Think capital cities see all the capital growth, while regional centres miss out? Think again. John Hilton scours the country for regions with a range of excellent opportunities

There is a simple solution to the surging prices and falling yields that have made some capital cities no-go zones for investors.

The catch is that it may involve you looking outside of your comfort zone. You guessed it: regional areas. The good news is that the regions actually offer benefits that their capital city counterparts often lack. Namely, more affordable prices and higher yields, which are two components of what Terry Ryder, founder of hotspotting.com.au, calls the “win, win, win situation”.

Ryder’s third component is that regional areas offer good prospects for capital growth, just as long as you pick the right place.

The downside of choosing the wrong area is that some regional markets can fluctuate greatly in value, if you invest somewhere that’s too reliant on one industry.

In addition to selecting areas with a variety of employment drivers, another way to go about it is looking at infrastructure projects on the horizon, says Ryder.

Why is this so? Infrastructure means more jobs, increased economic activity and improved amenities for residents – a perfect recipe for capital growth.

And if you want proof of just how well a regional area with a diverse economy and new infrastructure can perform, take a look 76km north of Sydney to Gosford.

“All of a sudden last year there was 20% growth in median prices which was common for Gosford city,” says Ryder.

“I say to people: ‘Well you have probably missed the best time to buy in Gosford, so look for the next location that has similar qualities, but has not had the same amount of growth.' Those places do exist.”

Nevertheless, Ryder believes that despite Gosford’s surge in values, it still offers good prospects for investors, in addition to other regional centres spread right across Australia. Read on to find out why.

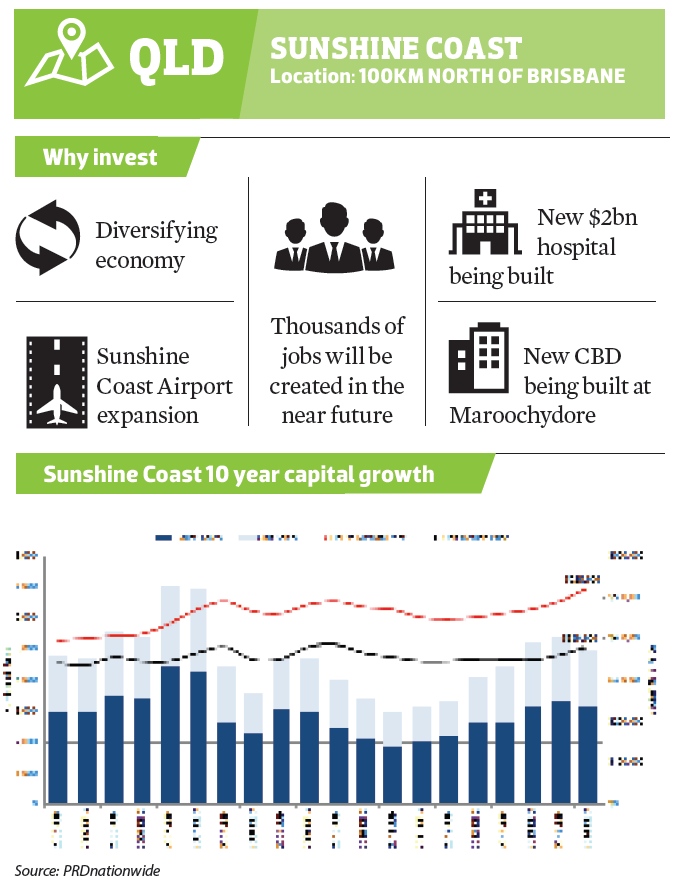

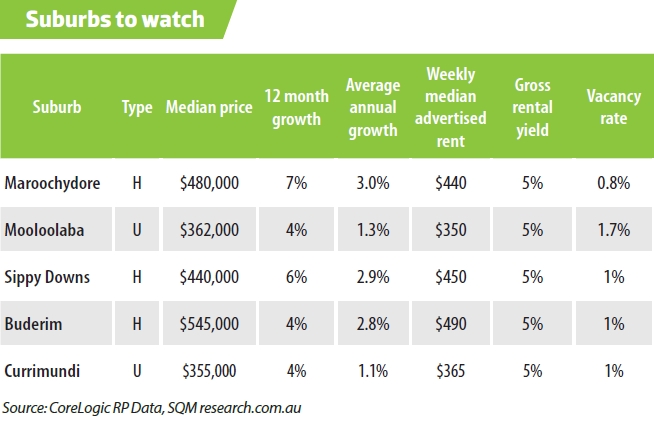

QLD SUNSHINE COAST

The Sunshine Coast might once have been synonymous with tourism, but it is fast evolving into something much better, says Ryder.

In fact, the key strength of the Sunshine Coast now is its diversifying economy, which is being helped along by the billions of dollars invested in infrastructure projects.

“Suddenly they have got this whole new industry: the medical sector,” says Ryder.

“They didn’t have that before, but the state government has decided to build a $2bn hospital.”

The Sunshine Coast Public University Hospital will open with about 450 beds in 2016, with the ability to grow to over 738 beds. If required, it can be expanded to 900 beds beyond 2021.

The hospital is part of the 20 hectare Kawana Health Campus, which will include the hospital’s Skills, Academic and Research Centre, the co-located Sunshine Coast University Private Hospital and opportunities for health-related commercial developments.

“Suddenly all these other things are springing up,” says Ryder. “Another announcement is that there is going to be a big retirement village which is going to be next to the hospital.”

In addition to the thriving health industry, other key economic sectors include education, retail and construction.

Then there’s the $347m Sunshine Coast Airport expansion which is expected to boost the Sunshine Coast economy by $4.1bn over the first 20 years, and is projected to generate more than 2,200 jobs in the community.

There is also a whole new CBD to be built at Maroochydore which will occupy the current grounds of a golf course.

