Contrary to what much of the recent media coverage might suggest, there are many pockets close to CBDs and the coast that have not yet had their growth spurt. John Hilton looks at how and where to find areas on the verge of taking off

The late American entrepreneur James Cash Penney once said: “Growth is never by mere chance; it is the result of forces working together”.

This quote can be applied to property prices, as there are ways you can identify the many “forces working together”, and hence anticipate growth.

For instance, have you ever wondered why a particular suburb has significantly lower property prices than its immediate neighbour? Sometimes this can be attributed to the cheaper suburb being further away from a key growth driver, such as the train line or the beach.

However, it’s often the case that both suburbs have seemingly similar characteristics and the only real noticeable disparity is the median property price. If that’s the reality, there’s a good chance that the more affordable area will soon be ready to thrive.

Enter the ripple effect. Your Investment Property Investor of the Year 2010 winner, now property manager Prue Muirhead sums up this process as follows: “When a suburb becomes too expensive for a purchaser to buy, they will look at a neighbouring cheaper suburb. As growth areas rely on supply and demand, the demand for this suburb will increase and, in turn, the value of the homes in that area will increase also.”

But in addition to using the ripple effect to find the best bargain areas, investors must consider a range of other factors that work together, in order to maximise their profit and minimise their risk.

How to find an area that’s set to surge

1. Be open to searching interstate

Chances are that the most appropriate suburb to invest in for growth potential is not within a 10km radius of your home. In fact, looking outside your local area and buying sight unseen can actually be an advantage, because it forces you to look more at the growth drivers and statistics as opposed to trivial and emotional things, like whether or not you like the look of a bathroom. If you are still nervous about venturing into the unknown, the services of a buyer’s agent might be your best bet.

2. Look for the visible warning signs

Look closely and you may realise that a working-class suburb is starting to show signs of accommodating a wealthier demographic. Cate Bakos of Cate Bakos Property reveals some of the telltale signs that gentrification is underway and that property prices should adjust in a positive manner accordingly:

- New cafes starting up in the high street

- Low-density development activity, such as developers purchasing house blocks and building two to three townhouses on a site

- Renovation projects underway on old houses

- Introduction of ‘disposable income’ shops

- ‘Phasing out’ of lower-rent service provider shops (such as local accounting firms, dry cleaners, etc.) to make way for galleries, boutiques, cafes and bars

- Increased numbers of prep children in an annual school intake

- buying in an area only because its neighbour is performing well

- buying somewhere that has recently had its growth spurt

- the main growth driver potentially leaving the suburb (such as loss of a manufacturing industry)

- buying where supply is likely to outpace demand

- choosing a suburb where the population is

- decreasing and/or the median age is increasing

- choosing an area that does not provide renovation opportunities

- choosing an area without a progressive council

- being lured into new house and land estates with speculative growth rates

3. Study supply and demand

It’s very important to look for a low vacancy rate so that you are more likely to find a tenant for the property. In addition to reading Your Investment Property, speaking to multiple local real estate agents for up-to-the-minute vacancy rates is a wise move. Other stats that indicate supply and demand include the typical number of days a property is on the market before it is sold, the amount of stock on the market, the auction clearance rate, the renter-to-homeowner ratio, and the internet search score. Read How To Find The Best Property Using Available Data for more information.

4. Research future infrastructure growth

New or improved roads, rail or bus links are all examples of transport infrastructure that can add tremendous value to a suburb. Moreover, if a government is planning this kind of development, it is a good sign they are anticipating a strong population increase in the area, which is a giveaway that property prices will rise too. It is also an indication that medical and education facilities, shopping precincts and employment hubs will also have to grow accordingly.

“All of the proposed future spends are available online, through the appropriate council websites,” says Muirhead.

It’s also a good idea to watch out for planning alerts, local community news, streetscape changes and new development starts, says Bakos.

And aside from upgrades and additions, it’s important to consider intangible drivers that add value, such as scenic views of water, trees or a city.

5. Consider the demographic

If the population’s median age is decreasing, while the population itself and the average household income are increasing, this is a solid indication that growth is on the way. For the most recent reliable stats, check out ABS.gov.au.

