Occasionally, we hear stories from people who look back and realise they dodged the proverbial bullet. They may have locked in a fixed interest rate just before mortgages skyrocketed, for instance, or offladed a property right before a suburb crashed in value.

But more often than not, it’s the flip side of that coin that investors lament. They talk about missed opportunities, the properties sold just before market boomed, and the homes divested years ago that have since doubled, tripled, or quadrupled in value.

It’s these missed opportunities that form the basis of this story today, as we feel it’s prudent to look back in order to look forward. By crunching the numbers on past property performance with the team at OnTheHouse, we’ve been able to isolate the top 20 best-performing suburbs in every state* (top 10 in the ACT), in terms of annual capital growth for free-standing houses.

If it were possible to get your hands on a time machine and travel back a couple of decades, these are the suburbs you’d like to have invested in – because over the last 20 years properties in these communities have increased in value four-fold on average. A home that was purchased for $150,000 in 1995 is now worth $600,000.

Furthermore, these suburbs are projected to continue enjoying strong capital growth well into the future.

Just what attributes, features and amenities do these neighbourhoods have that potentially put them a cut above the rest? We’ve spoken to a number of property experts and researched these markets on your behalf to uncover their common threads and isolate their potential indicators of growth. So, without further delay…

* Insufficient data was available for the states of Tasmania and the Northern Territory, so these regions are not featured.

DSR key

The Demand to Supply Ratio (DSR) ranking is a measure of the availability of properties in a suburb, relative to the demand from tenants and buyers. The DSR Score compares 15,000 suburbs against eight leading supply-demand indicators, including rental vacancies, days on market, stock on market, vendor discount, rental yield, auction clearance rate, proportion of renters to owners-occupiers, and online search interest.

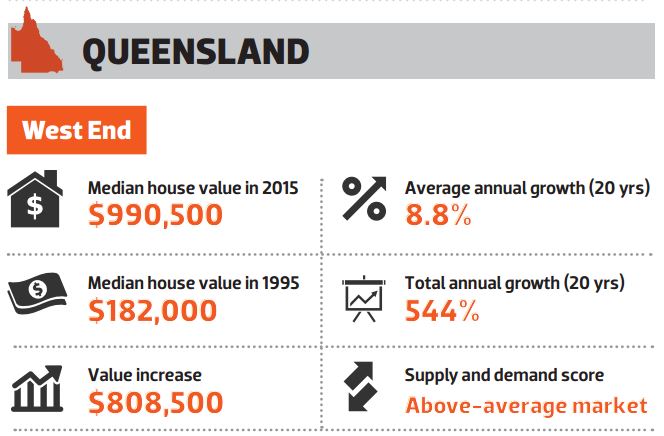

Growth attributes

● Inner city, located close to CBD and South Bank

● Quirky, unique and cultural characteristics driving demand

● Gentrification, with further opportunities to add value

Source: OnTheHouse/DSR, June 2015

Suburb features

● Proximity to the CBD and strategic location within Brisbane’s layout.

● Access to strong transport links, with buses and trains to the CBD and neighbouring suburbs.

● Situated directly south of South Brisbane, and adjacent to the popular South Bank parkland, man-made beach and dining and entertainment precinct.

● Gentrification has helped property values in the suburb increase five-fold.

● Gentrification has helped to develop the suburb’s quirky, alternative charm, adding to West End’s character and appeal.

● Strong renter demand.

● Tight vacancy rate of 2.4% (DSR, June 2015).

● Capital growth forecast for the next five years is 6% annually.

Growth potential

“West End offers a great lifestyle, being a riverside suburb, and its close proximity to the CBD offers great access to employment. Twenty years ago, it was a very industrial area and it wasn’t a desirable place to live. Today, the suburb boasts a mix of new and old houses and apartments of various quality and size, with further opportunities to add value through renovation and development.” – Zoran Solano, senior buyer's agent at Hot Property Specialists, Brisbane

