An oversupply of listed properties is going to spell doom for property prices in markets such as Tamworth, Bathurst, Merinda and a host of others, according to newly released figures

Believe what you like about property markets, but one fundamental rule rings true about them. If there is a persistent oversupply of properties listed on the market prices will go down.

It’s a simple supply and demand equation. If you increase the amount of properties for sale (supply), but there is no visible increase in the level of buyers (demand) there is no reason for buyers to accept higher levels of pricing. The abundant supply of properties will mean they can be picky and have a lot of freedom to negotiate a deal that suits them best. This will inevitably be at the expense of property prices, which are likely to drop.

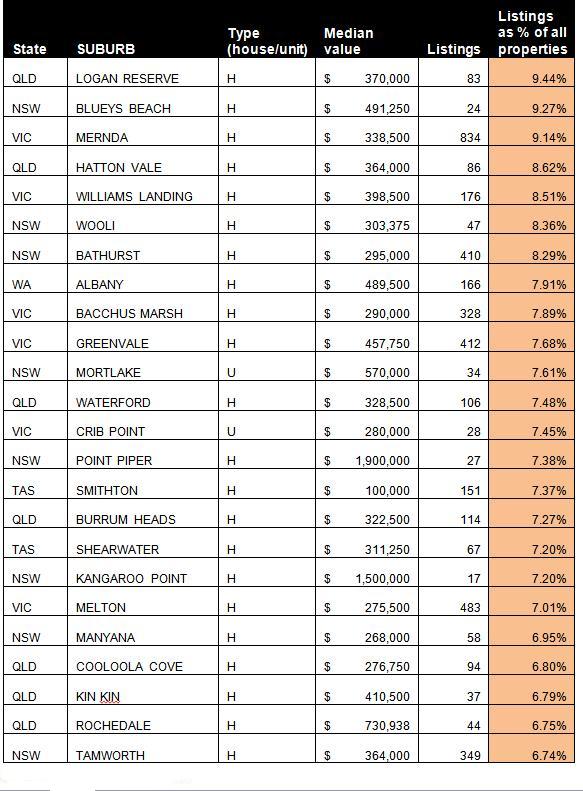

Across Australia, the far majority of suburbs have less than 2% of all local properties on the market at any one time. Cue the alarm bells for these suburbs, which each have more than 6% of their total properties currently listed for sale, according to DSRscore.com.au. Some have close to 10%, indicating that some form of price adjustment is on the horizon.

Scroll to the bottom of the page to see the full list of suburbs.

Source: DSRscore.com.au, Feb 2013