Another giveaway that numbers of young professionals are on the up is if local bars, cafes and restaurants are becoming more upmarket.

6. Monitor median prices and growth rates

This is where the ripple effect comes in. The best way to go about identifying this is, firstly, to find an expensive suburb that has experienced a surge in growth in the last 12 months. This often happens within 10km from a CBD or towards the coastline, and can occur due to new transport infrastructure or perhaps the emergence of a cafe culture.

The next step is to find its cheaper immediate neighbours that have not yet had their growth spurt. Monitor the next group of neighbours as well, because the ripple can often go further than the adjoining suburbs.

Then compare the growth and prices of the premium suburb to those of its neighbours. Put simply, the greater the difference, the greater the potential. A good rule is that if there’s more than a 10% difference in prices, the cheaper suburb should have some ground to gain.

Just keep in mind that the neighbours with the most similarities to the source of growth are the ones most likely to get a higher share of the ripple. Also, check that whatever it is that’s fuelling the price rise would also suit the demographic of the cheaper suburb.

Therefore, identifying the chief growth driver(s) is crucial to your success in riding the ripple effect.

On the other hand…

The fact that the neighbouring area is performing well is not a good enough reason in itself to buy in a marketed ‘undervalued’ suburb, says Bakos. “There are some stigmatised areas which will either take much longer to gentrify or could struggle completely to gentrify,” she says.

In addition, be aware that the ripple may not always go beyond the premium suburb, and a general slowdown in the market could always put the growth rate to bed.

Aside from monitoring the values of neighbouring suburbs, investors are taking big risks if they don’t take into account the stability of the local economy and future infrastructure plans.

Investors can also come unstuck if they choose areas that have suddenly experienced population growth but have no obvious reasons for high-income earners to flood into those markets, says Bakos. Markets like this could include new estates in fringe areas.

“If an area is buoyed by a population surge based on it being ‘affordable’, this does not mean that it will grow rapidly,” she says. “In fact, if houses and land options in the surrounding areas are boundless, the growth could be severely constrained for many years.”

Moreover, investors need to be cautious when investing in speculative areas that are ‘predicted’ to have an increase, says Zoran Solano of Hot Property Specialist Buyers Agency.

“It is when investors are lured to new house and land estates or developments with speculative growth rates and rates of return which is really concerning.”

SUBURBS SET TO SURGE

Kedron, Qld

Median price for units: $341,500 (compared to neighbours Stafford $400,000 and Enoggera $420,000)

12-month growth: 5%

Rental yield: 5%

Vacancy rate: 2.88%

- Kedron is just 7km from the CBD and about 6km from Brisbane International Airport. Despite not being connected to any train services, there has been much recent work on the Northern Busway. The Windsor to Kedron section was completed in 2012 and the Kedron to Bracken Ridge section is currently under planning.

- The suburb itself is close to a major Westfield Shopping Centre, which is in the neighbouring suburb of Chermside.

- Kedron has lots of restored Queenslander housing as well as properties just begging to be renovated. This includes low-rise apartment buildings and townhouses dating back to the 1970s.

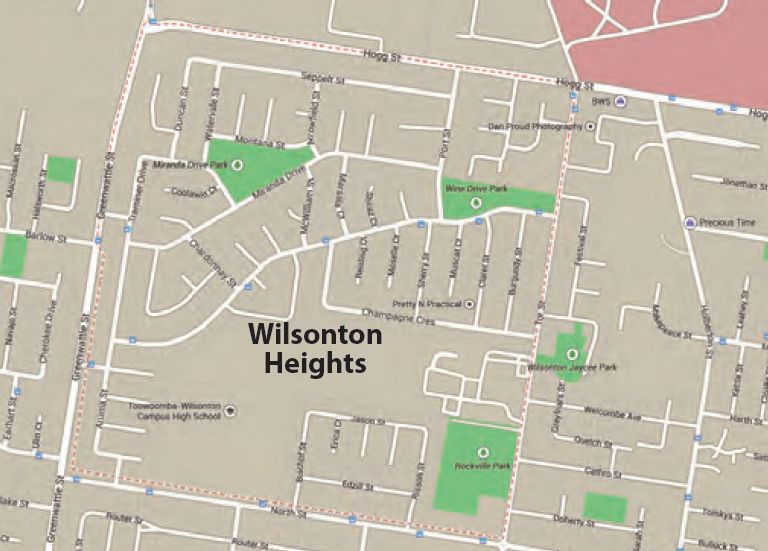

Wilsonton Heights, Qld

Median price for houses: $279,500 (compared to neighbours Cranley $405,250 and Toowoomba City $315,000)