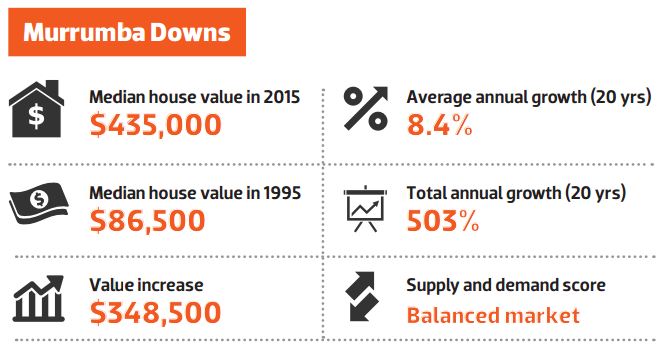

Growth attributes

● Growing infrastructure, including the $1.15bn train link (due for completion 2016)

● Adjacent to prime community of North Lakes

● Shrinking land supply

Source: OnTheHouse/DSR, June 2015

Suburb features

● Located 24km north of Brisbane’s CBD, Murrumba Downs is directly south of North Lakes, a sprawling master-planned community developed around the North Lakes Golf Course.

● The $1.15bn Moreton Bay Rail Link, due for completion in 2016, will link Murrumba Downs (plus five neighbouring suburbs) to the CBD.

● Land supply is becoming limited, as the family-oriented suburb is now well established.

● The Murrumba State Secondary College was opened in 2012 to help cope with the influx of families moving to the area.

● Ikea will open a 29,000sqm megastore in North Lakes in 2016, a move that will create around 250 jobs for the region.

● Westfield North Lakes plans to open a new section at the same time, with 60 new stores and linking to Ikea.

● Solid rental suburb, with 27% of locals being tenants and a vacancy rate of 4.2% (DSR, June 2015).

● Capital growth forecast for the next five years is 7% annually.

Growth potential

“Continuing growth and upgrades in infrastructure, cafes, restaurants, education and shopping are underpinning growth. Murrumba Downs is a stone’s throw from the city and it’s in the middle of everything, around 30 minutes from the CBD and 30–40 minutes from the beach. With the new schools going in, prices keep going up.” – Jenny Royle, real estate agent, Murrumba Downs.

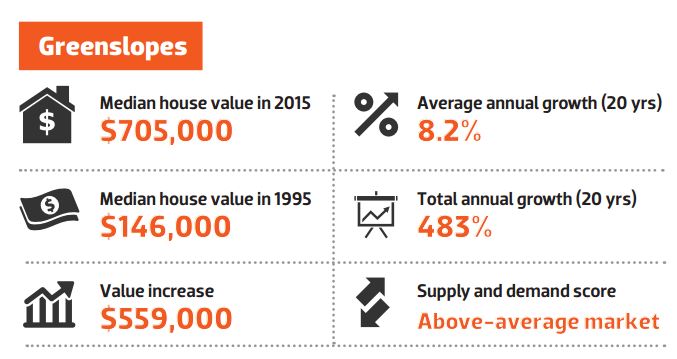

Growth attributes

● Proximity to the CBD

● Benefits from $700m bus infrastructure upgrades, which shave 90 minutes of the weekly CBD commute

● Rejuvenated by gentrification

Source: OnTheHouse/DSR, June 2015

Suburb features

● Proximity to the Brisbane CBD, which is just 5km away.

● Easy access via the Pacific Motorway and Logan Road.

● Opportunities to renovate and add value.

● Residents benefit from the first two stages of the Eastern Busway, a bus-only corridor that was constructed between 2007 and 2011 at a cost of almost $700m. The Busway saves regular commuters between Brisbane City and Coorparoo (Greenslopes’ direct neighbour to the north) nearly 90 minutes in travel time per week.

● Home to Greenslopes Hospital and Prince Albert Hospital, offering strong local employment opportunities, which underpin the rental market.

● Proximity to the nearby Stones Corner village is positive; the ‘once dead’ shopping precinct is experiencing urban renewal, which is drawing people back to the area.

● Robust rental suburb with a tight vacancy rate of 1.75% .

