What are the depreciation rules if you inherit a property? Can you still claim plant and equipment on a new build if it’s a few months old by the time you take possession? And what’s the story if you convert a PPOR into a rental? Tyron Hyde provides some answers...

The dust has finally settled on the new legislation regarding changes to the way depreciation will apply to second-hand residential properties. In this article we will dig deep into some of the questions we have commonly been asked since 9 May 2017, when the changes were announced in the federal budget.

Before we get into the nitty-gritty, let’s begin with a quick recap. A property investor who acquires a second-hand residential property after 10 May 2017 that contains ‘previously used’ depreciating assets will no longer be able to claim depreciation on those assets. ‘Depreciating assets’ in this case refers to things like ovens, dishwashers, blinds, etc.

Now let’s start with some of the easy questions we’ve been asked.

Q: Do these new rules apply to brand-new investment properties as well?

A: No, they don’t. If you buy a brand-new property you will be able to carry on claiming depreciation exactly the way you have done so to date. That means you can claim both the plant and equipment, and on the structure of building.

Q: How do these new changes affect purchasers of non-residential property, such as offices and industrial suites?

A: The proposed changes only relate to residential property. Commercial, industrial, retail and other non-residential properties are not affected in the slightest.

Q: Can I still claim depreciation on things like the bricks, concrete and windows?

A: Yes, you can, provided the residential property was built after 1987, when the building allowance kicked in. You will still need a depreciation schedule to calculate these deductions. This component typically represents between approximately 80% and 85% of the construction cost of a property.

Q: Can I still claim depreciation on plant and equipment items if I buy them and have them installed?

A: Yes, you can, provided they are brand new or from 2nds World or the like. However, if you buy a second-hand item on Gumtree, for instance, you cannot claim the depreciation.

There is now no other depreciable asset class in which this occurs. The new laws governing residential properties state that the item cannot be ‘previously used’ if you are claiming depreciation on it. However, if you buy a previously used lounge on Gumtree and put it in your office, you can claim it. Go figure!

Q: If I buy a property in a trust or company name, will I get around these laws?

A: The proposed changes do not apply if you buy the property in a corporate tax entity, super fund (note self-managed super funds do not apply here) or a large unit trust.

This is interesting, and I suspect a lot more people will start buying properties in company tax structures to take advantage of the depreciation benefits.

Next we’re going to dive into some of the more complex questions that have come out of this legislation.

"The ATO still acknowledges that the investor should be able to claim depreciation, but is limiting the claim to when the property is sold"

Q: Complex question #1: What if I bought a property prior to the budget and the changes to depreciation and lived in the property until now? Can I claim the depreciation if I move out and convert the home into an investment property?

A: If you bought a property prior to the budget and it was owneroccupied, and then you moved out after 1 July 2017, you would not be able to claim depreciation on the plant and equipment in that property.

The property needed to be income-producing in the 2016/17 financial year in order to qualify for full plant and equipment depreciation deductions. Those items would be deemed to be previously used and thus caught in the net of the new legislation, even though you acquired the property prior to the budget. As a result, these changes are kind of ‘half-grandfathered’, if you ask me.

Q: Complex question #2: What happens If I inherit a property? Can I claim the depreciation on the plant and equipment as well as on the building?

A: You will certainly be able to claim the depreciation on the residential structure of the building, provided it was built after 1987. So there’s no change there – and this covers most properties.

While there is no specific ruling on the plant and equipment associated with inheritances, it seems to me that if you inherited a property with plant and equipment items contained within it, they would be deemed to be previously used, and you therefore would not be able to claim them.

This would, in my opinion, even occur if the person that you inherited the property from bought the property brand new. As I have mentioned, there is little guidance on this topic, so it might be best to check this with the ATO if this question is relevant to you.

"If you want to maximise your depreciation benefits on an overseas property, look for a newer property built in the last decade or two"

Q: Complex question #3: What happens if I buy a unit that is three months old, where the developer has already found a tenant and is selling it ‘as new’. Can I claim both the plant and equipment and the building allowance?

A: In this case the answer is yes. The new legislation allows a developer a period of six months in which to find a tenant and sell the property as a leased investment, without nullifying the depreciation claim for the incoming buyer.

This was a late change to the legislation and occurred after industry consultation between the Treasury department and the property industry, including myself.

Q: Complex question #4: Can I still claim depreciation on a property that I bought overseas?

A: The answer is yes, you can claim depreciation on an overseas investment property, but there are a few key differences. The first main difference is with regard to claiming the building allowance. With Australian properties you’re entitled to claim 2.5% of the construction costs per annum, as long as the property was built after July 1985. The percentage for overseas properties is the same, but the date is different. Construction of the overseas property must have commenced after 22 August 1990.

So, if you want to maximise your depreciation benefits on an overseas property, look for a newer property built in the last decade or two.

The plant and equipment, such as carpets, ovens, lights and blinds, can also be depreciated as they would be in an Australian investment property, but according to the new rules they now have to be brand new or not previously used.

Q: Complex question #5: What happens if I engage a builder to renovate my investment property? Can I still claim depreciation?

A: In simple terms, yes, provided all the plant and equipment items that are installed are brand new. You will also be able to claim all the structural items installed, such as kitchen cupboards, tiling windows, etc. Now, some of you might be wondering: what happens when you sell a property that you bought after the 2017 budget?