12-month growth: 9%

Rental yield: 5%

Vacancy rate: 1.68%

- The suburb is located in Toowoomba, a regional city that is a feed-off area for the Surat Basin, which is a major supplier of coal seam gas. Even though it benefits from this boom, it does not depend on it due its diverse economy boasting agriculture, manufacturing and administration offices.

- Houses here really are a bargain compared to neighbouring Cranley where they average upwards of $100,000 more. This fact, coupled with rental yields rising above 5%, means it’s no wonder houses in Wilsonton Heights spend just 58 days on the market on average, which is good for the Toowoomba area.

- A family Queenslander house might be the way to go in this suburb. It is estimated that the population in this city will grow to 228,461 by 2031. A lot of the workers coming to Toowoomba will be bringing their families, meaning demand for houses could soon put intense pressure on supply.

Slacks Creek, Qld

Median price for units: $195,000 (compared to neighbours Underwood $384,000 and Daisy Hill $280,000)

12-month growth: 1%

Rental yield: 8%

Vacancy rate: 1.67%

- Units in Slacks Creek are practically a steal at $195,000, even without comparing to prices in neighbouring suburbs, which are often double the amount. This has helped push the rental yield up to 8%, which is another attractive feature for investors.

- In recent years this suburb has really improved, with upgrades to the M1 and the opening of the biggest IKEA store in the southern hemisphere, which was relocated from Rochedale South. It is also only about 15 minutes from Brisbane City and 30 minutes to the Gold Coast.

- It was once known for its high crime rates, but this trend has been reversing. What is increasing is the number of renovated homes, another sign that this suburb will rise in value.

Alexandra Hills, Qld

Median price for houses: $408,000 (compared to Wellington Point $519,000 and Cleveland $510,000)

12-month growth: 5%

Rental yield: 5%

Vacancy rate: 0.66%

- One reason this is a popular place to live is that only Cleveland separates Alexandra Hills from the stunning waters of Moreton Bay.

- The area is experiencing a surge in buyer investment largely due to transport infrastructure, which has made the 20km trip into the CBD much easier.

- The suburb is part of the Redland City Council, a progressive and relatively new council which is actively promoting the development of services, industry and housing.

- Houses in Alexandra Hills spend just 46 days on the market and the vacancy rate is just 0.66%, indicating demand is already strong there.

Alexandra Hills, Qld

Median price for houses: $408,000 (compared to Wellington Point $519,000 and Cleveland $510,000)

12-month growth: 5%

Rental yield: 5%

Vacancy rate: 0.66%

- One reason this is a popular place to live is that only Cleveland separates Alexandra Hills from the stunning waters of Moreton Bay.

- The area is experiencing a surge in buyer investment largely due to transport infrastructure, which has made the 20km trip into the CBD much easier.

- The suburb is part of the Redland City Council, a progressive and relatively new council which is actively promoting the development of services, industry and housing.

- Houses in Alexandra Hills spend just 46 days on the market and the vacancy rate is just 0.66%, indicating demand is already strong there.

Virginia, Qld

12-month growth: 11%

Rental yield: 5%

Vacancy rate: 1.46%

- On the northern side of Brisbane, Virginia is well positioned for capital growth when you compare its price point to that of the adjoining suburbs of Northgate, Nundah, and Wavell Heights, says Zoran Solano.

- The population continues to grow due to ongoing development and the popularity of the Northside business area.

- Prices are already starting to grow at a healthy rate, but it’s not too late to catch the end of the current growth phase.

- There is a lot of timber and tin Queenslander-style housing, which is popular with many young families due to its affordability.