Growth potential

“Greenslopes has been ‘underrated for a long time’ and is oozing potential – particularly for those with a renovation or development strategy. It’s being rejuvenated by gentrification. Zoning changes now allow for higher-density housing, so there will be more units coming online in the area, which will increase the population and drive capital growth.” – Zoran Solano, senior buyer's agent at Hot Property Specialists, Brisbane

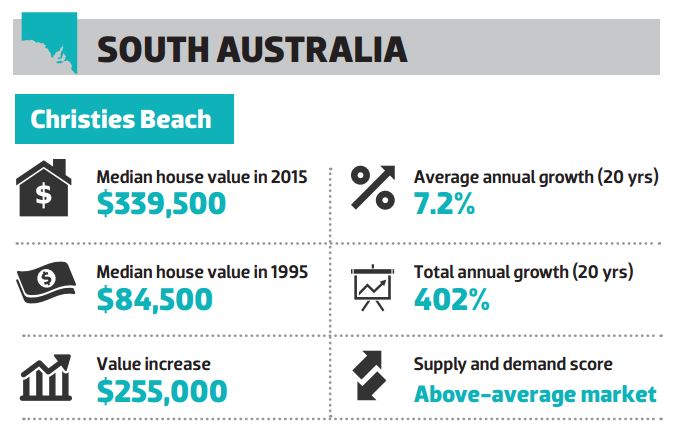

Growth attributes

● Recent rezoning is encouraging development

● One of Adelaide’s most affordable beachside suburbs

● Easy access to CBD via strong transport links

Source: OnTheHouse/DSR, June 2015

Suburb features

● Christies Beach is one of Adelaide’s cheapest beachside suburbs; you can still buy a free-standing home there for under $350,000.

● Affordable house prices are due to its distance (around 32km) from the CBD.

● The suburb attracts two distinct demographics: older English migrants who settled in the area back in the 1960s, and younger families drawn there by its affordability.

● Homes are generally situated on large blocks of land, creating opportunities to profit from development.

● Redevelopment opportunities due to recent rezoning from the council.

● Onkaparinga Council is actively spending money to upgrade facilities and features along the Esplanade and foreshore.

● The $52m expansion of Colonnades Shopping Centre, in the adjacent suburb of Noarlunga, is currently underway, and is expected to create hundreds of jobs.

● Home to a high proportion of renters, with 41% of locals

being tenants.

● Current vacancy rate is at the lower end at 2.1% (DSR, June 2015).

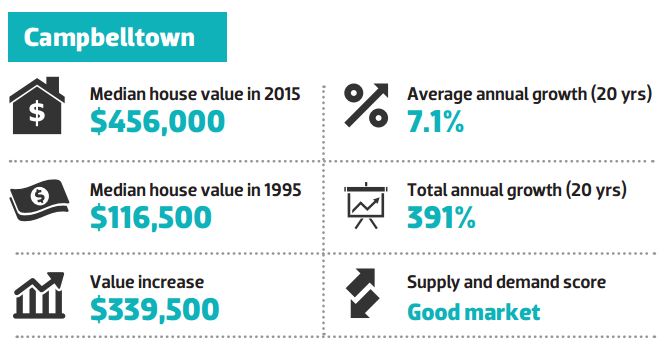

Growth attributes

● Recent rezoning is encouraging development

● Quick city commute via the O’Bahn Busway

● $160m investment in transport links planned

Source: OnTheHouse/DSR, June 2015

Suburb features

● Located 9km from CBD, but offers a quick city commute via the O’Bahn.

● Good access to public transport, particularly with the O’Bahn, which is like a bus on guided rails.

● State government is planning to invest $160m to extend the O’Bahn, a move that would reduce daily bus commute times by an average of seven minutes.

● Recent rezoning is encouraging new higher-density development, which will drive growth going forward.

● Demographics are varied and evolving, and the suburb has a strong sense of community. “Many Italians settled up in Campbelltown years ago, establishing market gardens on the land to grow vegetables, and there are still some market gardens there today,” says Koulizos. “It gives a nice multicultural feel to the suburb.”

● Home of the River Torrens Park, a vibrant parkland popular with families and fitness enthusiasts.

● Strong rental demand, with 38% of the suburb comprised of renters.

