Do you see real estate agents as essentially untrustworthy souls who are a necessary evil of the property investment game? You’re not alone.

According to this year’s annual Image of Professions survey from Roy Morgan, real estate agents are the third least trusted profession in Australia – just behind advertisers and car salesmen.

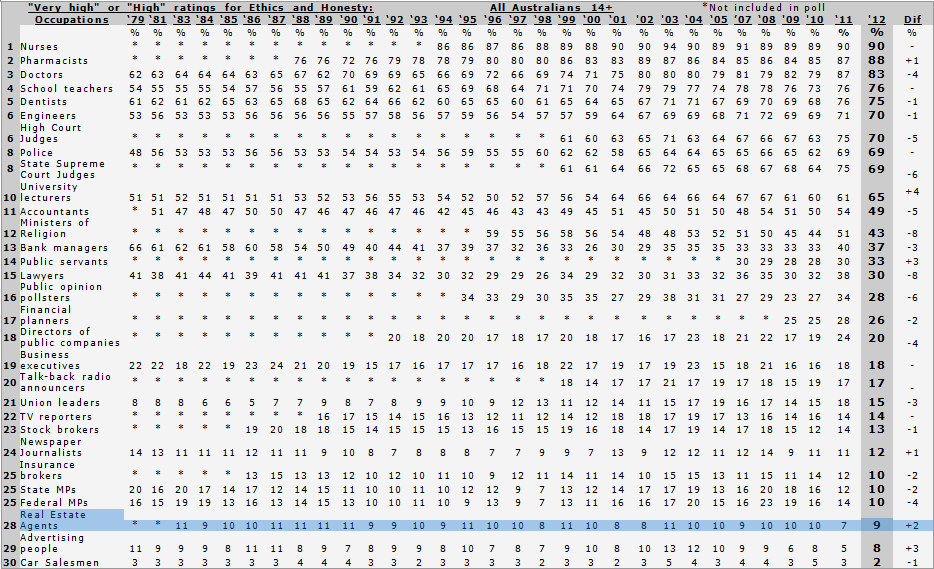

Only 9% of respondents gave real estate agents a ‘very high’ or ‘high’ ranking when asked to score the occupation for honesty and ethical standards. This was, however, a 2% increase on last year’s score.

Advertisers scored 8%, while car salesman came in at a lowly 2%. At the other end of the scale were nurses (90%), pharmacists (88%) and Doctors (83%).

“Once again Car Salesman (2%, down 1%) rank at the bottom of the list — a position they have held for over 30 years. Bucking the overall trend, the two next lowest professions both improved slightly in 2012 — Advertising people (8%, up 3%) and Real Estate Agents (9%, up 2%),” said Roy Morgan spokesman Gary Morgan.

But it’s not just your real estate agent that you should be wary of, if the results of the survey are anything to go by. The score for accountants dropped from 54% to 49% this year; bank managers saw their score slide by 4% (37%); and lawyers saw their perceived trustworthiness crash by 8% (30%).

Financial planners (down 2% to 26%) and insurance brokers (down 2% to 10%) have also seen their standings slip.

The results:

Respondents were asked: “As I say different occupations, could you please say – from what you know or have heard – which rating best describes how you, yourself, would rate or score people in various occupations for honesty and ethical standards (Very High, High, Average, Low, Very Low)?”

Source: Roy Morgan

Do you agree with the poll results? Have your say by commenting below or joining the debate on our property investment forum.

More stories:

Property investors tipped to return to the market