“They are going to turn land there into a CBD, something that the Sunshine Coast doesn’t have at the moment,” says Ryder.

Another key infrastructure project is the $350m Sunshine Plaza expansion which is projected to create 6,900 full-time construction and operational jobs and 1,350 new retail jobs on completion.

#pb#

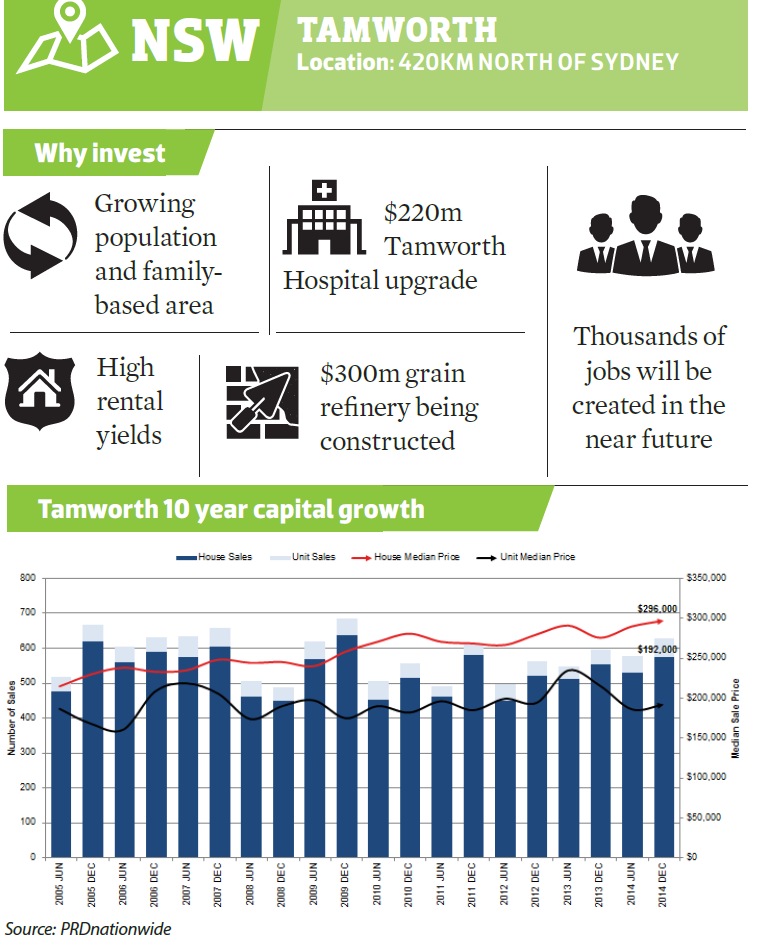

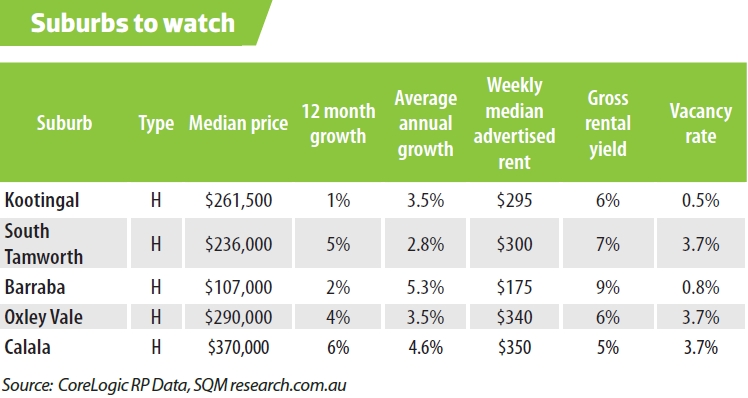

NSW TAMWORTH

The beauty of Tamworth is that it successfully blends the best of country lifestyle with vibrant economic activity says Diaswati Mardiasmo, national research director at PRDnationwide.

“In Tamworth you have all your commercial needs, but at the same time it is a really family-based place as well,” she says. “There is going to be a lot of economic activity and job growth in Tamworth, and when you have that high level of confidence then people are going to invest there.”

Mardiasmo cites its excellent shopping options, which is about to get even better thanks to the $18m development comprising the Woolworth Supermarket and Dan Murphys Liquor Store. The new stores will support about 500 jobs and an additional 200 during the planning and construction phase.

Moreover, Mardiasmo also sees it as a place where people can take advantage of the lifestyle, yet still conduct their business efficiently.

“You get an increasing amount of people who are choosing to do business in Tamworth because they know that they don’t need a brick and mortar place in Sydney anymore, as things can be done online,” she says.

According to PRDnationwide, population growth for the Tamworth Local Government Area is expected to rise to 67,750 by 2031. This is an annual growth rate of 0.6%.

Infrastructure projects include the $220m Tamworth Hospital upgrade which will provide better facilities for patients and an increased capacity. There is also the $300m grain refinery near Tamworth which is expected to create up to 500 jobs during its construction phase and another 75 full-time jobs once it becomes operational.

Tamworth is also recognised as the “National Equine Capital of Australia”, as it has lots of equine events held in the area, not to mention the Australian Equine and Livestock Events Centre which is the biggest of its kind in the southern hemisphere.

The other title it holds is the “Country Music Capital of Australia”, as it hosts the annual Tamworth Country Music Festival.