● The vacancy rate is extremely tight at 1.9%

Growth potential

“The O’Bahn is a big plus for the area, as people can quickly commute to work in the CBD. It can drive on normal roads and in certain sections; it can speed up on its own track and cut through areas.” – Peter Koulizos, property lecturer and author

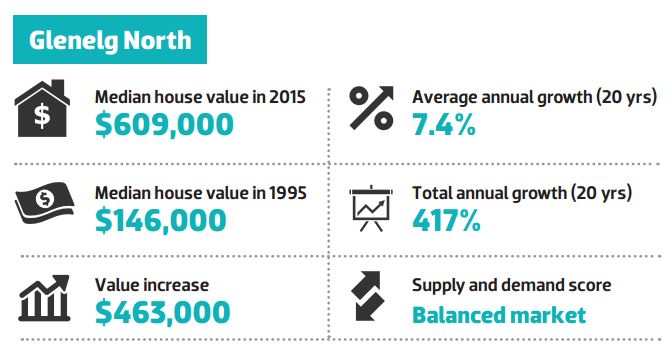

Growth attributes

● Situated next to prime suburb of Glenelg, driving growth through the ripple effect

● Easy access to CBD via strong transport links (tram, bus, car)

● Potential to add value through renovation and development

Source: OnTheHouse/DSR, June 2015

Suburb features

● Prime beachside location around 12km from the CBD.

● Being right next door to Glenelg, Adelaide’s prime beachside

suburb, is Glenelg North’s best attribute, according to Koulizos.

● Offers an easy commute to the city via bus, tram, or car straight up the Anzac Highway.

● Typified by ’50s and ’60s homes built on big blocks of land which are ripe for development.

● The northern end of the suburb abuts a sewerage treatment plant and is directly under the flight path, but that doesn’t deter people, Koulizos says. “People still pay millions to live there on the water.”

● Offers access to sought-after private schools, such as Emmanuel College and St Peters Woodlands Grammar School.

● Investors with a renovation strategy should target the older homes between Patawalonga Lake and the beach, Koulizos advises. “The other side of the lake is better for a buy-and-hold strategy,” he says, “while buying a unit may make sense as an affordable entry point to the market.”

● Solid rental suburb, with 36% of locals being tenants and a balanced vacancy rate of 3.3% (DSR, June 2015).

Growth potential

“Plenty of redevelopment is already happening in the suburb, which is bringing higher-density apartments and townhouses to the market. This redevelopment is driving growth and encouraging younger people to move in. Investors with a renovation strategy should target the older homes located in between the Patawalonga Lake and the beach. The other side of the lake is better for a buy-and-hold strategy, while buying a unit may make sense as an affordable entry point to the market." – Peter Koulizos, property lecturer and author.

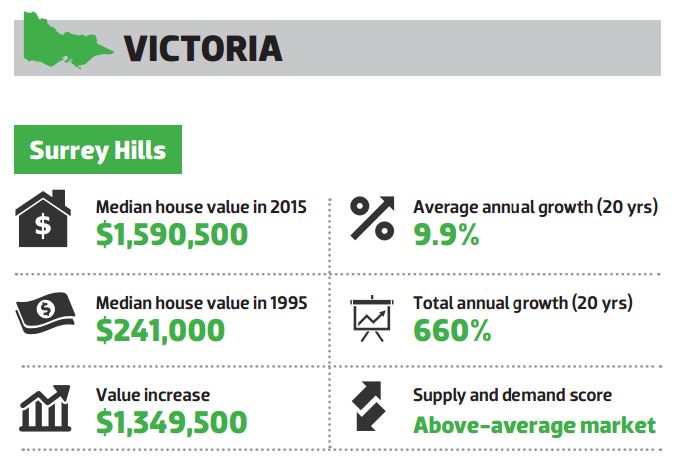

Growth attributes

● Located near prime suburbs, benefiting from the ripple effect

● Easy access to the city via train, bus and road

● Appealing school zoning, with access to quality private and public schools

Source: OnTheHouse/DSR, June 2015

Suburb features

● Proximity to Melbourne CBD just 11km away.

● Desirable and well-established suburb with a strong cafe culture.

● Benefits from the ripple effect.

● Appealing school zoning; Surrey Hills falls under the Boroondara City Council, comprising some of the best private and public schools in the state.

● Direct transport to the city and local amenities. “With access to both the Belgrave and Lilydale train lines, residents can access the nearby Canterbury and Mont Albert shopping strips that exude a well-established village feel,” says Greville Pabst, CEO of WBP Property Group.

● An abundance of villa units in the area offer an affordable entry point for those who can’t afford the high median house price.

● Capital growth forecast for the next five years is 7% annually.

● Solid rental suburb, with 22% of locals being tenants.

● Low vacancy rate of 2.4%.

