2013’s worst performing markets include a mix of suburbs in Cairns, Albury and the Sunshine Coast, but perhaps the most surprising markets to lose wind over the year were suburbs in Gladstone, Qld.

Many property pundits had forecast in 2012 that Gladstone house and unit values would see strong growth over 2013 because of billions of dollars in infrastructure projects being diverted into the city economy.

However, an excessive level of building saw certain Gladstone markets become oversupplied with properties and the opposite happened – values tumbled.

The Gladstone areas to be worst affected include Glen Eden and the city’s CBD.

Other areas to see lacklustre activity include the Sunshine Coast's Peregian Springs and Montville, where values are still suffering from a ramp up in building activity from a few years ago. This saw the market become oversupplied.

Queensland's Moranbah, a small mining town within the Isaac region, has also seen a remarkable downward shift in prices - largely as a result of a growing FIFO workforce that is circumventing the town as a source of accommodation.

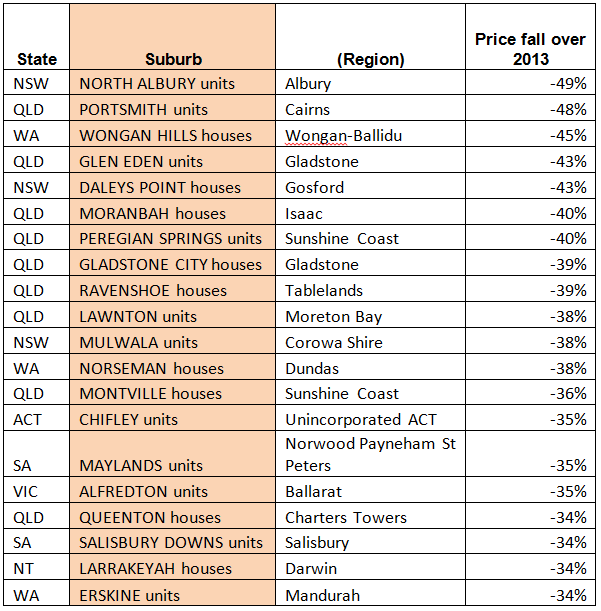

Among the top 20 worst performing markets over 2013, three were in NSW, nine were in Queensland, three were in WA and two were in SA. The ACT, Victoria and Northern Territory each had one market.

2013's worst performing property markets were:

Source: RP Data, Nov 2013