As the saying goes, ‘what goes up must come down’.

Following two years of unprecedented growth, property prices across New Zealand are trending downwards, with the Real Estate Institute of New Zealand (REINZ) recording a 9.2% drop in property values since the November 2021 peak.

This decline brings heavy ramifications, with research conducted by Bloomberg Economics revealing New Zealand has the ‘bubbliest’ property market, ranking first among 19 OECD countries facing the greatest risk of a property price correction.

Three places back from our Kiwi neighbours, Australia sits in fourth place ahead of some major players including the US, Canada, and the UK.

CoreLogic NZ’s Chief Property Economist Kelvin Davidson said the signs of weakness are very clear for New Zealand.

“At the headline level, 323 suburbs have seen values drop by at least 1% over the past three months, with another 163 suburbs recording value falls of less than 1%, meaning a touch more than half of all suburbs have now entered a downswing,” Mr Davidson said.

“When looking at the largest value falls, 11 suburbs declined by 5% or more, including parts of Auckland, Dunedin, Upper Hutt, Lower Hutt, and Porirua.

“In dollar terms, the largest drop in the last three months to May has been in Auckland’s Point Chevalier where the median value fell $104,400 or 4.6%.”

Downturn a matter of when, not if for residential NZ investment

ANZ economists say residential investment is in the firing line as interest rates push higher to combat decades-high inflation, house prices fall, and shortages of both materials and labour continue to add uncertainty in the near term.

“The calculus of building has shifted dramatically in the space of a few quarters and the stars are now aligned for an unwind,” ANZ Research reported.

“In fact, some indicators are already pointing sharply south, but it’s difficult to diagnose whether this is more a story about constrained supply or waning demand.

“We think it’s a mix of both, but come 2023 softer demand will be the dominant driver. Overall, we have penciled in around a 6% contraction in residential investment activity over 2023, which relative to previous cycles can very much be thought of as a soft landing.”

Reserve Bank of New Zealand (RBNZ) Chief Economist Paul Conway fears the tide may well have turned against housing as New Zealand’s go-to investment.

"Housing market dynamics in the future are unlikely to be the same as in the past,” Mr Conway said.

“For several decades, we have traded houses among ourselves at ever-increasing prices in the belief that we were creating prosperity, but the tide may well have turned against housing being a one-way bet for a generation of Kiwis.”

Australia’s property market may follow suit

Throughout history, sales volumes and housing market growth have trended together. As of May 2022, there were 39,790 estimated sales settled across Australia, according to CoreLogic Australia data.

CoreLogic Australia Head of Research Eliza Owen said while that is high for this time of year, it is 26.9% lower than in April of 2021.

“In fact, monthly sales volumes across Australia have generally been trending lower since November last year,” Ms Owen said.

Proving to be a key driver to falling sales volumes and property prices both here and across the ditch is interest rates.

New Zealand first began the process of responding to soaring inflation in October 2021, with RBNZ increasing the cash rate from a then emergency setting of 0.25%. At the same time, Australia’s cash rate remained at the historic low of 0.10%.

Since then, New Zealand has increased the cash rate at a rather rapid pace to reach 2.50% as of July, with Australia sitting behind at 1.35%.