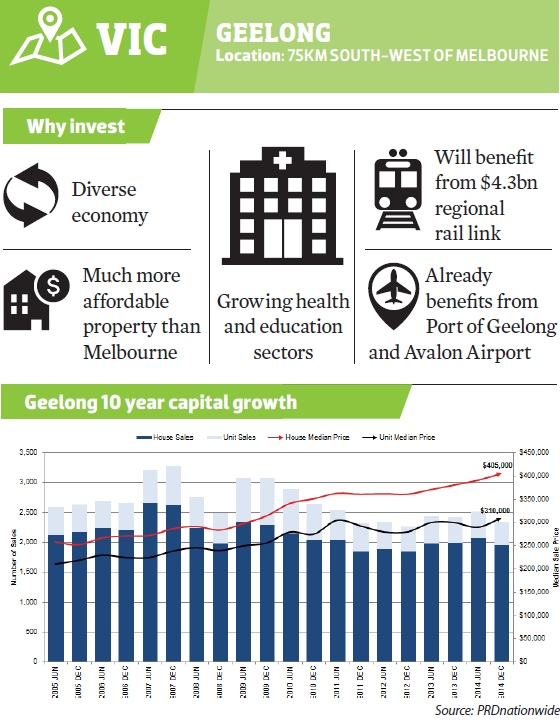

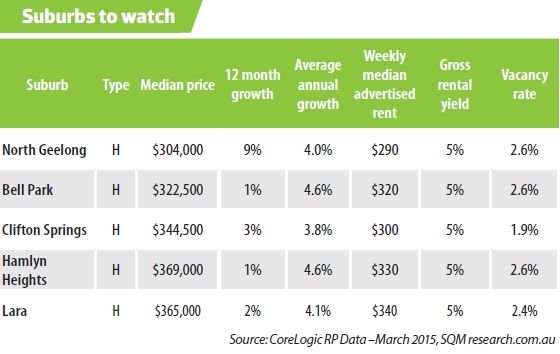

VIC GEELONG

Don’t believe everything you read about the doom and gloom often prophesised in the media regarding Geelong’s fate being tied to the ailing car industry. Far from being down and out, Geelong stands out as Victoria’s regional market with the most going for it, says Ryder.

“Geelong used to be a factory town, but it has evolved from that,” says Ryder. “The car plant closes and about 500 people lose their jobs and it sounds devastating, but that’s not the biggest employer any more.

“The health sector is the biggest employer and the education sector is number two. Between those two sectors there is something like 10,000 jobs in Geelong and those sectors are growing and employing more people.”

Geelong also stands to benefit from the $4.3bn regional rail link, which has been built to provide V/Line trains from Geelong and other areas with their own paths in and out of the Melbourne CBD. It is scheduled to open in late June. The link is anticipated to make the City of Geelong an even better option for businesses to open and employees to work.

As the second largest city in Victoria, Geelong already enjoys ease of access to the state’s capital thanks to the various highways. Further, Avalon Airport (situated 15 kilometres to the north-east of the Geelong urban centre) provides regular flights to Sydney, Brisbane and Perth.

There is also the Port of Geelong (Victoria’s second largest port), located on Corio Bay, which acts as an import terminal for commodities including crude oil, petroleum products and alumina. Additionally, it’s an export point for grains and fertilisers.

Geelong also continues to be a drawcard for tourists who are attracted to sites such as the Waterfront Geelong and the Eastern Beach on the shores of Corio Bay.

Overall, it’s an excellent affordable alternative to Melbourne in Ryder’s view.

#pb#

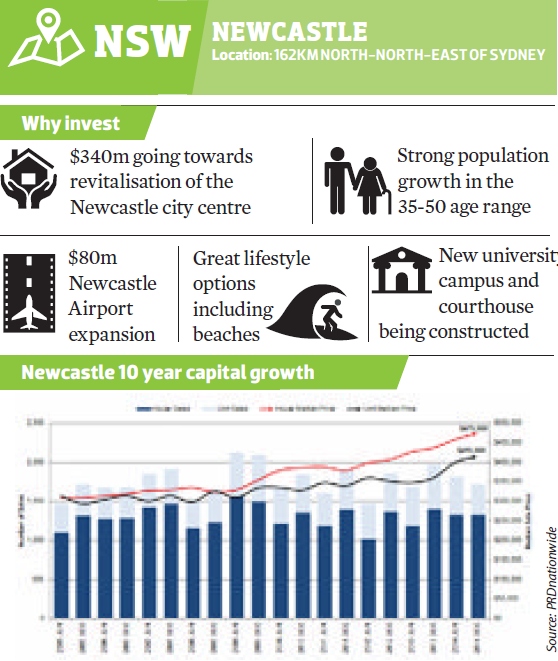

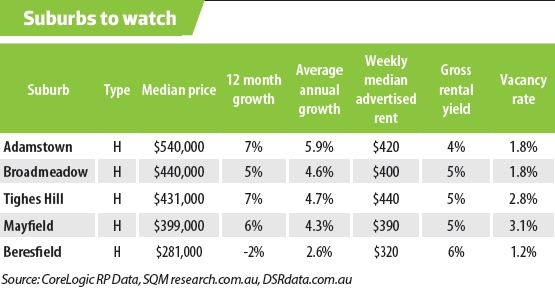

NSW NEW CASTLE

Talk about a transformation.

“Newcastle was once ‘Sydney’s younger brother’, but now it’s very much its own city,” says Hovig Evanian, business development manager at Hudson Homes.

“I think the liveability of Newcastle has come about because of the extensive amount of infrastructure.”

In particular, Newcastle is seeing strong population growth in the 35-50 age range, he says.

“I think the old demographic used to be retirees and now we are seeing more young families who are being driven by affordability,” says Evanian.

“The major employers there right now are health services, retail and manufacturing. The beauty of this area is that it benefits from mining but does not rely on it.”

Moreover, Newcastle University opened up a new law faculty last year and the fastest growing employment drivers are legal and financial services.

There is also a new inner city campus being added to Newcastle University which is expected to attract an additional 3,500 students and staff.

In 2014, the Port of Newcastle was sold for $1.75bn and of that NSW Premier Mike Baird promised $340m of the proceeds would go into the revitalisation of the Newcastle city centre.

