A significant monthly drop in the number of properties listed for sale has offered hope to property investors that homebuyers are coming out of the woodwork.

According to the latest figures from SQM Research, residential sales listings recorded a monthly decrease of -4.3% during January – reaching a total of 368,510.

This was the second consecutive monthly decrease in property listings, following steady increases over the course of last year.

SQM Research managing director Louis Christopher cautioned investors that these figures represent seasonality, but noted that January’s falls were far greater than those that were recorded this time last year.

Is this the result of more buyers coming into the market? Should February’s figures reveal a similar number of property listings, or only a marginal increase, Christopher believes that this could be the case.

“We expect a bounce in listings in February as the season opens again. However if the bounce is marginal or there is no bounce at all, then it will be clear to us that something else is going on in the market – such as listings being absorbed by an increase in buyer activity," he said.

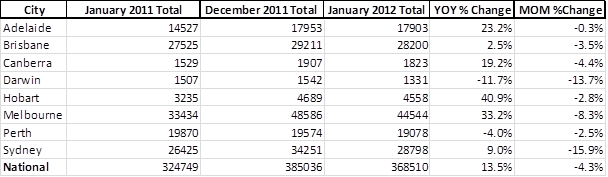

While monthly stock on the market figures fell in all of Australia’s state capitals, only two saw a year-on-year decline – Darwin and Perth. Hobart (40.9%) and Melbourne (33.2%) saw the largest yearly increases.

The results:

Source: SQM Research, January 2012

Are buyers making a comeback? Have your say on our property investment forum.

More stories:

Rate hold a missed opportunity to boost property