It’s now the beginning of March and the summer property season finished with a bang with record auction clearance rates week after week and property values rising around Australia.

Sometimes it’s hard to remember how lucky we are as a nation compared to the rest of the world.

Not only from the point of view of total COVID-19 cases and its containment, but also how our economy has recovered from the short sharp recession we experienced last year and how we’re getting on with our lives.

Around 90% of the jobs that disappeared due of Covid have been recovered, consumer sentiment has increased, household savings have skyrocketed and we’re spending more and this has led to strong retail sales.

It seems the lockdown has given many people time to think that life is too short and we deserve a reward, so many Australians are out buying new cars, campervans, jet skis, TVs and all sorts of audio-visual equipment, with many retailers running out of stock.

This increase in confidence, coupled with historically low interest rates and pent-up demand caused by our property markets being put on pause last year has also stimulated the property markets around Australia.

Now that we’ve got a couple of months data under our belt it’s a good time to see what’s really happening in our property markets which is what I discuss in this week’s Property Insiders chat with Australia’s leading housing economist Dr Andrew Wilson, chief economist of MyHousingMarket.com.au

We also discuss what will eventually stop our property markets growing.

Australia’s housing market is in the midst of a broad-based boom

Home values surged higher in February; spurred on by a combination of record low mortgage rates, improving economic conditions, government incentives and low advertised supply levels.

Housing values are rising across each of the capital city and rest of state regions, demonstrating the diverse nature of this housing upswing.

One of the challenges of a fast moving market is to have realistic data, and there’s quite a lag in some of the data provided by the Australian Bureau of Statistics and even many of the data providers.