This is where it gets really interesting. The budget statement words it like this: “Acquisitions of existing plant and equipment items will be reflected in the cost base for capital gains tax purposes for subsequent investors.”

The following scenario (see boxout, right) will help you make sense of that. In this example, under the old rules Peter would have claimed depreciation allowances over the period he owned the property. Now the government is saying he can’t claim the depreciation all the way through, but it is taken into consideration when he sells the property.

So, even though Peter hasn’t been able to benefit from ongoing depreciation deductions for his plant and equipment, the ATO still acknowledges that the investor should be able to claim depreciation, but is limiting the claim to when the property is sold, and the amount is included in the capital gains tax calculation.

Example:

Peter buys a second-hand property for $600,000 in July 2017, with plant and equipment valued at $30,000.When Peter sells the property for $800,000 in 2020, the $30,000 of original plant and equipment is written down to $10,000.

» Peter pays $600,000 for the property in 2017

» He sells the property for $800,000 in 2020 with $10,000 worth of plant and equipment remaining

» Undeducted plant and equipment is $30,000 – $10,000 = $20,000 » Peter’s CGT equation = $800,000 – $600,000 = $200,000

» Less undeducted depreciation $200,000 – $20,000 = $180,000 capital gain

Show me the numbers!

Show me the numbers!

At the end of the day, how much will these changes actually mean in terms of the amount of depreciation you will be able to claim moving forward? In order to understand this, it’s best to examine three different scenarios:

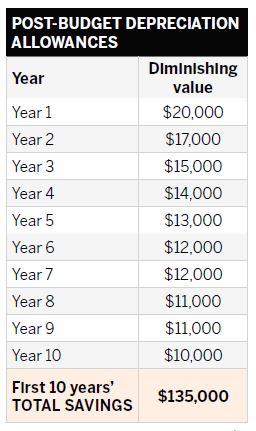

- Scenario 1: An investor buys a brand-new unit or house for $850,000. As you can see from Chart 1, the depreciation amount you can claim if you bought the same property pre-budget or post-budget hasn’t changed. That’s because brand-new property is exempt from these changes.

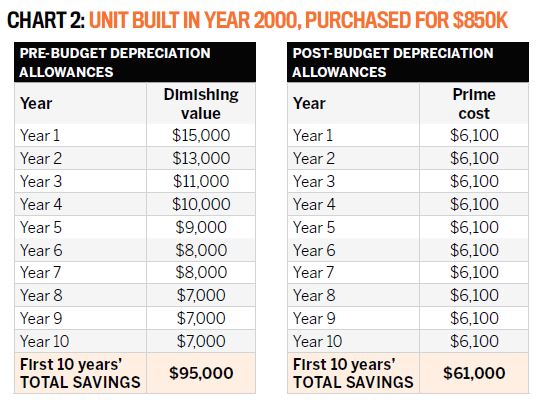

- Scenario 2: An investor buys a residential house or unit for $850,000 that was built in the year 2000. As you can see from Chart 2, the depreciation allowances available have now been dramatically reduced in the early years. Towards about Year 8 they level out and aren’t that different.

The pre-budget chart on the left-hand side still shows that you can claim the plant

The key takeaway from this is: the depreciation allowances on second-hand property built after 1987 are affected most in the first five years of property onwership. After this point, there’s not much difference.

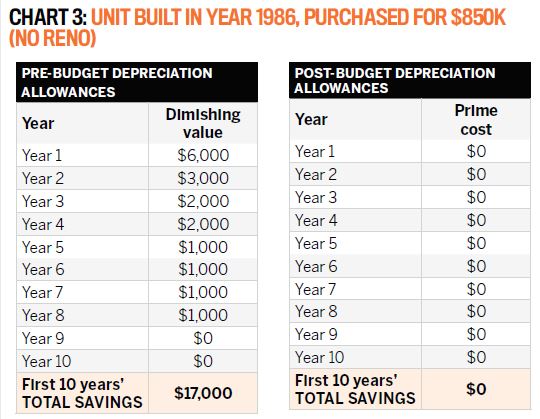

- Scenario 3: An investor buys a residential house or unit for $850,000 that was built prior to 1987 and hasn’t been renovated. In this scenario, it’s all or nothing! Pre-budget, we, as quantity surveyors, would visit a property, regardless of its age, and revalue plant and equipment items such as carpets, oven, etc.; in essence, starting the depreciation process again.

The government wanted to stop this continual revaluation of plant and equipment, and this will be achieved by the new legislation. As you can see from Chart 3, if you buy a property built prior to 1987, there will be no claim at all if the property is still in its original state. Why? Well, the plant and equipment will be deemed to be ‘previously used’, thus no claim would apply; and in order to claim the building allowance the property would have had to be built after 1987.

However, this is very rare, as most properties built prior to 1987 have had some renovation done to them – such as installing a new bathroom or kitchen, for example – and those costs are claimable. Finally, I have been asked this many times: “Tyron, what do you think about the changes?”

Here’s my take on it: I agree that the constant revaluing of plant and equipment items on very old properties made no sense and needed refinement. However, I think the approach the government has taken in disallowing depreciation on properties that are near-new doesn’t make a lot of sense and could have been rolled out far more logically.

.jpg) Tyron Hyde

Tyron Hyde

is director of Washington Brown

Depreciation Specialists and has

over 20 years’ experience in the

construction and development industry.