Positive Real Estate has been sourcing deals nationally for almost 10 years and has successfully targeted each of the growth markets in Australia often TWO YEARS before many other experts; sourcing some huge profits for clients – simply by following the science behind town planning. There are huge capital gains to be made - just by understanding the town plan, dissecting it and honing in on significant growth drivers.

Town planning essentially is “the greatest good for the greatest number.”

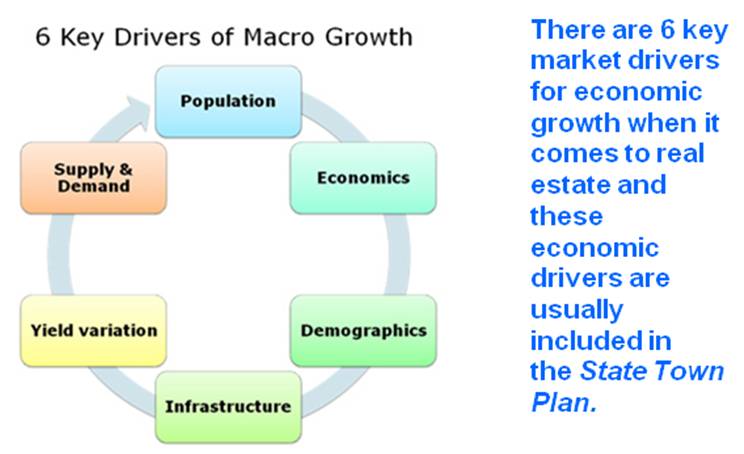

Every state has a town plan that offers some exceptional must-know fundamentals for profitable real estate investing. If you knew where all the infrastructure was going; where all the population was moving to and where the government was going to spend a truckload of money – would you be interested in investing in that area? Of course you would!

In my experience one of my biggest successes has come from following the spending habits of the government and the consumer habits of people and the places they inhabit. Knowing how to study the town plan means you know where you can invest for future profits.

If you follow these 6 key market drivers – you will find significant growth when it comes to real estate.

At Positive Real Estate we pride ourselves on understanding the Town Plan.

The State Government usually lays out Town plans for 25-30 years in advance. Some state plans are certainly better than others – and that’s what we research in detail to analyse which locations will benefit the most, based on where the government is spending their money.

Learning all of this crucial information makes you a better property investor. I believe there is no natural born property investor out there in the real estate market – you all need to earn your stripes and you do that by learning so I would encourage you to come along to our next Property Investor Night.

Town planning is a key education requirement for your journey through investing. It can be the difference between selling a property for $200,000 or for $4,000,000. By researching the town plan carefully you can foresee the potential profit to be made and AVOID disastrous investment decisions; like selling just before a BOOM, or investing in an area that will have little infrastructure spend. Understanding an area, projecting its future and judging its change will serve you well.

The study of real estate fundamentals is important. It will serve you well and serve you for a lifetime. If people took the time to understand and school themselves in real estate practices, wealth would not just be for a select few.

The Mistake Of Not Knowing Your Town Plan!

Sam Saggers - May 31, 2012

72 - 76 Bayswater Road, Potts Point is now 40 luxury apartments, next to the Vibe Hotel Sydney. The land was recently valued at $8.9 million dollars. In 1982 my family owned this parcel of land and had done so for over four decades. On the land they operated a 60-room bed and breakfast. As people do, they grew weary of the property and the going concern of the bed and breakfast; therefore they duly sold the property for $200,000. Five years later, this property sold for $4 million....

continue reading>>

Sam Saggers is CEO of Positive Real Estate and Head of the buyers agency which annually negotiates $250 million-plus in property. Sam's advice is sought-after by thousands of investors including many on BRW’s Rich 200 list. Additionally Sam is a published author and has completed over 2000 property deals in the past 15 years plus helped mentor over 2200 Australian investors to real estate success!

Get more from Sam Saggers, register for a FREE property investor night

To read more Expert Advice articles by Sam Click Here

Disclaimer: while due care is taken, the viewpoints expressed by contributors do not necessarily reflect the opinions of Your Investment Property.