We find ourselves living in a time of great uncertainty, particularly when we cast our gaze upon the economic landscape of the past decade.

For an extended period, inflation and interest rates remained stagnant, with no indication of change in the foreseeable future.

These conditions persisted for so long that an entire generation has known nothing else.

However, the arrival of COVID brought with it a fall in interest rates which lulled many into a false sense of security.

But then inflation started to rise at a rate at which has exceeded all expectations, creating a profound sense of unease and apprehension.

The cost of living has skyrocketed, causing widespread discomfort, and the property market has been affected with demand declining and prices dropping, while stock levels shrank as sellers delay putting their homes on the market.

At this critical juncture, it is natural to wonder what the future holds.

What steps can we take to restore a sense of certainty and security?

In my view, there are three key changes that must be made to achieve this goal.

Here are my thoughts on the matter.

Inflation

The first domino to fall must be inflation.

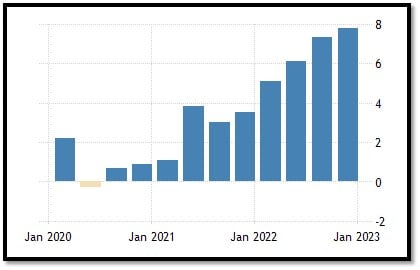

We have seen inflation climb rapidly over the last few years as it now approaches 8%.

This is usually a sign we are overspending and that is playing a role here, but there is also the other side of the equation.

Supply chain issues and the war overseas have affected things like fuel and oil, construction materials, and food shortages, which amongst other things have sent prices upward.

Most of the experts suggest that these issues will continue to resolve themselves and ease some of the pressure as the year goes on.

In fact, this is starting to present itself in some of the overseas data and I would expect it to do the same here once the data lag catches up.

Interest Rates

With inflation starting to recede and consumer spending falling, it will mean interest rates will be the next focus.

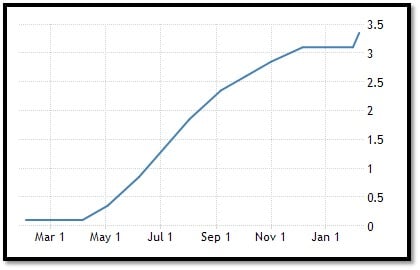

Ten consecutive interest rate rises now place the cash rate at 3.6%, with the potential for more to come.

It is never an exact science, and the RBA must consider a multitude of factors, but don’t be surprised to see an interest rate cut if inflation falls faster than expected.

Leaving the cash rate too high, with falling inflation could be a real issue for the economy, and are fast approaching the juncture.

In my mind, the RBA will need to change from a rapid-fire strategy in favour of a “wait and see” approach.

A steady cash rate with less volatility and maybe even a fall in interest rates should result in greater certainty.

Emergency Buffer

In late 2021, as a result of record-low interest rates APRA increased its minimum buffer that banks have to take into account when assessing your borrowing capacity to 3 percentage points.

In other words, borrowers must now be assessed on meeting their loan prepayments at least 3% above the loan product rate being offered.

A bank offering a loan at 5%, would be assessing borrowers' capacity to repay their loan at 8%.

While there are arguments for and against this buffer remaining, I would expect to see some movement down now we are well above emergency low-interest rates.

Doing otherwise will restrict borrowing capacity, potentially at a time the economy is slowing and in need of some propping up.

This may be the last domino to fall, however, I would expect this to occur when inflation is more palatable and interest rates have settled.

Leaving the buffer too high could result in a credit crunch, particularly for investors.

This could be a significant issue at a time we have a major rental crisis with authorities doing very little to help.

More investors could be an important solution to assist in easing this situation.

The Outcome

All market commentators seem to expect our markets to bottom out at some stage in 2023.

While they may disagree on when there is no doubt the market will be set for a reset.

The timing of this reset will depend largely upon inflation influencing interest rates.

Most expect that inflation is either close or at its peak and should begin to fall away as consumer spending declines and supply chain issues are resolved.

By mid-year, I would expect to have a clearer picture of the economic outlook.

The last piece of the puzzle could be and should be a reduction in the assessment buffer required by APRA.

This could be the icing on the cake and see our property markets finally reset and return to some normality in the back end of 2023.