Mardiasmo says that Newcastle’s emerging city centre is already evident and it’s gaining even more momentum. “Over the past 24 months about 20 cafes and bars have opened up between the beach and Darby Street,” she says.

“That would not be happening if there wasn’t significant demand for it and people requesting more commercial development.”

There is also a huge courthouse under construction, light rail going in, and the ever-present beautiful beaches that’s further evidence Newcastle offers great business and lifestyle options, she says.

Additionally, it is planned for Newcastle Airport to have an expanded $80m international terminal. This is projected to increase the annual passenger capacity from two million to five million.

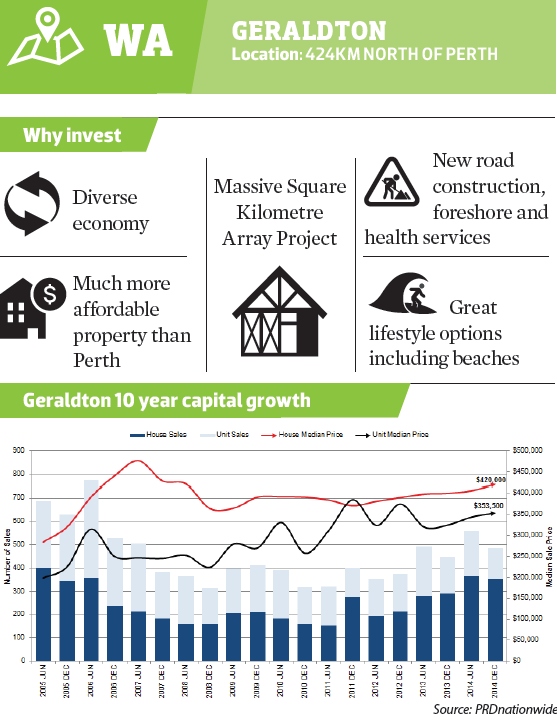

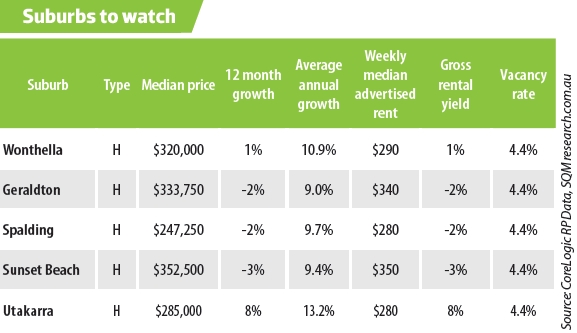

WA GERALDTON

Despite being affected to a degree by the declining iron ore industry, it’s definitely not the “only show in town” for Geraldton, says Ryder.

“With Port Hedland and Karratha it’s all about resources,” says Ryder. “But with Geraldton it’s about agriculture, fishing, tourism, manufacturing and a whole heap of other things.”

The Square Kilometre Array Project, which involves the construction of one of the world’s most powerful telescopes, is a project that’s sure to boost economic activity in Geraldton. The $1.9bn project will be built in both WA and South Africa in 2018. Despite the fact it’s 424km north of Perth, there are frequent plane services there from Geraldton Airport, which itself has some major upgrades over the past few years.

Last year it was announced that $6.68m would be spent on the initial stages of a Midwest Cancer Centre, in addition to crucial renal dialysis and associated support services like consultancy and office accommodation at the Geraldton Hospital.

Also last year, Geraldton’s foreshore was revitalised due to the State Government’s Royalties for Regions program. The redeveloped Esplanade includes a viewing tower with views of the city, the port, Champion Bay and Seal Rocks.

Early this year, Geraldton’s Rail Building was restored to allow the community greater capacity to host cultural festivals and public events.

Additionally, construction upgrades began last year (totalling $218m) on the North West Coastal Highway. The upgrades will support local jobs and improve efficiency and safety of the highway which is the main link between Geraldton, Carnavon, Karratha and Port Hedland.

#pb#

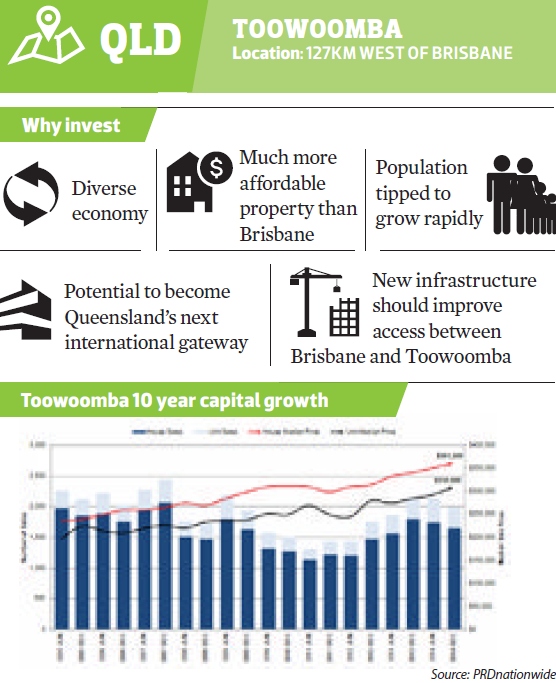

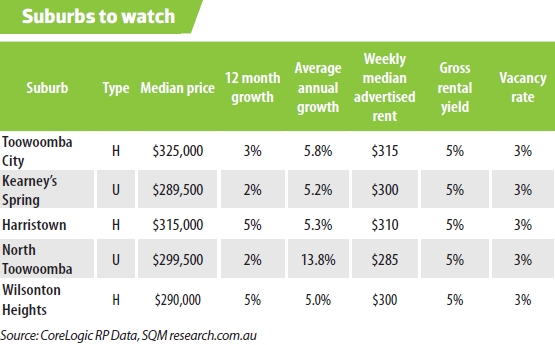

QLD TOOWOOMBA

It may not have the growth potential that the Sunshine Coast or Cairns have, but there is still a lot to like about Toowoomba, says Ryder.