Growth potential

“If you’ve got the money, you go to the prime suburbs of Camberwell, Canterbury and Balwyn – if you don’t have that budget, you go to Surrey Hills, the next suburb across. Its appealing school zonings are strong drivers for the Asian market.” – Mathew Barnes, associate director, Cohen Handler Melbourne

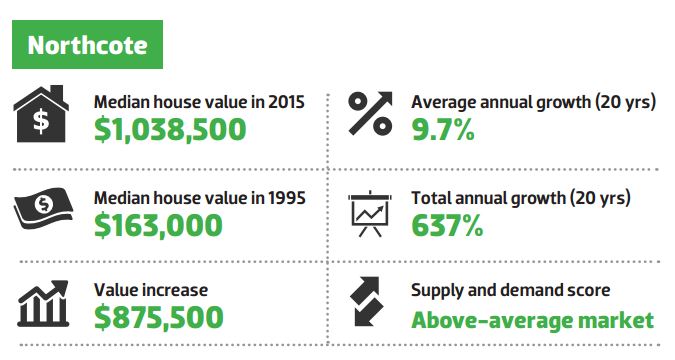

Growth attributes

● Demand is outstripping supply, for both rentals and sales

● Significant gentrification

● Strong cafe culture and lifestyle amenities

Source: OnTheHouse/DSR, June 2015

Suburb features

● Proximity to the Melbourne CBD just 7km away.

● Offers multiple public transport and bike-path options, including direct tram or train access to the city.

● Demand from renters and buyers is outstripping supply, especially for houses, driven by increased density and congestion in the inner city.

● Known for its artistic, hipster culture and attracting a younger

demographic.

● Northcote is undervalued compared to suburbs situated a similar distance to the east.

● Capital growth forecast for the next five years is 7% annually.

● Solid rental suburb, with 38% of locals being tenants and a tight vacancy rate of 1.8.

Growth potential

“Northcote has experienced significant gentrification and capital growth for both units and houses, although the large number of new apartment complexes may impact unit prices and rents going forward.” – Peter Sarmas, director, Street Advocate

“It’s got a really strong cafe culture and appeals to younger couples and singles who work in the city.” – Mathew Barnes, associate director, Cohen Handler

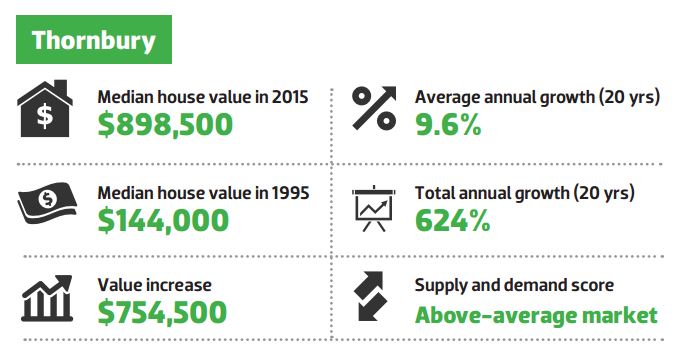

Growth attributes

● Swift commute to CBD via bike lanes, trains, trams

● Located next to prime suburb, benefiting from the ripple effect

● Revitalisation of High Street

Source: OnTheHouse/DSR, June 2015

Suburb features

● Proximity to Melbourne CBD just 9km away.

● Fast and easy commute to the city, which is accessible via bicycle lanes, trains and trams.

● Located directly north of Northcote, Thornbury is more

affordable but boasts many similar attributes.

● Capital growth has historically been driven by its relative affordability compared to neighbouring suburbs.

● Not as established or tree-lined as the inner east, but houses are on bigger blocks.

● Young professional families are attracted to the area because of the lifestyle it offers, its affordability, its schools, and the revitalisation of High Street, which is seeing a cafe and restaurant renaissance.

● Solid rental suburb, with 42% of locals being tenants.

● Extremely tight vacancy rate of 1.8%.