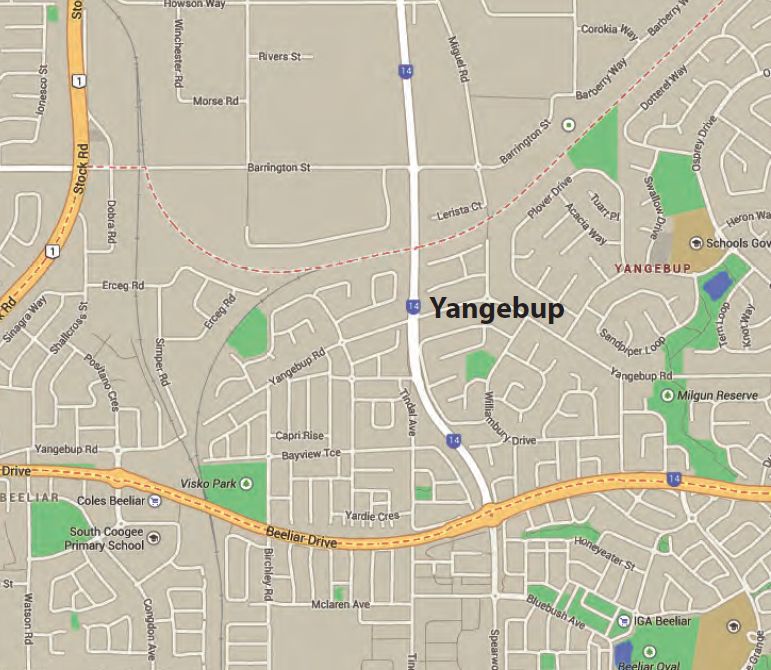

Yangebup, WA

Median price for houses: $486,500 (compared to neighbouring Jandakot $737,500 and Success $550,000)

12-month growth: 8%

Rental yield: 5%

Vacancy rate: 0.65%

- Yangebup is just 10 minutes’ drive from Fremantle, and it’s about double that to the Perth CBD. It is also only five minutes from the beautiful Coogee Beach, and this location has helped it lose its reputation as a low socio-economic area.

- Houses generally spend just 45 days on the market and the vacancy rate is only 0.65%.

- You can pick up houses with ocean views, which are particularly popular with buyers.

- The suburb’s affordability means there are lots of young people buying their first home or investment property there.

Inglewood, WA

Median price for units: $353,500 (compared to neighbouring Mount Lawley $437,250 and Dianella $420,000)

12-month growth: -4%

Rental yield: 6%

Vacancy rate: 1.66%

- Located just 4km from the Perth CBD, Inglewood has a commercial area on Beaufort Street and many recreational facilities. Its proximity to Edith Cowan University and the West Australian Academy of Performing Arts means the area is popular with young people.

- There has been a -4% drop in the median price over the last 12 months, giving investors the chance to purchase towards the bottom of the market.

- Units currently spend just 36 days on the market, and the vacancy rate is only 1.66%. Many investors would obviously be attracted to the high rental yield of 6%.

- Inglewood offers renovation opportunities and a wide variety of properties, including character housing, 1960s apartments and modern unit developments.

Bellevue, WA

Median price for houses: $350,000 (compared to neighbouring Swan View $400,000 and Boya $602,500)

12-month growth: 3%

Rental yield: 6%

Vacancy rate: 1.27%

- Houses in Bellevue are extremely affordable, particularly compared to those in the neighbouring suburb of Boya, which are more than $200,000 dearer. Investors are also attracted to the strong rental yield of 6%.

- Average annual growth is at 10.1%, yet 12-month growth is 3%, which leaves enough of an imbalance to suggest that growth will return to the market soon.

- Houses spend just 65 days on the market and the vacancy rate is just 1.27%.

- There are lots of renovation and subdivision opportunities.

- The Perth CBD is about 15 minutes away and there are plenty of commercial opportunities nearby in Midland.