“The reason why I rate the Sunshine Coast and Cairns above Toowoomba now is because Toowoomba has already had a really good couple of years of growth,” he says.

But despite the recent growth, there are many properties in the region which are still very affordable and have the added bonus of high rental yields.

According to Ryder, the main problem with the Surat Basin is not the actual resources sector, but the fact that developers in certain areas miscalculated the demand for fly-in fly-out workers.

“At any one point in time there is about 15,000 resources workers in the Surat Basin area and 94% of them, according to our research, are staying in temporary villages, not local accommodation,” says Ryder.

But the great thing about this region is that there is a lot more than just the mining industry. In particular, Toowoomba’s diverse economy benefits from education, agriculture, retail and manufacturing.

Toowoomba is already Queensland’s biggest inland city with a population of 155,000 (and Australia’s second biggest inland city after Canberra). Furthermore, Toowoomba’s population is tipped to boom, reaching about 180,000 by 2016, and more than 221,000 by 2031.

And it may be set to be Queensland’s next international gateway, as the international-scale airport officially opened in 2014. There is also construction underway of the Wellchamp business park and a proposal for a nearby aviation school.

Furthermore, the tender for the $1.5bn Second Range Crossing project is due to be announced this year, with the idea being to improve general public access between Brisbane and Toowoomba and ultimately improve road freight safety and commute times. However, investors targeting Toowoomba should be mindful about buying in flood-prone sections.

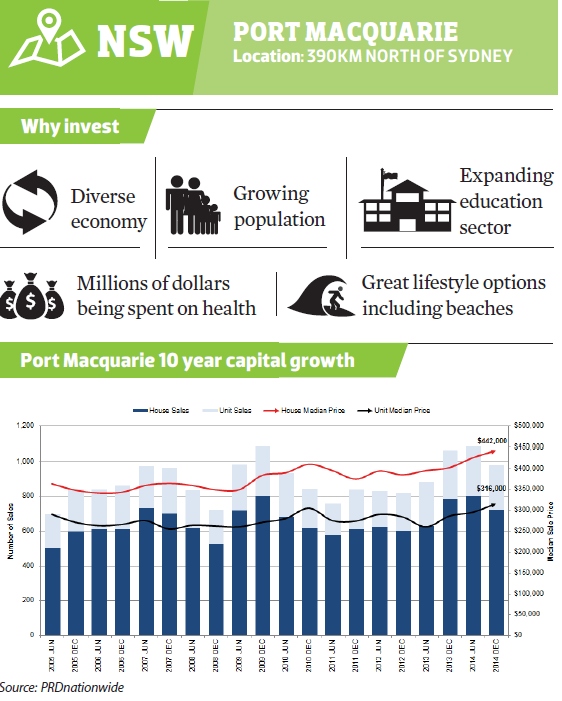

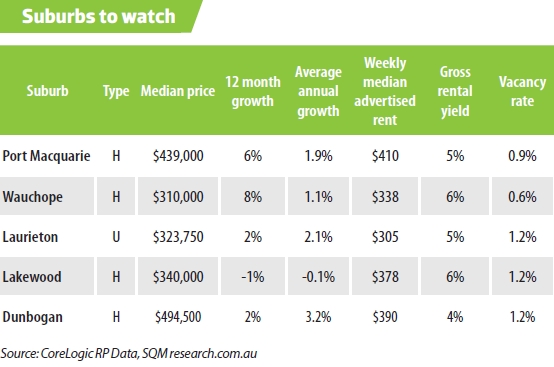

NSW PORT MACQUARIE

Another place that is evolving beyond a tourist centre is Port Macquarie, says Ryder.

“Port Macquarie has got lots of money being spent on infrastructure, including the university expansion and the airport upgrade,” says Ryder.

“It’s also getting the benefits of the broadening of the economic base.”

In addition to being a rich tourist centre, it benefits from gas, water, electricity, manufacturing, retail and construction to name a few.

Port Macquarie has a regional airport which has direct flights to both Sydney and Brisbane. In fact, the council completed a $21m upgrade to the airport in 2013.

Education is also playing more of a role in the economy, as there has been a new $30m Charles Sturt University campus approved for Port Macquarie. It is planned to eventually become a full-scale university with roughly 5,000 students.

Furthermore, the $1.2bn upgrade to the Pacific Highway (just north of Port Macquarie) is expected to create somewhere in the vicinity of 1,000 jobs and improve the tourism sector.

And in addition to the Port Macquarie Base Hospital and the Port Macquarie Private Hospital, the former Lourdes Nursing Home has now become a GP super clinic after having a $7m upgrade. Moreover, the $110m upgrade to the Base Hospital will provide jobs for up to 250 additional staff.

Retail has not missed out either, with $17.6m being spent on a new Kmart.

According to a report by PRDnationwide, there is expected to be an increase in the Port Macquarie’s population of 19.3% by 2031, which is anticipated to be a result of an ageing population looking for an affordable seaside lifestyle.