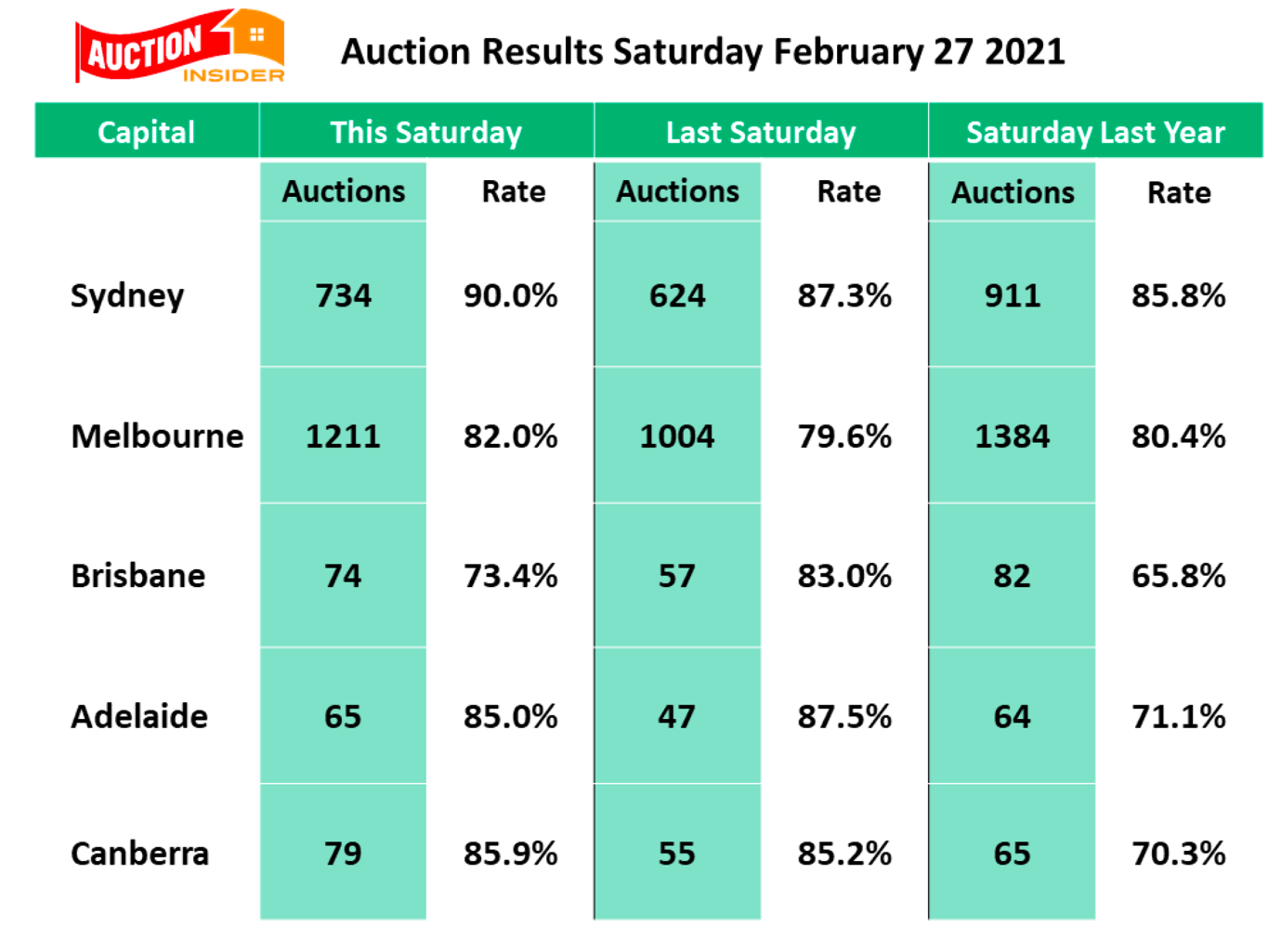

At times like this auction clearance rates are a good indication of how vendors and buyers are feeling, and now that we’ve had a number of weeks of action data available, we are getting a good idea of what’s happening.

