Cotality's latest Monthly Housing Chart Pack published on Wednesday revealed the national dwelling values rose by another 2.2% over the three months to September, "as price momentum builds".

This is the largest quarterly increase since May 2024 and has pushed the national dwelling values 4.8% higher over the past year.

"This $11.8 trillion milestone is a clear testament to the resilience of Australia's property market," said Eliza Owen, Cotality's head of research for Australia.

Ms Owen acknowledged "some uncertainty" around the timing of another cash rate cut and the possibility of inflation weighing on momentum through the final quarter.

Despite this, she believes that if the property market were to continue at its current pace, "it's possible the combined market value could hit $12 trillion by the end of the year".

Currently, three of the country's four major banks have already revised their rate cut forecasts from November to either February or May next year.

This shift followed inflation figures coming in hotter than expected and the release of the Reserve Bank of Australia's (RBA) September meeting minutes, which economists described as hawkish.

"Unlike in the August minutes, when the board assessed 'the likely pace of reduction in the cash rate over the period ahead', there was no discussion of further easing in the September minutes," ANZ senior economist Adelaide Timbrell said.

Since the recent easing cycle in February, Australia's benchmark interest rate has been reduced by a cumulative 75 basis points.

As of September 2025, the cash rate target remains at 3.60%.

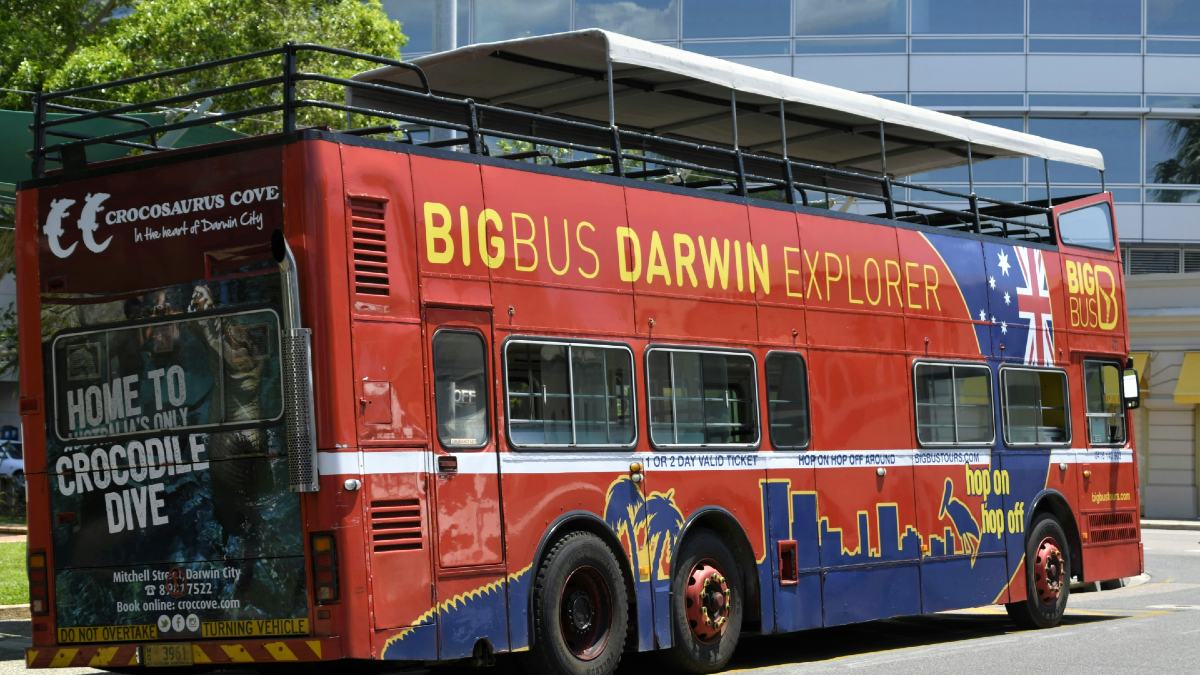

Darwin markets lead the pack amid recent rate cuts

Zooming into the performance of individual suburbs, Cotality uncovered where the market has thrived most decisively since the first interest rate cut this year.

The period between the end of February and September highlights the markets responding strongest to lower borrowing costs and tight supply.

One of the clear trends seen in Cotality's analysis of suburb-level dwelling values is Darwin markets setting the pace for capital growth.

Suburbs like Wanguri and Durack (NT) both led the nation with a significant 20.1% rise in values.

"This surge in Darwin suburbs reflects a powerful combination of relative affordability, extremely low levels of housing supply, and a notable lift in investment activity," the report said.

By contrast, larger capitals Sydney and Melbourne accounted for the majority of areas experiencing a dip in values since the rate cuts began.

The steepest declines were concentrated in inner-city, lifestyle suburbs, primarily those with high-density unit stock. Milsons Point in Sydney saw the sharpest drop at -7.1%, with Kirribilli close behind at -6.3%.

Buyers now going after affordable markets

Ms Owen said these latest findings reflect market dynamics more broadly.

"Even though we've gone hyper-local with the suburb analysis, the data highlights a broader trend of Darwin leading Australia's capital growth trend," Ms Owen said.

"City home values are up 13.4% through the year to date. It's a relatively affordable market, and investors may be taking note of high yields and rapid value increases."

She also noted that some of the top performing regional markets were also the most affordable, citing Boggabri in regional NSW and Rochester in regional Victoria, which each have a median value of below $400,000.

"With other capital cities and major regional markets soaring in value over the past few years, it seems like buyers are targeting what is left of the affordable land and housing across the country as interest rates fall and rents re-accelerate," Ms Owen opined.

Outside of Darwin, the mid-sized capitals continued to lead growth, with Perth home values up 4%, Brisbane up 3.5%, and Adelaide up 2.5%.

Image by Francis Cooper-McKenzie on Unsplash