#pb#

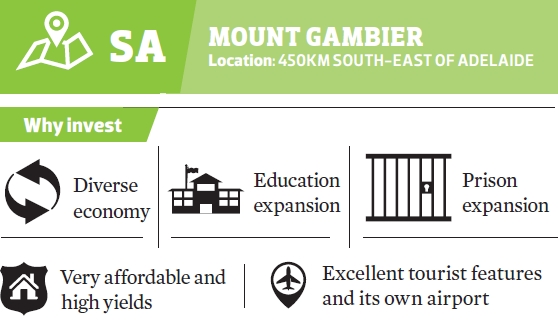

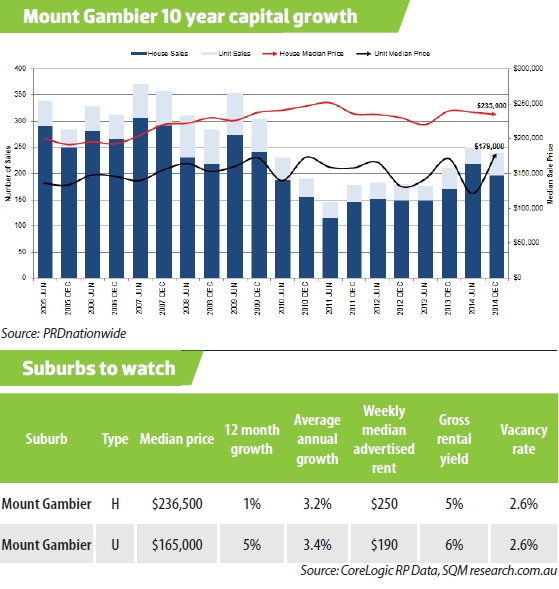

Besides being very affordable and having high rental yields, there is lot more to like about Mount Gambier. It boasts a range of industries including professional services, education, mining and agriculture.

Tourism also plays a major role, with the Blue Lake, Valley Lake Wildlife Park and various caves that attract cave divers from around the world.

There are also a number of expansions taking place which are sure to benefit economic activity in the region.

Indeed, late last year, a third $2m 24-bed expansion of Mount Gambier Prison was approved by the state government. This came on top of a $22.9m 108-bed accommodation unit finished in 2013 and the recent $25.4m 60-bed expansion.

There is also the UniSA Mount Gambier campus, which will have the capacity to quadruple student numbers to 1,000, as part of its $12.5m expansion. The build is projected to create about 60 full-time jobs spread among 500 workers.

One of the chief goals of the upgrade is to attract more young people to stay in the area, and attract other young people from other parts of South Australia.

“Mount Gambier is also emerging as a centre for jazz music. It is certainly trying to make itself the jazz capital of Australia,” says Ryder.

Moreover, the $2.7m Mount Gambier Public Dental Clinic officially opened late last year, and in February this year, the new chemotherapy unit opened as part of the hospital’s $27m redevelopment.

And even though Mount Gambier is located in South Australia, it is closer to Melbourne (435km away) than it is to Adelaide (450km away). Both cities can be accessed via Mount Gambier Airport.

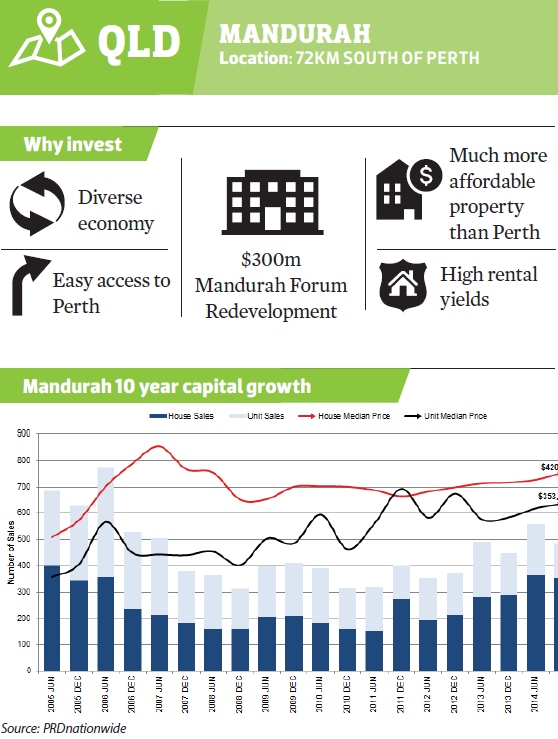

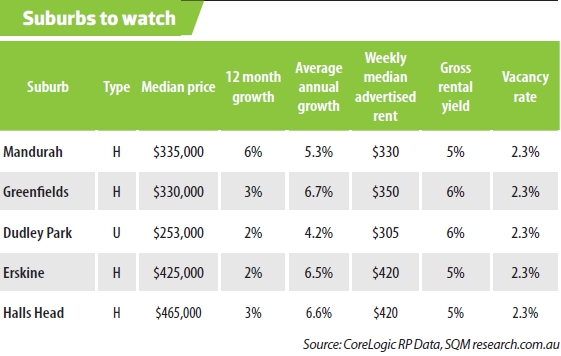

QLD MANDURAH

The seaside region of Mandurah is the second-largest city in Western Australia and has easy access to Perth, which is 72km away. Indeed, there is a regular fast train which takes only about 48 minutes to get from Perth to Mandurah.

In fact, many residents choose to live in Mandurah and work in Perth. It is much the same with many in the mining profession who also opt for the beach lifestyle Mandurah offers.

Ryder says it used to be that mining towns got all the benefits from the boom, but in these times many workers fly in and stay in accommodation camps built by the mining company.

“These days they fly home and spend their money where they live and that happens to be places like Mandurah,” says Ryder. Some of the upcoming infrastructure projects include the $38m Mandurah Aquatic and Recreation Centre Redevelopment, which is due to be completed in late 2015.

There is also the Mandurah Forum Redevelopment which is set for completion in 2016. About $300m is being invested into the community to expand and revitalise the Forum. The result will include 150 new stores, 600 additional carparks and an estimated 700 permanent jobs will be created at the centre.

Mardiasmo says that the median house price in Mandurah of $335,000 is particularly affordable compared to Perth. “The rental yields for both houses and units are above 5% so you are getting good value for money if you are investing in Mandurah,” says Mardiasmo.

She also argues that one of the benefits for investors looking at Mandurah is that unlike a lot of regional areas in WA, mining is not the prime source of its economic activity.

