Surging holding costs have made negative cash flow the “new normal” for many property investors in Australia.

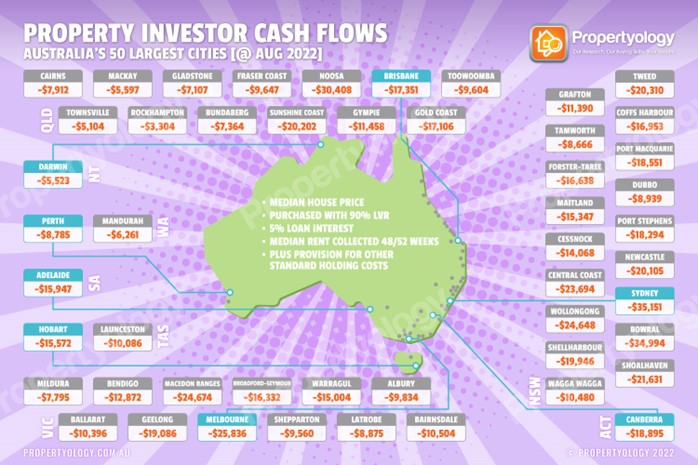

According to Propertyology, investors who are purchasing a detached home with a 10% deposit can expect a shortfall of less than $10,000 in only six of the 20 largest cities. In many areas, shortfalls are likely to be bigger.

For instance, an investor looking to get a property in Parramatta in Sydney’s middle ring would likely see a loss of $48,000 yearly.

The same can be said in Melbourne’s Maribyrnong, where investors could potentially see an annual loss of $28,000.

Meanwhile, the shortfall between rental income and associated expenses in Adelaide, Brisbane, Hobart, and Canberra now ranges $15,000 to $20,000.

Propertyology head of research Simon Pressley said the best cash flows among the biggest cities are in Darwin, Mackay, and Townsville, where annual holding costs are at around $5,000.

“Perth, Cairns and Toowoomba are next best with cash flow shortfalls of between $5,000 and $10,000 per annum,” he said.

Meanwhile, across 140 townships, only detached properties in Port Hedland, Karratha, Broome, and Kalgoorlie are cash flow positive.

“It always pays to cast the net wide — for example, a major regional city like Dubbo has already produced a similar average annual capital growth over the last 20-years to Sydney and, with net annual holding costs of approximately $9,000, currently has one the best cash flows in Australia for property investors," Mr Pressley said.

Given the current market conditions, Mr Pressley said a realistic rule-of-thumb is for investors to budget an annual shortfall of around $10,000 to $15,000.

The infographic below shows the annual shortfall investors can expect in the 50 largest cities:

Mr Pressley said while landlords have benefitted from fast-rising rents and low mortgage rates in recent years, the larger costs in expenses and upward trajectory of the cash rate have established a new normal for property investment.

“In a big-picture scheme of things, I think that’s healthy. But the timing of the recent rises creates a perfect storm for the already dire shortage of rental supply,” he said.

Propertyology revealed the 2022 calendar year ended with only 32,000 properties advertised for rent across Australia — this is significantly lower than the 80,000 advertised properties three years ago when the national population was 700,000 fewer.

“Housing does not grow on trees. At least 200,000 permanent skilled migrants plus 500,000 international students will arrive over the next 12 months, resulting in even more tenants getting displaced and rents rising significantly in 2023,” he said.

This makes it necessary for all levels of government, Mr Pressley said, to encourage more investors.

“The nation depends heavily on everyday Aussie property investors funding 98% of all existing rental accommodation to Australia’s tenant population of approximately eight million people,” he said.