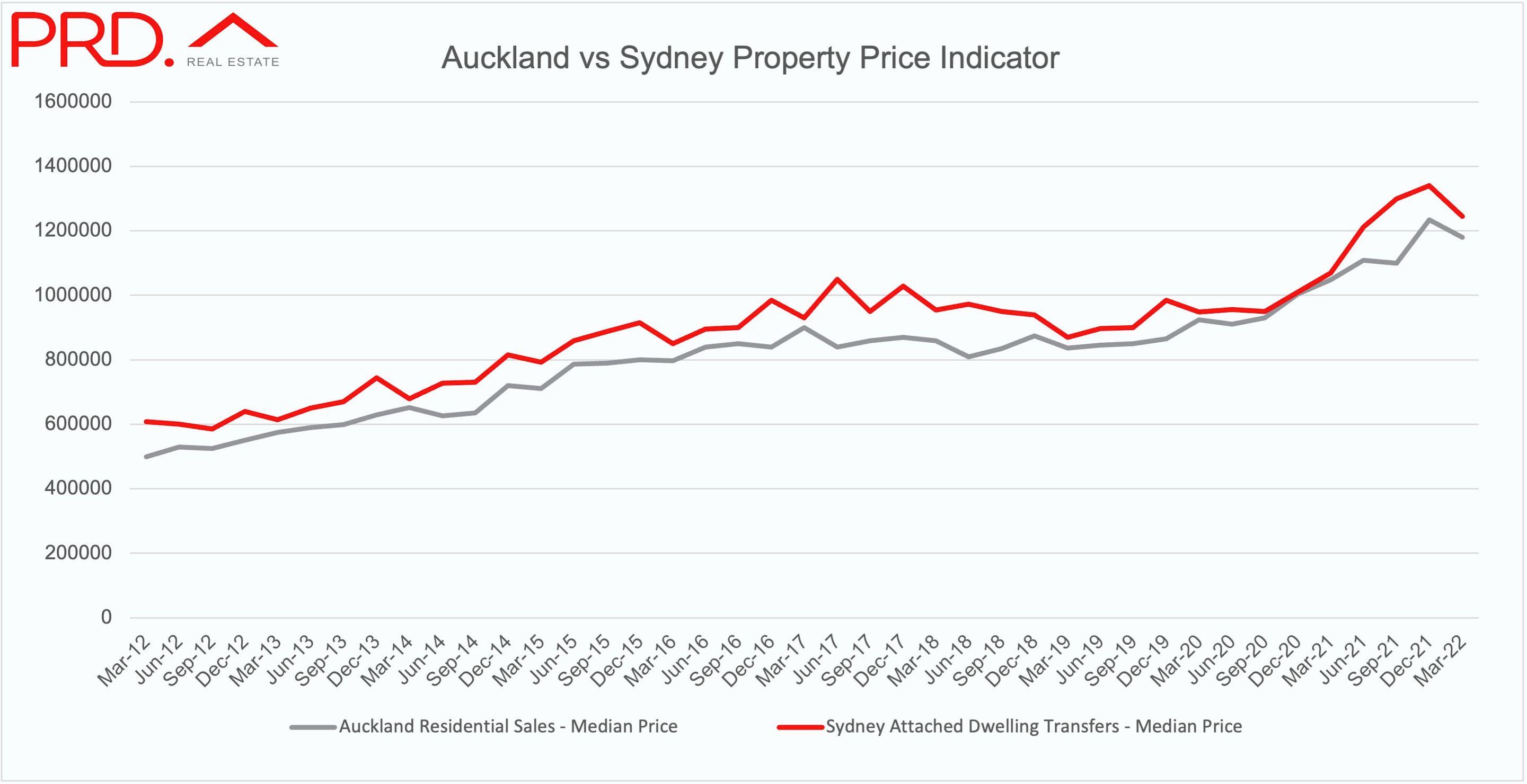

PRD Chief Economist Dr Diaswati Mardiasmo notes when New Zealand increased cash rates in October 2021 by 25 basis points, property prices increased a little, with the next 25 basis point increase in November 2021 stabilising prices.

“Since December 2021 New Zealand property prices started to decline, all the way to February 2022,” Dr Mardiasmo told Your Investment Property Magazine.

“New Zealand increased the cash rate by 25bps in Feb 2022, and prices spiked in March 2022 due to a fear of missing out. It wasn’t until New Zealand’s cash rate was increased by 50bps in April that property prices started to really cool down.”

Dr Mardiasmo said importantly Australia’s cash rate was lifted by 50 basis points in its second consecutive increase, whereas NZ’s cash rate did not rise by 50 basis points until its fourth consecutive cash rate increase.

“Taking our experience from past cash rate increases in 2006-2007 and 2009-2010, it took several increases to see property prices stabilise, even then at a higher level,” she said.

“We would need a big cash rate increase to cool down the market completely, however, we appear to already be doing that at a faster rate than New Zealand, which may translate to a quicker speed in cooling down prices.

“Overall our markets are more varied than that of New Zealand’s - the differing depth of demand and supply imbalance in our market is more prevalent.”

In the face of adversity, opportunities may arise

With a number of residential buyers currently sitting on their hands, Michelle May, Principle of Michelle May Buyers Agents, believes the property cherry is ripe for Aussie investors to reap the benefits from less competition.

“There is a lot of choice currently in the apartment market, however, I do think that investors should proceed with caution and only really go for properties that will see them in good stead for the future,” Ms May told Your Investment Property Magazine.

“There are many micro-markets within a particular city, with the likes of Randwick operating very differently to Paddington, so you need to look at the quality of the property, and then how that property works within the market mechanics of that particular suburb.”