Indeed, it also boasts industries such as agriculture, manufacturing, retail, fishing, crabbing and tourism.

#pb#

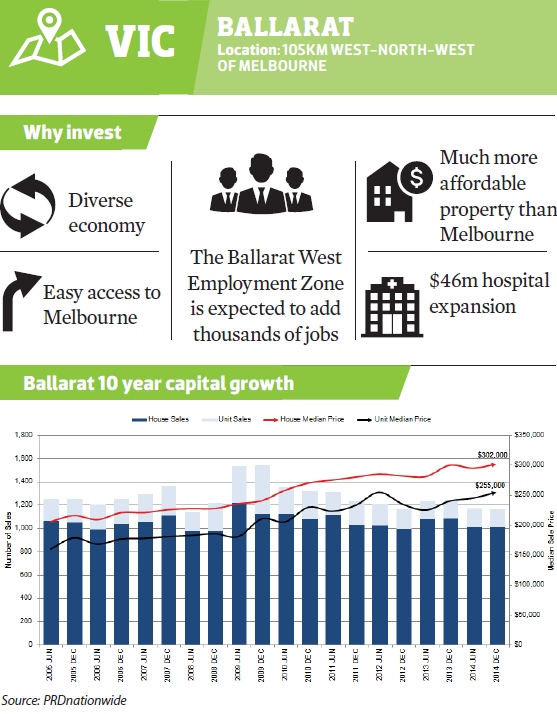

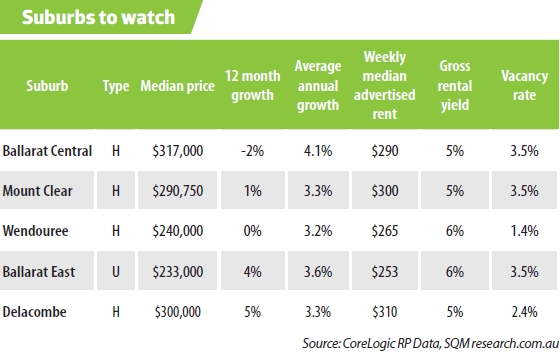

VIC BALLARAT

Commuting to Melbourne from Ballarat is becoming easier and easier, says Ryder.

“You can buy a house there for about half the price of Melbourne and have a semi-rural type of lifestyle but still commute to Melbourne,” he says.

Ballarat is another regional area that’s set to benefit from the $4.3bn Regional Rail Link that provides quicker and simpler access to Melbourne.

But the other good thing about Ballarat is it has its own diversifying and growing economy, says Ryder. What was once a centre for mining and agriculture, now boasts health, retail, tourism, education and information technology, not to mention emerging industries such as renewable energy.

In 2014, the Ballarat West Employment Zone (which is a 623 hectare precinct) received $25.2m from the most recent Victorian budget. It will be home to a range of industries from transport and manufacturing to research and development. It has the potential to create 9,000 local jobs and boost the Ballarat economy to the tune of $5bn annually.

Work has also got underway last year on the $8.4m police and emergency services hub in Ballarat West.

The $46m expansion of Ballarat Base Hospital is due to be completed in mid-2016. It will feature 60 beds and day treatment facilities in a new three-storey building, a new helipad and a multi-deck carpark.

There will also be a $31.5m upgrade to Ballarat’s Eureka Stadium and the Western Bulldogs AFL team will play home matches there for premiership points from as early as 2017.

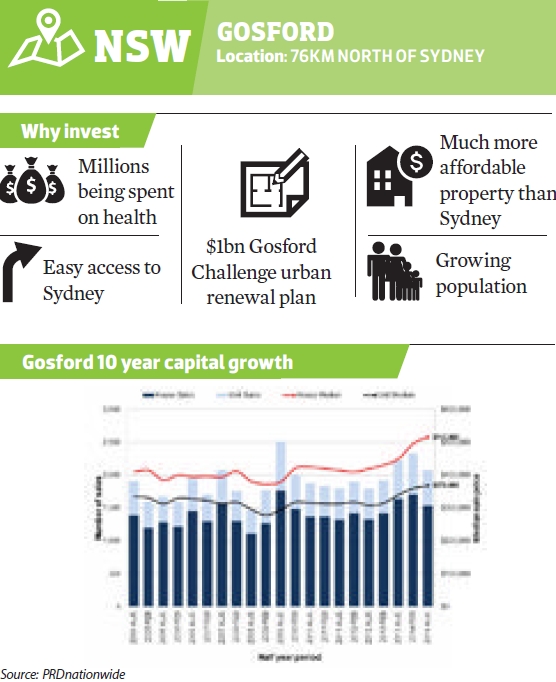

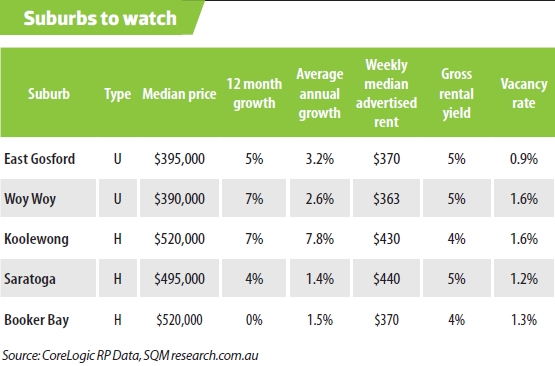

NSW GOSFORD

Houses in the suburb of Gosford have experienced a whopping 27% growth over the 12 months.

“We are seeing a ripple effect from Sydney,” says Ryder. “We have seen Gosford have very strong price growth in the last year or so.”

Even though Ryder believes the best time to buy in Gosford was 12 months ago, he still reckons there are encouraging signs for future growth.

For one, the federal government is planning to relocate 600 public service jobs from Canberra to Gosford.

