According to the latest quarterly ANZ/Property Council Survey, those within the industry believe it will continue to be one of the national economy’s heavy lifters over the coming year.

“Property will still be a growth driver for the economy in 2016, even with an expected easing of housing construction levels,” Property Council of Australia chief executive Ken Morrison said.

“Industry confidence levels remain strong, forward work levels and staffing expectations are positive, and the industry expects non-residential construction to improve,” Morrison said.

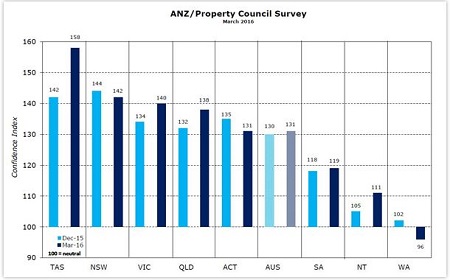

According to the survey , confidence in the property industry rose by one point nationally over the December quarter to 131, despite confidence decreases in New South Wales, the ACT and Western Australia.

A score of 100 or more is considered a positive outlook, with Tasmania home to the highest confidence level at 158.

Confidence levels are at their lowest in Western Australia at just 96.

Source: Property Council of Australia

ANZ chief economist Warren Hogan said the end of 2105 saw a clear easing in the capital growth performance of the nation’s housing market, which will have some impact on its economic contribution.

“We expect that the housing sector’s contribution to growth is set to ease, through softer construction activity and a reduced ‘wealth effect’ from weaker price growth,” Hogan said.

“The housing market has clearly eased through the second half of 2015. Triggered by the impact of tighter mortgage lending regulation for investors and higher mortgage lending rates, housing market sentiment has weakened sharply,” he said

While the residential market may not have quite the same impact on the economy during 2016 as it did in 2015, Hogan said another sector is looking to pick up some of the burden.

“The pipeline of commercial property construction, however is gradually growing,” he said.

“Capital growth has strengthened across most commercial property sectors, with the expectations of capital growth strongest in retail and tourist accommodation property."