantly over the last few years.

So there are fewer new investors entering the market.

Of course, the figures above are net numbers meaning the change in the number of investors after some investors have exited the market by selling a property and others have entered the list when they bought a property.

A final note

When it comes to property investment, no matter what profession you work in, if you get it right then you have the potential to achieve spectacular capital growth over the years.

But if you get it wrong, you could end up with a property that drains your finances as well as your chances of ever becoming part of that small group of Australians who own multiple properties.

Interestingly, an audit of clients of Metropole showed that they are 7.3 times more likely to own 6 or more properties than the average Australian property investor.

That’s because attaining wealth doesn’t just happen, it’s the result of a well-executed plan.

That’s why I suggest you allow the team at Metropole to build you a personalised, customised Strategic Property Plan which will help you to achieve the financial freedom you desire.

We’re much more than just another buyer’s agent. We help our clients safely build intergenerational wealth.