“If that happens, that’s going to be 600 families looking for properties in and around Gosford,” says Ryder.

Infrastructure development is also looking pretty good. According to PRDnationwide, between now and 2022 Gosford is set to receive $2.9bn in new projects. This includes a number of large scale developments like the $1bn Gosford Challenge urban renewal plan, which is expected to be a big boost to the local economy. The purpose is to redevelop central Gosford’s Waterfront into a mixed use precinct, which should help attract hundreds of new jobs to the area.

Work is already underway on the $368m redevelopment of the Gosford Hospital. The Baird government is also attempting to finalise a world-class university medical school right in the heart of Gosford. This should help attract and retain youth in the area who would otherwise go to Sydney or Newcastle for tertiary education.

There is also the $400m upgrade to the M1 Pacific Motorway which would accommodate the increase in traffic due to the predicted population growth in the Central Coast. Then there’s the billions of dollars of infrastructure proposed, planned or under construction in the neighbouring Wyong Shire. This includes the $500m Chinese theme park which would create thousands of jobs in the construction phase and an additional 1,000 ongoing jobs once completed.

Population growth for the Gosford Local Government Area is expected to increase to 189,050 by 2031, which reflects a 0.4% annual growth rate, according to PRDnationwide.

“We are seeing a significant amount of people who choose to stay working in Sydney but decide to move to the Central Coast,” says Evanian. “They commute through a mix of car and train.”

#pb#

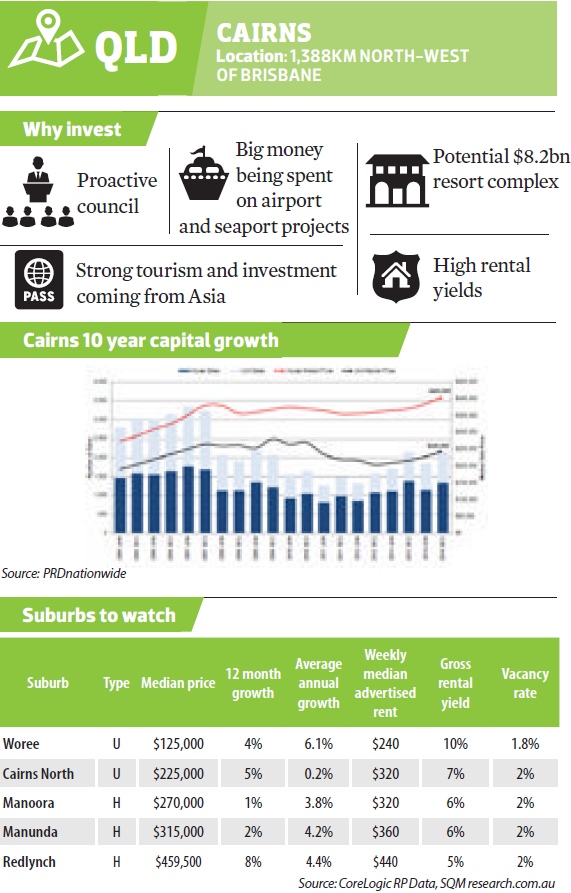

QLD CAIRNS

Through the power of infrastructure spending Cairns is becoming a much stronger place, says Ryder.

“Cairns has a very proactive council,” he says. “I think they recognised that they were economically weak because they were a one-trick pony: it was all tourism.

“So what they have been doing is trying to boost investment and development by giving developers discounts or waiving fees to encourage people to do things and employ local people.”

Cairns is also boosted by tourism and investment that’s coming increasingly from Asia. Late last year, China Eastern Airlines began operating directly out of Cairns Airport, with direct flights going from Shanghai to Cairns. The latest International Visitors Survey found that Chinese visitors continue to rise in Cairns, with an increase of 6,400 or 4.4% for the year ending September 2014, compared to the previous year.

Infrastructure spending includes $454.6m for the Cairns Hospital, which includes an additional 168 beds (total 531 beds). Also on the list are a $1bn Cairns Airport upgrade and a $110m seaport project.

Another potential game changer is if the $8.2bn resort complex goes ahead. Even though the idea is still just that at this stage, if Aquis did go ahead it would add a number of hotels, a casino, a sports stadium, a convention centre and a golf course. However, like Toowoomba investors looking at Cairns should keep in mind that certain sections can be susceptible to floods.

NSW DUBBO

The diverse economy and growing population are just two of the many positives Dubbo has going for it, says Ryder.

“I think diversity of economy is really important if you're going to invest in a regional centre,” he says. “Dubbo has six or seven major economic strands and big money is being spent on its hospital.”

Despite being 400km north-west of Sydney, Dubbo has a large regional airport and is on a major rail route. The airport has regular flights to Sydney and Broken Hill, and just last year the latest stage of the $1.56m development at the airport was completed. Additionally, according to recent figures from the Regional Development Australia Orana, the unemployment rate of Dubbo is 4.8%, compared to NSW at 5.7% and the nation at 6.4% Dubbo is already home to Australia’s largest sheep meat processor, Fletcher International, which is also the city’s largest employer.

The town provides health services to the surrounding region, and the Dubbo Base Hospital is a major employer. Other significant industries include agriculture, retail and tourism. In particular, the Taronga Western Plains Zoo at Dubbo attracts about 220,000 visitors every year.

There’s also the $1bn Dubbo Zirconia Project which is based on one of the world’s largest in-ground resources of rare metals and rare earths. The company Alkane Resources is aiming to process 1,000,000 tonnes of ore throughput per year over about 70 years.

However, what Dubbo really has going for it is affordability.

“You look at all Dubbo’s positives and think there would be a lot of demand for real estate,” says Ryder.

“I can buy there in the $200,000s and get a 6.5% return. But a lot of city-based people don’t even think about those options.”