Berowra Heights, NSW

Median price for houses: $687,500 (compared to neighbours Hornsby $868,750 and Berowra $742,500)

12-month growth: 8%

Rental yield: 5%

Vacancy rate: 0.83%

- This suburb may be 29km from the Sydney CBD, but it’s only 15 minutes from the Hornsby CBD and its giant Westfield Shopping Centre. It’s also leafy, peaceful and safe, which appeals to families looking for houses.

- As more people seek houses outside the more expensive suburbs closer to the city, expect prices to rise even further. The demand indicators are certainly getting better, with the average house spending just 28 days on the market and a vacancy rate of only 0.83%.

- Investors should welcome the fact that houses in nearby suburbs are heading towards $900,000, as it demonstrates that there is much room for growth in Berowra Heights.

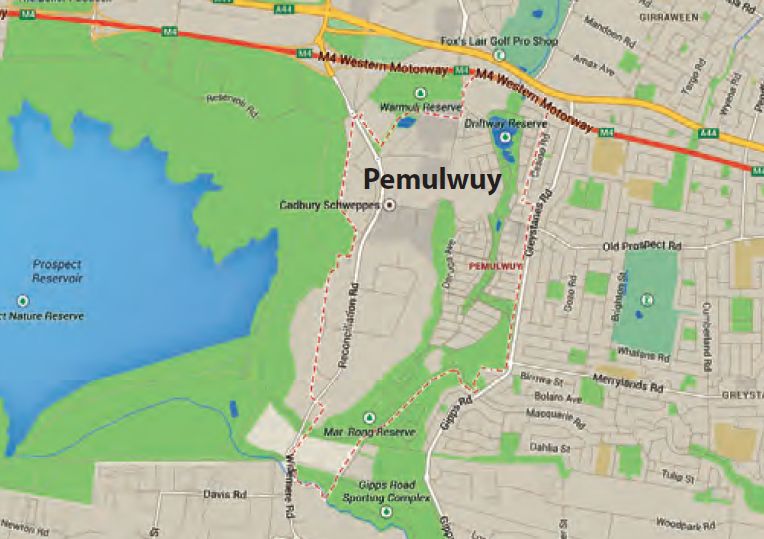

Pemulwuy, NSW

Median price for units: $405,000 (compared to neighbours Girraween $472,889 and Parramatta $475,000)

12-month growth: -1%

Rental yield: 6%

Vacancy rate: 1.88%

- With the boom happening in Parramatta, its neighbouring suburbs will be increasingly appealing to investors as they will not only piggyback on Parramatta’s success but are also available for a lot less money, according to the latest Herron Todd White report. Parramatta is already the sixth-largest CBD in Australia.

- It is projected there will be 300,000 new jobs created in Western Sydney by 2031, with plans for the development of the new airport at Badgerys Creek set to produce around 35,000 jobs.

- With an affordable price for units, strong capital growth potential and rental returns in excess of 6%, it’s no wonder Pemulwuy is catching the eye of investors.

Schofields, NSW

Median price for houses: $576,000 (compared to neighbours Rouse Hill $740,000 and The Ponds $720,000)

12-month growth: 6%

Rental yield: 4%

Vacancy rate: 1.16%

- A quick sell in Schofields may not be wise, as house prices there are still affordable but may not be so in a few years’ time. This is a popular option for people priced out of nearby suburbs, such as Rouse Hill and Baulkham Hills.

- The suburb may be 33km from the CBD, but the M2 Hills Motorway provides easy access to the city, as do the bus and train connections.

- The development of the North West Growth Centre will result in increased infrastructure investment, including more transport options. There are already plans for upgrades to Schofields Road.

Eastwood, NSW

Median price for units: $572,000 (compared to neighbours North Ryde $750,000 and Denistone $724,000)

12-month growth: 3%

Rental yield: 4%

Vacancy rate: 1.92%

- Recent transport infrastructure has made it even easier to get to Macquarie University and Macquarie Centre. This is resulting in more young people looking for a unit in Eastwood.

- The wide range of Asian restaurants and shops means Eastwood is increasingly recognised as a multicultural area, and it therefore attracts a wide demographic.

- Eastwood’s business community is negotiating funding for local infrastructure, such as a bridge crossing to link east and west. They argue that more funding will attract more residents and help schools.

