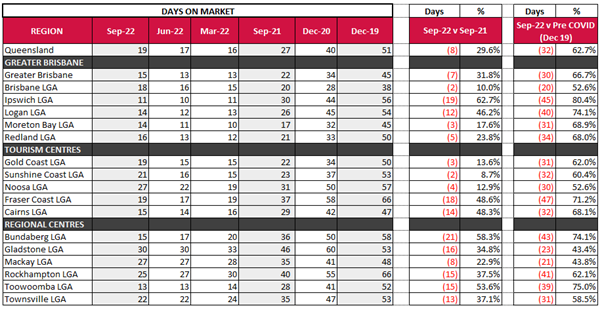

Homes in Queensland are selling significantly faster now that before the pandemic — the average number of days-on-market in the state is sitting at 19 days, down from 51 days pre-COVID.

Real Estate Institute of Queensland (REIQ) CEO Antonia Mercorella said the enduring selling days and higher listings indicate that the property market is holding firm.

“It’s somewhat of a relief that the frenzied buying behaviours and bullish offers spurred on by COVID-19 are behind us, but there’s still strong buyer demand and competition for scarce stock that’s driving sales across the line,” she said.

While the days-on-market got as low as 16 days earlier this year, at less than three weeks during the September quarter it shows buyers still can’t afford sit on their hands if they’re serious about securing a sale.

Meanwhile, the number of listings across Queensland during the September quarter was up, hitting 120,407 versus 113,387 last year. This shows that while supply is low, properties are still consistently coming on to the market.

“This tells us that vendors are still feeling confident about selling conditions.”

Ms Mercorella said despite the aggressive rate hikes and the impacts of inflation slowing down the market, the state’s “phenomenal” two-year growth remains a hard act to follow.

In fact, the downturn has resulted in a minimal decline of 0.77% in median house sale prices during the quarter. On an annual basis, prices are still 17.43% higher.

Median unit sale prices, on the other hand, are just down 0.47% quarterly but remained 11.06% higher over the year.

“We understand that based on looking at three months’ worth of data in isolation, there may be concern, but property is a longer-term investment requiring a long-term view, and certainly looking at annual comparisons paints an entirely different picture,” Ms Mercorella said.

“Queensland still has all the right fundamentals that are the trademark of a strong property market, including being an incredibly powerful migration magnet, relative affordability advantage compared to southern states, strong demand coupled with low supply, a record tight rental market, and low unemployment.”

—

Photo by Valeriia Miller on Pexels.