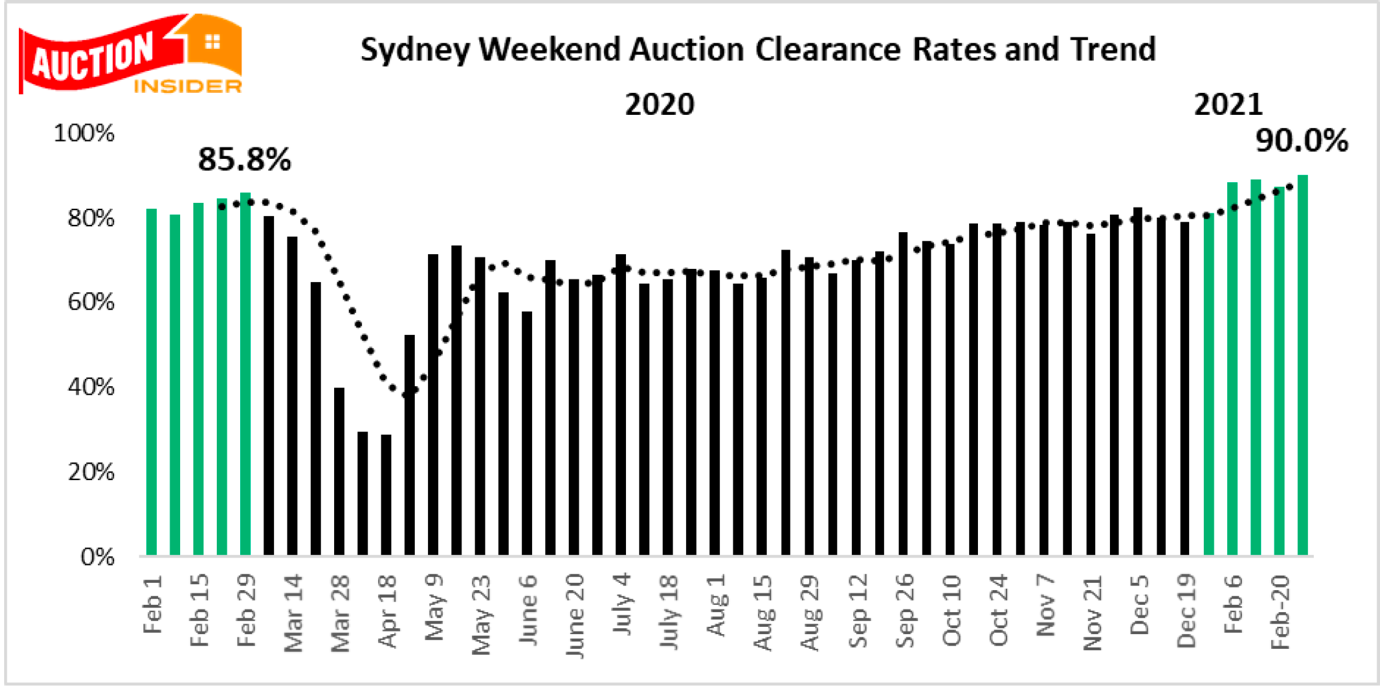

Watch this week’s video as Dr Wilson gives his summary of the auction markets around Australia. The Sydney auction market is now tracking at unprecedented levels which is likely to continue moving due to strong buyer demand at a time when new listing growth declines.

The Sydney auction market is now tracking at unprecedented levels which is likely to continue moving due to strong buyer demand at a time when new listing growth declines.

One weekend after another these high auction clearance rates continue despite more properties coming up for sale – prices can only go one way over the next year.

