Australians may be gloomy about the country's economic outlook, but the property market outlook may come as a surprise.

While Allianz and Newspoll’s Optimism Index indicates that Australians’ optimism about the economy remains at its lowest level since mid-2011, NAB’s latest Residential Property Index is back in positive territory.

The bi-monthly Allianz and Newspoll survey, which claims to measure Australians’ level of optimism about the future of the economy, environment and society –as well as their overall happiness – has now exceeded the historical low reached in May 2011.

“Australians’ optimism about the future of the economy hit a 2011 low in May, with the Optimism Index falling from 14 to 9, reaching a level less than half the Index level of 20 achieved when the survey commenced in November 2010. This may have reflected the aftermath of the summer of natural disasters, exacerbated by global economic uncertainties,” said Allianz Australia managing director Terry Towell.

“After bumping around at relatively low levels over the second half of 2011, Australians’ optimism about the economy has started 2012 on a low, with the Optimism Index falling back to only 8.”

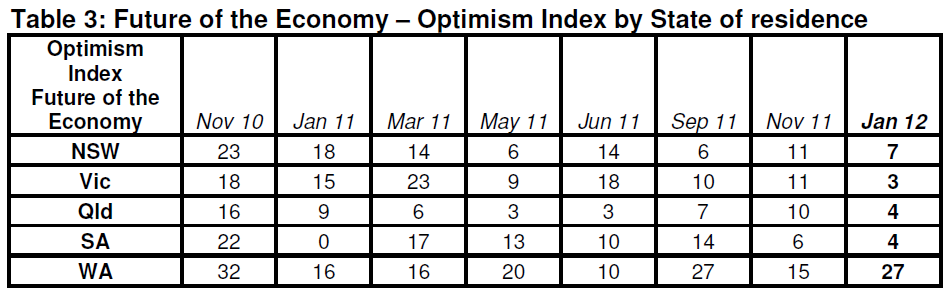

Western Australia was the state with the highest Index score (27), followed by NSW (7). Victoria bottomed the table with a score of 3, followed by Queensland and SA with 4.

Source: Allianz Future Optimism Index

The mood is better amongst property professionals however, with NAB’s latest Residential Property Index recording a positive score of +1 for the December quarter – following two consecutive quarters of negative results.

The survey recorded significant regional variations, with Victoria (-22) and Queensland (-18) once again proving to be the two states with the gloomiest outlooks. New South Wales (+31) and WA (+18) were the two states where confidence in the property industry was at its highest.

Looking ahead, the survey found that national house prices are expected to grow by 1.2% by December 2013. Once again, WA and NSW are expected to lead the pack.

“WA is expected to significantly outperform the other states, with prices rising by 3.2%. In NSW, prices are forecast to rise by 1.9%, with growth of 0.8% and 0.5% tipped for SA/NT and Queensland respectively. House price growth is forecast to be slowest in Victoria at 0.3%, but this represents and marked turnaround from a -2.1% decline forecast in September,” said the report.

It goes on to paint a positive outlook for the Australian real estate market, stating that NAB believes that these expectations “may be a touch pessimistic”. The bank points to the following factors that should underpin Australian real estate going forward:

- A shortage of housing

- Weak building commencement figures

- Falling interest rates

- Comparatively low unemployment

“These factors should continue to maintain a floor under house price growth, which we see resuming at below 4% in 2012 after drifting down in 2011,” says the report.

Do you think that property will make its comeback this year? Have your say on our property investment forum.

More stories:

Global debt crisis weighs heavy on investors’ minds