Released this week, the latest Regional Market Report from CoreLogic RP Data named the Illawarra as the best performing regional market in Australia in the year to March 2016.

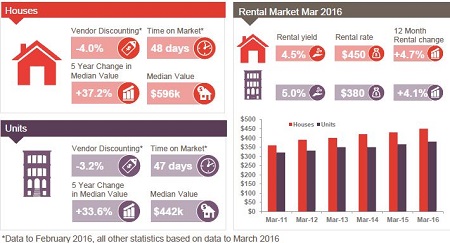

House prices in the Illawarra, which sits south of Sydney, improved 15.8% to a median of $596,000 over the 12 months according to CoreLogic, while the median unit price in the region jumped 13.2% to $442,000.

Houses in the region are also selling eight days faster than they were 12 months ago, while units are spending 11 days less on the market.

Over the year, rents across the region increased by 4.7% or $20 per week to $450 per week for houses and 4.1% or $15 per week to $380 per week for units.

Source: CoreLogic RP Data

CoreLogic research analyst Cameron Kusher said the Illawarra has been regional Australia’s “stand out performer” recently and said its proximity to Sydney has helped it.

“As you would expect, this market been driven largely by a surge in Sydney property prices as people find themselves priced out of the capital city housing market,” Kusher said.

“The Illawarra region offers not just an affordable alternative for owner occupiers; it’s also attracting buyers keen to secure holiday homes,” he said.

For Matt Knight, director of buyer’s agency Precium, which operates across the Illawarra and NSW south coast, the idea of the Illawarra being the country’s top regional market comes as no surprise.

“We typically see a ripple out of Sydney at the end of every boom and this cycle is no different. Having studied the last the two cycles it’s essentially been quite predictable,” Knight said.

“It’s demographics and people’s human nature. Whenever you get somebody like a baby boomer who might have a lot of equity in Sydney and is looking for a better lifestyle or somewhere to invest or you have a young family who are priced out then they start to look here,” he said.

Currently Knight said the majority of activity in the area is from owner occupiers, with investor activity having pulled back somewhat as result of the lending restrictions and the ongoing election campaign.

While the ripple out from Sydney has no doubt played a role in the region’s recent success, Knight said there are local factors that have also helped the Illawarra.

“The increase in buyers exiting Sydney has definitely caused a change in the market,” he said.

“The Illawarra Strategic Plan outlines a series of infrastructure projects for the area which is really helping confidence grow for both the Illawarra and the Shoalhaven.

“And the visible projects like the Berry bypass are really catching people’s imagination and people are really beginning to see the area isn’t as far away as they think.”

Knight believes the region is yet to peak, but he did offer some caution for those who may be considering rushing in before it does.

“People do have to do their research and due diligence because there are a lot of sub-markets in the Illawarra.

“The northern suburbs are in general more expensive. Essentially they’re performing like a beachside suburb in Sydney because a lot of people are commuting to Sydney and they have some fantastic beaches.

“There are pockets of lower socio-economic areas where people need to be careful of what they’re buying because may have trouble tenanting property. But there are also some real pockets of value which is why it’s important to understand the micro-market in the greater Illawarra.”