Growth potential

“It’s in close proximity to suburbs that share the same environmentally friendly and relaxed lifestyle. For those priced out of Northcote and surrounding neighbourhoods, Thornbury displays a steady growth in popularity.” – Greville Pabst, director, WBP Group

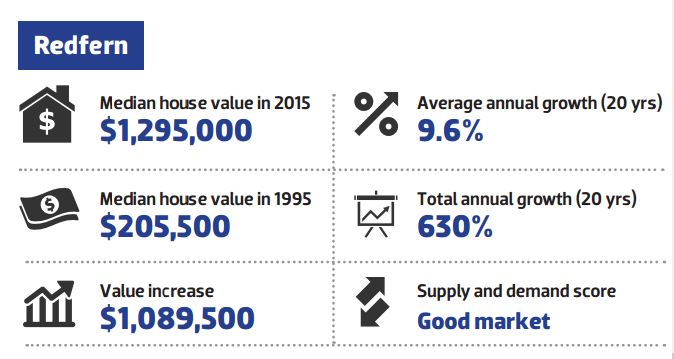

Suburb features

● Located just 3km from Sydney’s CBD.

● Upcoming projects include the $70m retail and housing development known as the Pemulwuy Project.

● Very well connected via train and bus to the CBD and other suburbs.

● Offers a convenient, leafy lifestyle while still being close to the city.

● Redfern Park, which had a $32m facelift in 2008, has added to the suburb's lifestyle amenities.

● Strong community atmosphere, with night markets, dance festivals and music events, trendy cafes, bars and restaurants, appealing to the younger demographic.

● Very high rental suburb, with 60% of locals being tenants and an extremely tight vacancy rate of 1.1%

Growth potential

“The urban renewal driven by the government, particularly between 2004 and 2010, helped revitalise the suburb. Redfern will continue to grow because there’s still a lot of development happening; it’s still evolving.” – Ash Oz, property investment strategist, OzPropertyPortfolio

Growth attributes

● Development of high-density housing

● Appeals to broad demographic, from actors to accountants

● Famous King Street delivers big on lifestyle amenities

Source: OnTheHouse/DSR, June 2015

Suburb features

● Located just 5km from Sydney’s CBD.

● Many amenities that appeal to a range of demographics, as the area offers an appealing bohemian lifestyle and culture.

● Broad range of restaurants, cafes, bookshops, antique shops, bars and art galleries, especially along King Street. In Newtown alone, there are more than 100 cafes and restaurants providing lots of different ethnic cuisines.

● Very well connected to the CBD via train and bus.

● Over 90% of dwellings are medium- or high-density apartments and units, which can offer a more affordable entry point to the market than terraces and (rare) free-standing homes.

● Popular suburb with renters; more than 50% of properties are tenanted.

● Extremely tight vacancy rate of 1.4%.

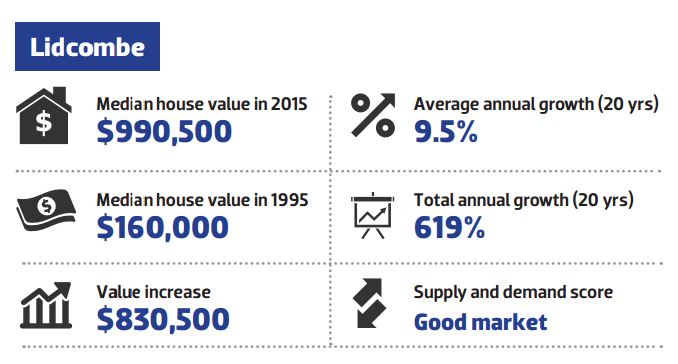

Growth attributes

● Close to two CBD hubs: Sydney and Parramatta

● Strong transport links via road, bus and train

● Solid lifestyle amenities appeal to wide demographic

Source: OnTheHouse/DSR, June 2015

Suburb features

● Located 18km from Sydney’s CBD and 11km from Parramatta.

● Family-oriented suburb with diverse, multicultural community that appeals to a broad demographic.

● Strong lifestyle amenities, including shopping facilities such as Costco in Lidcombe, and the DFO in the adjacent suburb of Homebush.

● Very well connected to both nearby cities, with solid transport links via road, train and bus.

● Close to Sydney Olympic Park, offering easy access to events and activities such as the Easter Show.

● As home to the University of Sydney Cumberland Campus, Lidcombe is convenient and appealing to students and university staff

● Capital growth forecast for the next five years is 7% annually.

● Solid rental suburb, with 35% of locals being tenants.

● Low vacancy rate of 2.0%.

Growth potential

“Parramatta is set to be Sydney’s next biggest CBD, so Lidcombe’s strategic location between the two is very convenient.” – Ash Oz, property investment strategist, OzPropertyPortfolio

.JPG)