There are signs that the property market is reaching the bottom of the cycle, but prices are unlikely to see a sustained recovery this year.

These are the predictions of Residex, following the release of January data that shows monthly median price falls for houses and units in most of Australia’s major cities.

“Prices continued to weaken in almost every capital city over January. Our data suggests we are moving beyond the bottom of the cycle, however the trend is not pronounced,” said Residex CEO John Edwards.

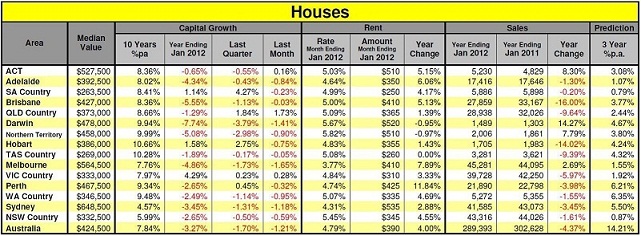

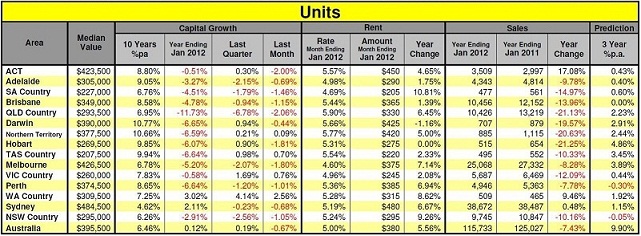

The national median house value fell by -1.21% during the month of January, according to Residex figures, while the median unit price dropped by -0.67%.

Of the nation’s capitals, Melbourne saw the biggest falls, with median house and unit values recording falls of -1.65% and -1.8% respectively. Sydney saw falls of -1.18% for houses and -0.68% for units, while Brisbane held firm for houses but saw a median unit price drop of -1.15%.

The biggest winners were units in the ‘WA Country’ category, which saw a median price rise of 2.56% over the month, followed by Queensland country houses (1.73%).

“On an Australia-wide basis we do not look as if we are through the worst of the correction phase. In most capital cities, while we may have reached the bottom of the cycle, there is no strong movement towards positive territory,” said Edwards.

“The next few months will be crucial in determining where markets head. However, as the reality of the actual performance of housing markets becomes evident we can expect to see further weakness and potentially ongoing price corrections.”

The results:

Source: Residex, January 2012

Is now the time to buy as the market bottoms out? Have your say on our property investment forum.

More stories:

Are buyers returning to the market?