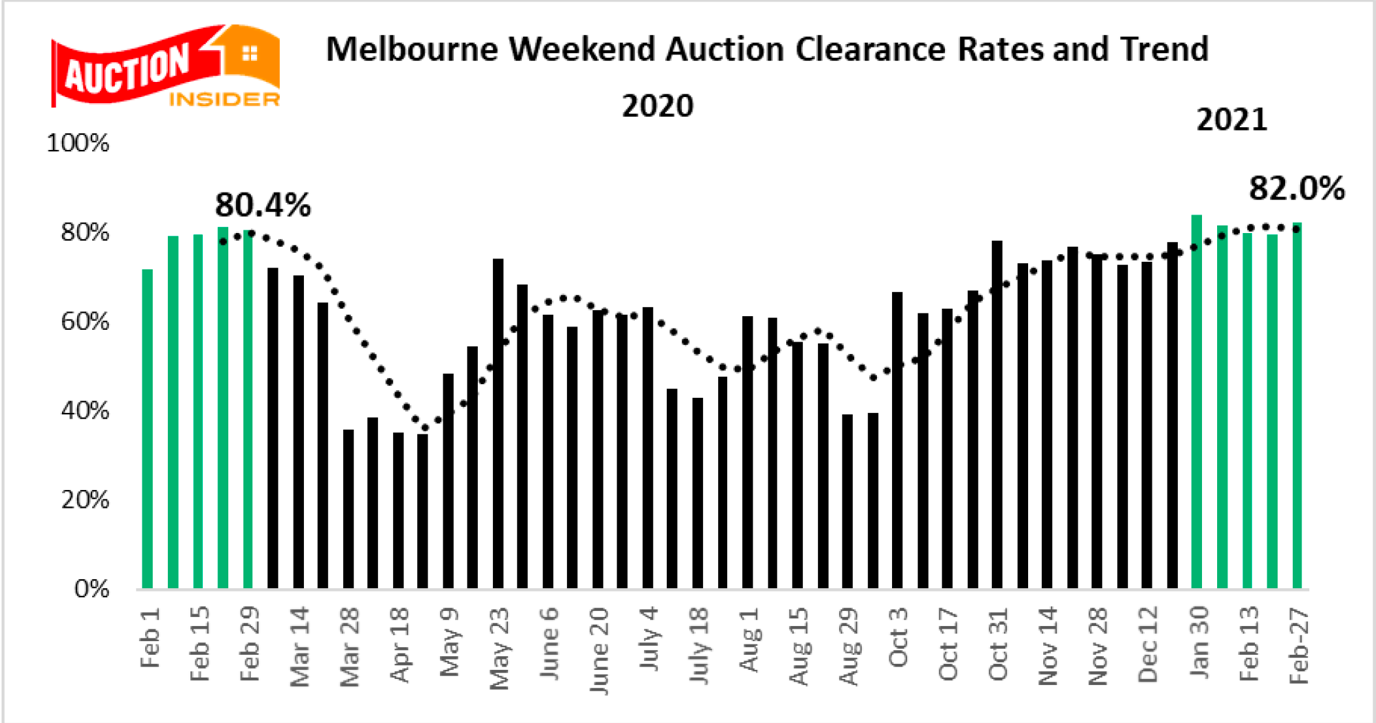

Melbourne finished summer on an auction high.

Melbourne's auction market continues to recover from its recent lockdown reporting its highest declared auction clearance rate for three weeks despite the usual surge in Super Saturday listings

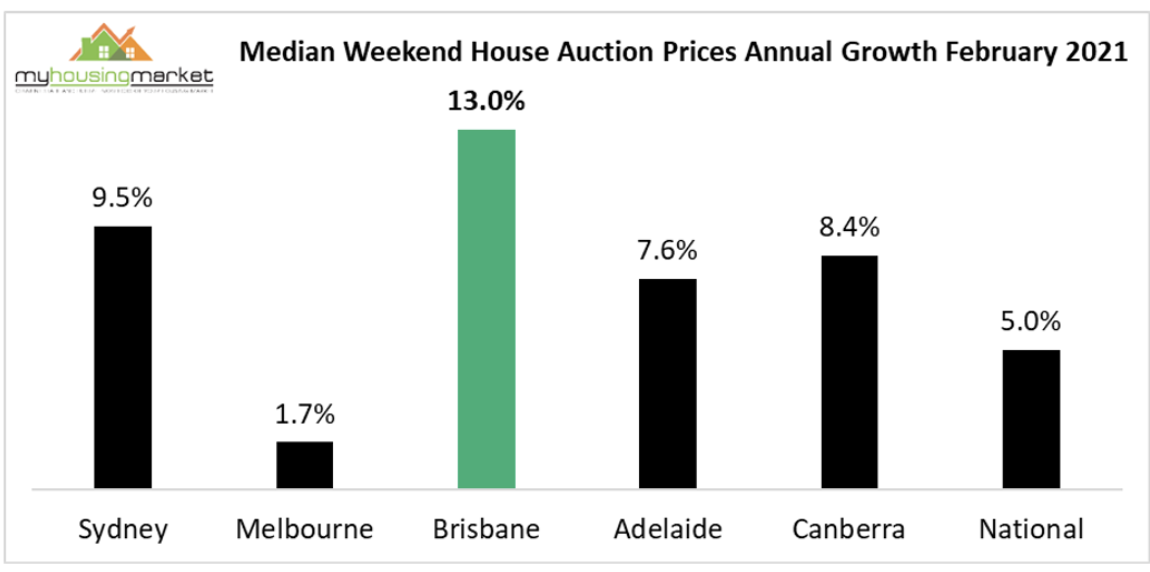

Record level city auction clearance rates across the board over February have predictably resulted in soaring house price growth with all capital cities reporting increases over the past year.

The national median price of houses reported sold at weekend auctions over February increased by 5% compare to February 2020.

Brisbane recorded the highest price growth over the year – up 13%, followed by Sydney up9.5%, Canberra +8.4%, and the Melbourne with the median weekend house auction price higher by 1.75% over the year.