- Units in particular appeal to people looking to live in Eastwood, as the median price of houses, at $1.25m, is out of reach for many.

Altona, Vic

Median price for units: $445,000 (compared to neighbours Williamstown $532,500 and Newport $537,500)

12-month growth: 5%

Rental yield: 4%

Vacancy rate: 2.39%

- This suburb got a lot of media attention when Julia Gillard’s brick home went under the hammer last year, says Cate Bakos. Now even more investors are privy to the opportunities it offers.

- It was previously Williamstown that hogged all the attention in this area, but Altona’s thriving cafe culture on Pier Street, its ease of access to the CBD via train and bus, and its laid-back beach lifestyle make it look like much better value.

- Three-year growth is just 3%, which is below average for the general area, meaning this suburb could be in line for growth in the near to medium term.

Footscray, Vic

Median price for units: $361,000 (compared to neighbours Maribyrnong $440,000 and Maidstone $410,000)

12-month growth: 2%

Rental yield: 4%

Vacancy rate: 2.61%

- Talk about throwing off the shackles of a dodgy reputation. The local council has put enormous energy into this area, from tackling crime to beautifying parks and precincts, says Bakos.

- Recently, Footscray has seen an explosion of great dining options, and houses in residential pockets are regarded as some of the most beautiful in Melbourne.

- It may be just 6km from the city, but the recent rail network upgrade has given Footscray a further edge.

- The suburb is becoming increasingly popular with singles, professionals and young couples who are looking for nice apartments.

- Some real estate agents are tipping it could become like the prestigious southeast Melbourne suburb of South Yarra.

Chelsea, Vic

Median price for units: $395,250 (compared to neighbours Bonbeach $432,000 and Patterson Lakes $402,500)

12-month growth: 5%

Rental yield: 4%

Vacancy rate: 1.84%

- Chelsea is very popular with beachgoers in the summer, and its beautiful bay views are highly desirable for people who place a priority on this feature but don’t want to spend a lot of money, says Bakos.

- In particular, Bicentennial Park is a major drawcard for joggers and cyclists, particularly since it updated its equipment.

- The suburb attracts a wide demographic, from young couple to retirees, and the one- and two-bedroom units that are common there appeal to both these groups.

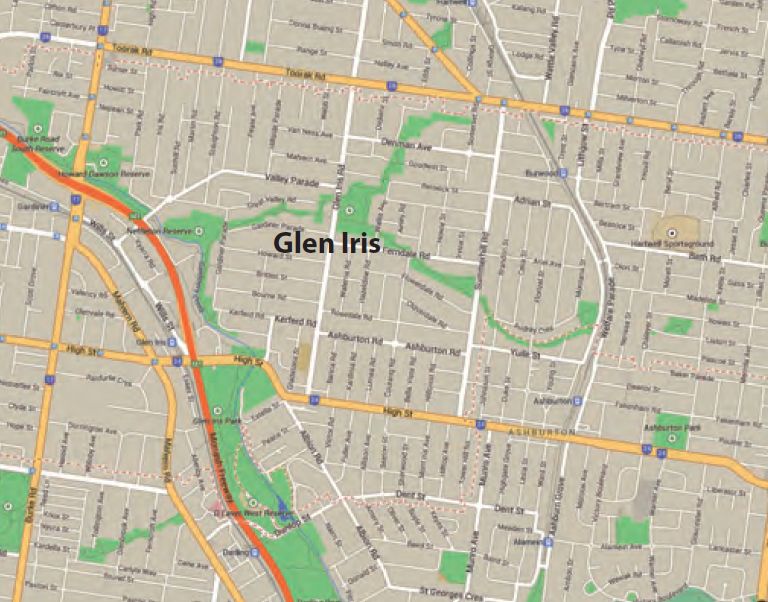

Glen Iris, Vic

Distance from CBD: 9km

Median price for units: $533,750 (compared to neighbours Camberwell $667,500 and Ashburton $702,500)

12-month growth: 5%

Rental yield: 4%

Vacancy rate: 1.88%

- Glen Iris is becoming increasingly popular with families attracted to its popular schools, recreational and sporting facilities, and quiet streets.

