WESTERN AUSTRALIA

Throughout 2014, the economies and property markets of much of the eastern states have come roaring back, leaving WA licking its wounds. But are things as bad as they seem, or is the WA market actually one for the astute investor?

If there’s one thing that’s certain in the wonderful world of economics, it’s that things can change fast.

Less than six months ago, WA boasted the nation’s best-performing economy and a AAA credit rating to boot. These days, however, it’s NSW that is the nation’s leading economy, and WA now shares the same credit rating as Tasmania, according to Moody’s Investors Service.

Moreover, the so-so economy has translated to so-so growth in dwelling prices.

“Subdued price growth in Perth [in the September 2014 quarter] was no real surprise as that market has consistently reported waning buyer activity over the past year,” says Andrew Wilson, chief economist at Australian Property Monitors (APM).

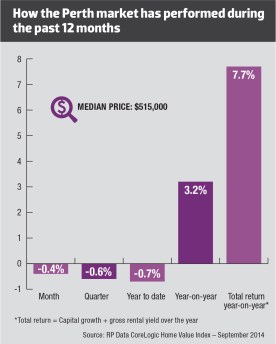

According to the RP Data CoreLogic Home Value Index results, Perth dwelling prices have only grown by 3.2% in the past 12 months. This is the weakest level of growth out of all the capital cities other than Canberra, and is dwarfed by that of the eastern powerhouses of Sydney (14.3%) and Melbourne (8.1%).

Current state of the market

The massive levels of investment of the resources boom have now come and gone, and what subsequently happened is housing temporarily took its place, says Harley Dale, chief economist at the Housing Industry Association (HIA).

“So there has been a very strong new-home building recovery in WA, the strongest in the country. In 2014, WA will build its largest number of new homes on record, so there has been a lot of supply come on in the space of about a couple of years,” Dale says.

“WA has had a couple of pretty strong price booms over the past decade, but price gains are relatively modest at the moment,” he adds.

According to QBE’s Australian Housing Outlook 2014 2017, property price growth in 2012/13 was underpinned by record net overseas and interstate migration inflows, leading to tight vacancy rates and substantial growth in rents. However, in 2013/14 population growth began to stall as vacancy rates and the economy started slowing down.

Meanwhile, in CommSec’s most recent State of the States report, WA lost its spot as the nation’s best-performing economy to NSW. It lost ground on retail trade, equipment investment and population growth, which had a lot to do with the fading of the mining boom.

However, WA is still the leading state in terms of housing finance, which is one of its new key economic drivers, overtaking mining. The number of commitments is now 8.5% above the long-term average.

This is an accurate indicator of strong real estate activity, housing construction, and overall activity in the financial sector. “And again home purchase and construction are vital ingredients in sustaining the economy, together with commercial building,” says the report.

WA is also the outright winner in respect of population growth, with an annual growth rate of 2.53%. This may sound impressive, yet it’s still its slowest rate of growth in almost four years and 3.5% below decade-average levels.

At 4.9%, WA’s unemployment is relatively low compared to the other states; however, it is still 18% above the decade average.

Outlook: What’s ahead

Times are tough in WA, says Dale. This is mainly due to the fact that so much investment has been “sucked out of the economy”.

“Labour market performance, which historically is much better than the eastern seaboard, is going to be deteriorating within WA. And economic growth will have a couple of years not doing what it was,” he says.

“We have the new-home building peaking this year, so there will be fewer homes built in 2015 than in 2014.”

Is the boom over?

It will be a long time before we see another investment boom the likes of which we have just been through, says Dale.

“Many would say that was not just a ‘once in a generation’ boom but the largest one Australia has ever seen. So that is not going to come around again in a hurry,” he says.

But investment is a long way from stopping completely, Dale argues. There are still huge gas reserves that will generate further revenue.

“You are not going to see the elevated investment in there for economic growth, and therefore household income growth, over the next five or 10 years that we have been accustomed to over the last five or 10 years. But it is still a reasonable outlook for WA,” says Dale. “I wouldn’t be looking for acceleration in property price growth. I wouldn’t be thinking there’s much short-term gain to be had.”

Dale says this applies especially to areas of WA that were fully leveraged through mining investment; they are all already seeing quite sharp falls in property prices and sharp rises in vacancy rates.

We have seen mining investment start to decline, but it hasn’t totally stopped, says Zigomanis.

“There are still projects working their way through. Two to three years out from now it will start to drop off really rapidly. There is more downside beyond the next 12 months rather than in the next 12 months,” he says.

Is there much worth in Perth?

The easing of rental market conditions in Perth is likely to continue over the next couple of years, says Dale.

Moreover, the QBE Housing Outlook says low interest rates should support Perth’s prices at around current levels over 2014/15 and possibly 2015/16. However, the slowing economy coupled with the predicted higher interest rates is likely to cause price declines by 2016/17.

Consequently, over the three years to June 2017, Perth’s median house price is forecast to be $525,000, or 2% below the June quarter 2014 median. This would represent a 10% decline, in real terms.

The report also predicts weaker underlying demand on the horizon. “With the current strong construction pipeline still working its way through to completion, any measured dwelling deficiency currently in the market is likely to be rapidly eroded,” it says.

Agriculture and tourism

At the end of the day, even if the price of resources goes down, the state still has a good head of steam, says John Edwards of OnTheHouse.com.au. “It’s close to Asia and it’s fundamentally got good assets, which should stand it in good stead for the future,” he says.

Indeed, there are an increasing number of tourists coming to WA, with more than 776,500 arriving in the 12 months to March 2014, which is up 4.3% on the previous year.

In particular, there a large number of Chinese tourists visiting WA, which is significant because they spend on average $3,000 more than the average international visitor. In response, the WA government has allocated more than $3.9m just for tourism marketing to China.

Meanwhile, the WA premier Colin Barnett argues that agriculture in WA could be on the way to experiencing its best fortunes in more than half a century. This is primarily due to Asian income growth and their increasing demand for Australian food.

Indeed, it is predicted that in the coming years the farming sector will grow faster than the mining sector in WA, due mainly to the rising demand for the state’s food products.

At the moment, the total value of WA’s agriculture and food products is $20bn at the retail and export levels, and two thirds of its agriculture and food products are exported.