Continuing Low and Flat Wages to Impede Home Price Growth

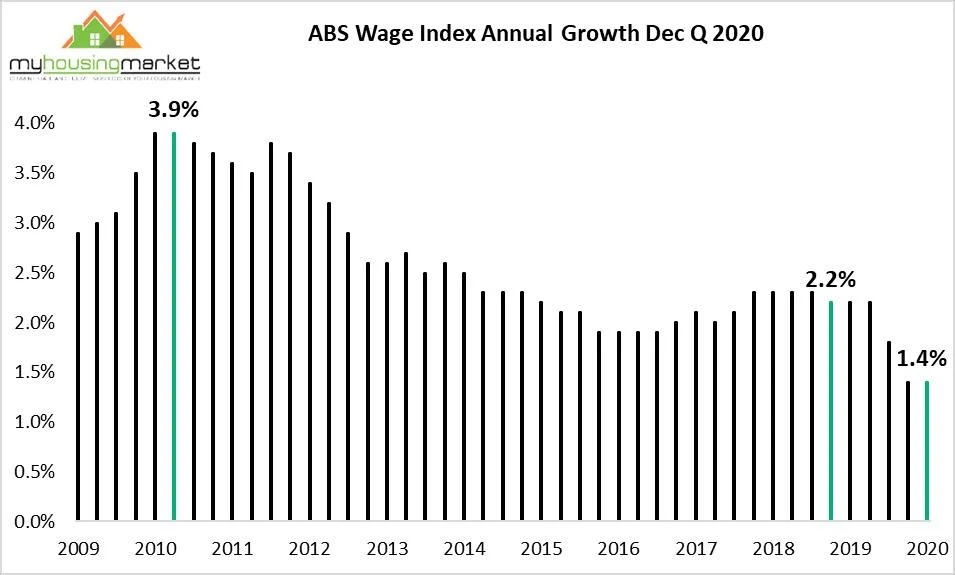

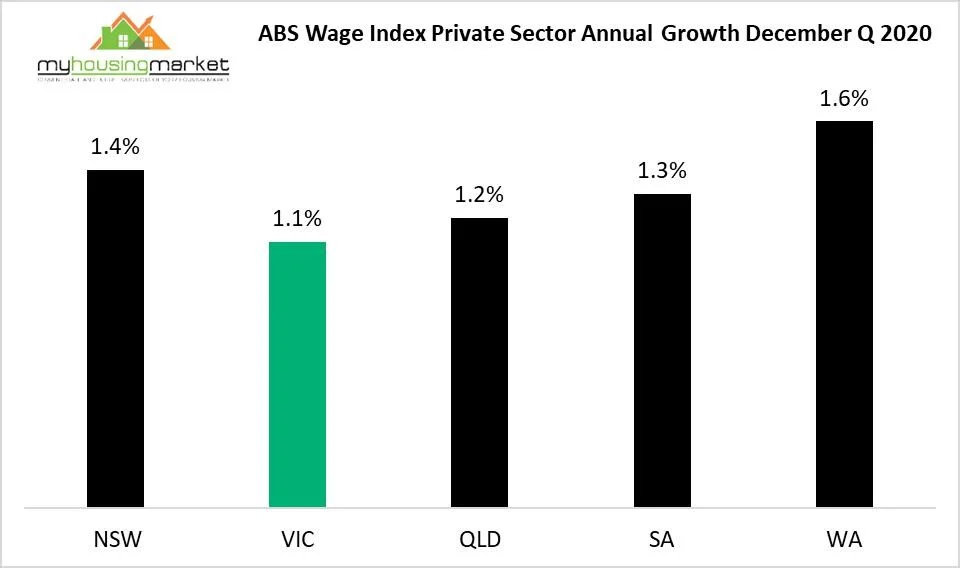

Wage growth remains at record low levels with no sign of a revival despite the strong recent labour market rebound.

The ABS reports that the national Wage Index increased by just 1.4% over the December quarter of 2020 compared to the same period in 2019.

The December quarter annual wages growth rate remains the lowest on record following the same result reported in the previous September quarter.

The latest annual growth rate is sharply below the 2.2% recorded over the December quarter of 2019.

Low and subdued wages growth is likely to continue for the foreseeable future and although the jobless rate continues to fall, it remains well above the levels required to deliver the competition for labour by employers that will push up wages.

The subdued outlook for wages will place a floor on price growth in currently strong housing markets and also act to constrain consumer spending particularly as coronavirus income support measures to wind down.

