According to figures from Juwai.com, which markets international property to China, inquiries to real estate agents and property developers from Chinese buyers looking to purchase Australian residential real estate increased by 87.1% during 2015.

According to the Juwai.com figures, Chinese buyers enquired about US$34.9b worth of Australian housing during 2015.

Gavin Norris, head of Australia for Juwai.com, said the surge in interest in Australian real estate among Chinese buyers was no surprise given their demand for properties across the globe, however Australia shouldn’t assume it will always be a destination of choice.

“These results are no surprise. I would hesitate to make any short-term predictions, but by 2020 we expect Chinese buyers to set new records for international real estate investment,” Norris told Your Investment Property Magazine.

“How much of that money gets poured into the pockets of Australians depends in part on how successful the local industry is at marketing,” he said.

While the impact of this week’s announcement from Citigroup that it will no longer accept a number of foreign currencies, including the Chinese yuan, from people looking to purchase Australian property has yet to be felt, Norris said he doesn’t believe decisions by a number of Australian lenders to not allow foreign income streams in mortgage applications will scare of the Chinese.

“It is true [some lenders] found ‘some’ loans backed by ‘questionable documentation,’ but it appears those loans are still safer and less likely to default than loans made to Australian citizens,” Norris told Your Investment Property Magazine.

“Overall, we haven’t seen any firm impact on the demand for property from the curtailing by Australian banks of loans to those with offshore income. I don’t think they were issuing many such loans in the first place. Most Chinese pay in cash from their savings. Those who use leverage also have the option of relying on Chinese lenders they are already familiar with.”

Both ANZ and Westpac revealed this week they have uncovered mortgages that have been backed by questionable foreign-income documentation.

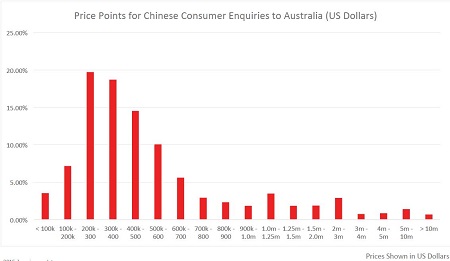

While prestige and luxury Australian properties are popular among the Chinese, the Juwai.com figures show the majority are looking for Australian real estate in the US$200,000 to US$500,000 range.

“Some people think all Chinese buyers are palling around at private clubs and in $20-million mansions, but China is like Australia in that there are more middle class than filthy rich,” Norris said.

Source: Juwai.com

Melbourne was the most popular Australian city for Chinese buyers in 2015, with it attracting enquiries about US$11.5b worth of real estate in the Victorian capital.

Sydney was the second most popular city, with Chinese buyers enquiring about US$8.23b worth of real estate, followed by Brisbane with US$2.61b worth of enquiries.

There could be some reordering of those positions in 2016 however, following the Victorian government’s decision to levy additional fees on foreign buyers.

“The big question for 2016 is whether the higher stamp duty in Victoria will push buyers to more inviting cities, or even to other countries. The desire to invest and live in Victoria could win out over the extra cost. We’ll have to wait and see,” Norris said.