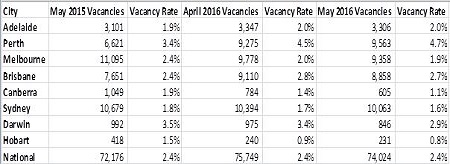

Released yesterday, figures from SQM Research show the national vacancy rate remained at 2.4% in May, unchanged from the mark recorded in April.

Conditions are also similar on a year-on-year basis, with a vacancy rate of 2.4% also being recorded in May 2015.

In May 2016 Perth was the only Market to see an increase in its vacancy rate, with it rising 0.2% over the month to 4.7%.

Over the month Darwin saw the biggest fall, with a 0.5% fall to 2.9% during May.

Canberra’s vacancy rate fell 0.3% over the month to 1.1%, while falls of 0.1% were recorded in Sydney, Brisbane, Melbourne and Hobart.

Adelaide remained steady at 2%.

Source: SQM Research

Hobart’s small fall over the month bought its vacancy rate to 0.8% and is the fifth straight month it has been recorded at below 1%.

In the year to May, Hobart’s vacancy rate has fallen by 0.7% and Louis Christopher, head of SQM Research, said conditions in the Tasmanian capital could soon become even better for land lords.

“National rents were slightly weaker this month with a 12 month average change that is mirroring the CPI index,” Christopher said.

“Going forward we do not expect any resurgence in rents for the foreseeable future, barring some cities such as Hobart, which we do expect higher rental growth rates due to a falling trend in vacancies,” he said.

Other notable decreases since May 2015 include a year-on-year fall of 0.8% in Canberra, 0.6% in Darwin and 0.5% in Melbourne

On the other side of the coin, Perth was home to the largest year-on-year vacancy rate increase with an “alarming” 1.3% increase since May 2015.