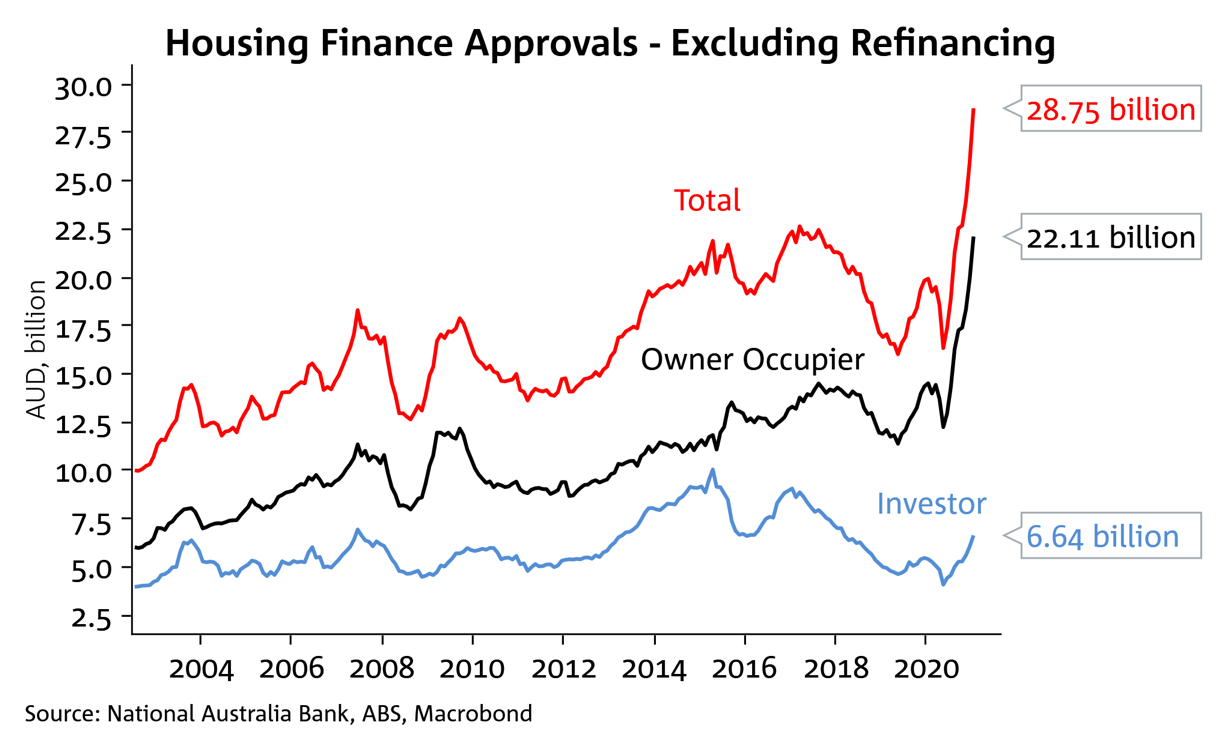

Housing loan approvals surge

While home loan approvals continue to surge over January, with new loan approvals now 49.3% higher than pre-pandemic levels, activity continues to be like be driven by owner occupier approvals which accounts for 76.9% of total loan approvals - both first homebuyers and existing owners looking to upgrade.

While investor loans have also increased, as a percentage investors at remain a very low levels, meaning the current property boom is not being fuelled by speculation but by owner occupiers upgrading and looking for shelter.

These strong finance figures mean house prices are going to continue to increase strongly over the coming months.

..........................................................

Michael Yardney is CEO of Metropole Property Strategists, which creates wealth for its clients through independent, unbiased property advice and advocacy. He is a best-selling author, one of Australia’s leading experts in wealth creation through property and writes the Property Update blog.

Michael Yardney is CEO of Metropole Property Strategists, which creates wealth for its clients through independent, unbiased property advice and advocacy. He is a best-selling author, one of Australia’s leading experts in wealth creation through property and writes the Property Update blog.

To read more articles by Michael Yardney, click here