My apologies, self-employed people, but you’re risky, unreliable, seasonably variable and sometimes a little fuzzy with your paperwork.

Or at least, that’s what a lender will say when you walk in the door asking for a loan.

No doubt, it can take a little extra nous to land finance when you’re your own boss. But I think if you’re smart enough to run your own business, you’re certainly smart enough to figure out how to get what you need from a lender.

Let’s simplify everything into a quick guide to how banks will treat you as a self-employed borrower, and then the steps you can take to land the loan you want.

First of all, banks need to see details on paper.

Yes, this one’s obvious, but for some, administration is not second nature. Make sure you keep all your incoming and outgoing monies in order. You’ll need to provide BAS documents, tax returns and bank statements.

Use a finance program or App to keep everything on track and on hand. You don’t want to miss a piece of vital documentation that could make or break your chances for approval (and your accountant will thank you at tax time).

Know that banks will mitigate their risk by downplaying your income.

Banks are smart. They know self-employed people are more risky, so they’ll look at two years’ worth of your income and choose the lowest-earning year as the numbers they’ll base their lending on, or use an average of the two. Unfair? Absolutely. But their priority is securing their loan, so they’re going to make sure you can afford the repayments.

You might need to wait if your business needs another year to gain more profit, or you could look at sourcing a cheaper property that fits within your borrowing power as it stands. You might need to save up a bigger deposit to offset a smaller loan amount.

Tip: There are some banks that only look at the previous years’ income, so if your business is less than two years old or you earned substantially more in the latest financial year, source a bank who will work on one year of documentation.

Be aware that banks will offer you ‘alternative’ loans that will likely cost you more.

You may have heard of ‘low doc’ loans, which require less documentation compared to full-doc loans. Therefore, this may be an option for a self-employed person who can’t gain approval for a regular loan.

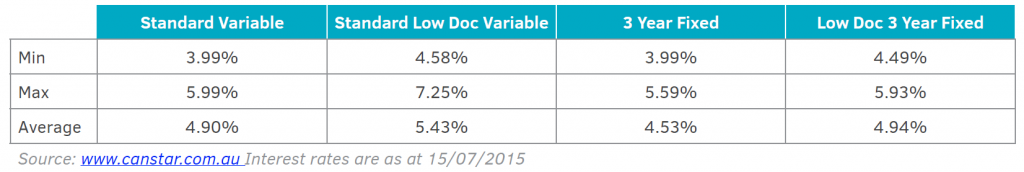

However, there’s a catch. Often these low doc loans charge a higher interest rate and higher one-off fees, so banks can protect themselves from risk.

Here’s Canstar’s interest rate comparison from a 2015 study:

While a low doc loan might be a good choice for you in your circumstances, always do the numbers before diving in.

Other ways to boost your borrowing power as a self-employed person:

Be mindful that your deductions can be your undoing. Reducing your taxable income through deductions means that in the banks’ eyes, you earned a lot less than you did.

If you’re planning on applying for credit in the near future, ask yourself this at tax time: if I claim all my deductions, am I going to miss out on a loan for my next property? Is the tax return amount worth it?

Reduce the limit on your credit card.

Regardless of how much is owing on your credit card, banks will see your limit as the amount you owe. Dropping your $20,000 limit to $6,000 can do wonders for your serviceability.

Have savings in the bank and a history of good budgeting.

If you can prove your saving ability and provide a buffer, banks will look on you more favourably.

Being self-employed might present its challenges when it comes to working with lenders, but with a thoughtful strategy and some processes in place, banks will struggle to find a reason to say no.

Til next time, happy investing!

Helen Collier-Kogtevs

.................................................................................................

Helen Collier-Kogtevs is the Managing Director of Real Wealth Australia, a leading education and mentoring company for real estate investors. Not only is she a highly successful property investor and an educator, but also a best-selling author, and a philanthropist.

Helen Collier-Kogtevs is the Managing Director of Real Wealth Australia, a leading education and mentoring company for real estate investors. Not only is she a highly successful property investor and an educator, but also a best-selling author, and a philanthropist.

Helen is particularly passionate about helping people, especially people who are keen to create wealth and make a difference in their lives, and she has been mentoring thousands of new and experienced investors in their pursuit of wealth creation through property.

She founded Real Wealth Australia to mentor investors create wealth and financial freedom by focusing on helping them build an investment strategy to fit their individual goals, rather than focusing on one particular investing method using her successful “10 Properties in 10 Years™” system.

Disclaimer: while due care is taken, the viewpoints expressed by contributors do not necessarily reflect the opinions of Your Investment Property.