Australia’s rental markets are poised to have its tightest conditions over the next two months, after vacancy rates retreated in January after the seasonal rise in the last month of 2022.

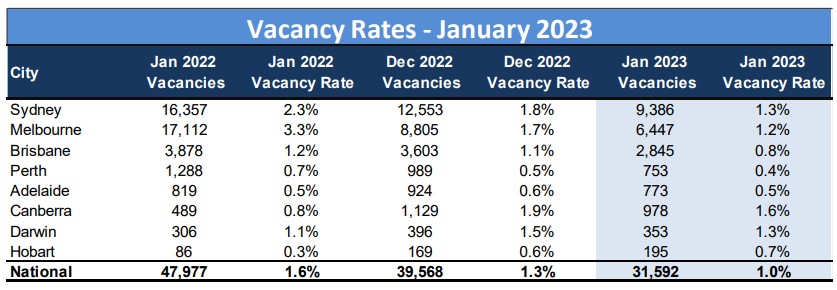

According to SQM Research, national vacancy rates declined to 1% in January, with all capital cities, except Hobart, and most regional markets reporting declines over the month.

Overall, there were 31,592 vacant residential properties available for rent in January, which was a decrease from 39,568 in December.

Sydney, Melbourne, Perth, Brisbane, and Canberra recorded declines in their respective vacancy rate to previous record lows.

Across regional markets, with Sydney’s Blue Mountains, Melbourne’s Mornington Peninsula, and Queensland’s Toowoomba all registered falls in January after evidence of an easing of conditions in the second half of 2022.

Interestingly, rental vacancy rates on Queensland’s Gold Coast bucked the trend and continued to rise.

SQM Research managing director Louis Christopher said the brief rise in rental vacancies over December was only due to seasonal factors.

“We are expecting a further tightening in rental vacancy rates over the month of February based on evidence that weekly listings have fallen again thus far in the current month,” he said.

“We have previously warned that the months of February and March will be the most difficult time for tenants in the national rental market in many years.”

The ongoing tension in the rental markets triggered an increase in rents.

Over the past 30 days to 12 February 2023, capital city asking rents increased 2.4%. Compared to the same period last year, rents across state capitals were 24.7% higher.

On a national level, rents increased 17.4% annually.

Mr Christopher said the ongoing surge in rents is pushing up rental yields, especially with falling prices.

“I believe ‘would-be’ investors will be attracted to higher rental yields in later 2023, provided the cash rate peaks at below 4%,” he said.

“However, if the cash rate rises above 4% it is likely home buyers including investors will largely stay away from the housing market for another year, and so investment dwelling approvals will remain in the doldrums, setting us up for another super tight rental market in later 2024 and 2025.”

—

Photo by 89Stocker on Canva.