- Most other suburbs in the area have a 12-month growth rate north of 15%, but in Glen Iris it’s just 5%, indicating there is much room to move here.

- There are a range of properties in Glen Iris, including single-dwelling housing, period style and modern apartments, which appeal to a wide range of age groups and cultures.

- In particular, many people are attracted to the suburb’s affordability compared to the likes of Camberwell, which over the last 12 months has become way out of the price range of many investors looking at units. Consequently, Glen Iris is well poised to benefit from the ripple effect.

Craigieburn, Vic

Median price for houses: $365,000 (compared to neighbours Greenvale $550,000 and Attwood $550,000)

12-month growth: 7%

Rental yield: 5%

Vacancy rate: 2.3%

- There has been much infrastructure work taking place in Craigieburn, including the $330m Craigieburn Central, a new development that is home to 160 new retailers, complete with department stores, restaurants and a cinema complex. This means residents will no longer have to go to Epping or Broadmeadows for their special shopping needs.

- The $48.5m Craigieburn Park will provide state-of-the-art athletics and aquatic facilities by the time it is delivered before January 2017.

- The rental yield of 5% is strong for Melbourne, particularly for houses.

- There are plenty of big houses, good schools and new infrastructure developments that make this suburb particularly appealing to families. The new Craigieburn Library and the suburb’s many childcare facilities and safe parks are further evidence of this. It is also close to the airport and major freeways.

Seaford, SA

Median price for houses: $327,750 (compared to neighbours Moana $368,500 and Port Noarlunga South $350,000)

12-month growth: -4%

Rental yield: 5%

Vacancy rate: 1.15%

- This area seems to be increasing in popularity, and this could be a response to upgrades in transport infrastructure such as the Seaford Rail Extension and the Southern Expressway Duplication, which is nearing completion, according to the latest Herron Todd White report.

- Seaford also has all the infrastructure of Moana and Port Noarlunga, yet is up to $40,000 cheaper to buy in, says Prue Muirhead.

- The general rule for coastal SA suburbs is the better the view, the better the investment. And Seaford is a suburb with many spectacular ocean views.

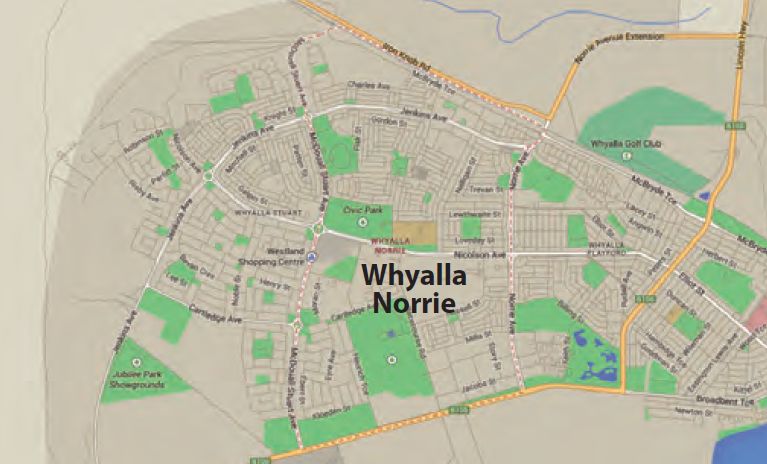

Whyalla Norrie, SA

Median price for units: $150,000 (compared to neighbours Whyalla $175,000 and Whyalla Playford $197,000)

12-month growth: -4%

Rental yield: 8%

Vacancy rate: 0.72%

- This area is attracting investors due to its proximity to the water, its positively geared properties and the forward-thinking local council, says Muirhead.

- The extremely affordable median price of units, at $150,000, is among the cheapest in the area and has helped rental returns increase to 8%.

- When the Olympic Dam eventually does expand, expect to see capital growth well above average.

- In addition to resources, the local economy also benefits from its tourism industry and the seaport located on the east coast of the Eyre Peninsula.

- According to recent results from Real Estate Investar, Whyalla was the most searched suburb in SA.

This feature is from Your Investment Property Issue #88. Buy the copy to read more!