Recent figures from the REIQ revealed that over the December 2015 quarter, inner city Brisbane’s vacancy rate increased by 0.4% to 3.8%.

While that movement means the inner city rental market now fits the REIQ’s criteria for a weak rental market, chief executive officer Antonia Mercorella pointed to historical data in defending the area’s prospects.

“Twelve months ago, in December 2014, the vacancy rate was 3.8% - exactly the same as it is in this survey, December 2015 – and in the March quarter it returned to 3.1%. In December 2013 the vacancy rate rose to 4.1% and then the next quarter it fell to 3.1%,” Mercorella said.

But Simon Pressley, managing director of property investment advisory firm Propertyology, said the historical comparisons may not hold weight this time around.

“I’ve seen what the REIQ had to say and I’m not questioning the evidence they’ve used to make that claim, but I don’t think we’re going to see the same sort of occurrence this year where the vacancy rate is lower over the March quarter,” Pressley said.

“It’s something we’ve been tracking for a while now and the increasing vacancy rate is a real thing in the city. We’re not going to dramatise it and say that it’s going to go up to 5% or 6%, but it is going to be higher for the next couple of years,” he said.

While the REIQ’s figures show seasonal fluctuations in the inner Brisbane vacancy rate in the past, Pressley said the sheer number of new dwellings, in particular apartments, built in the area recently has altered the market and landlords should brace themselves for a period of poorer rental returns

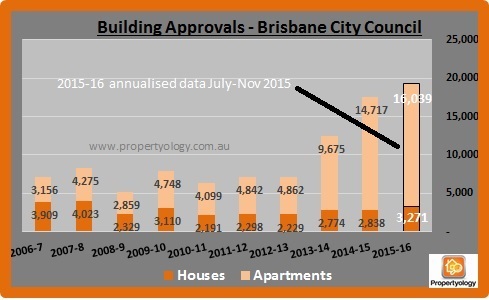

“Propertyology anticipates that rents will soften in parts of Brisbane over the next couple of years. This is particularly the case for apartments within the 3 kilometre radius of the CBD. Propertyology tracks building approval data of every city council in Australia and the data for Brisbane is quite incredible.

“Historically, Brisbane City Council approves 4,000 apartments each year; however, 24,000 have been approved over the last two years. Much of this new stock is being purchased by ill-informed investors and they are unlikely to get the rental income which they had hoped for.”

Source: Propertyology

It may not only be the cash flow of investors that takes a hit from the increased supply levels, with Pressley believing buyers of new apartments may suffer in the capital gains stakes as well.

“I think if you look across most of Australia there’s a distinct possibility that if you’ve bought a brand new property that it might be worth less in six or 12 months’ time. Obviously that doesn’t apply to everywhere and there will be pockets where values go up, but it’s a possibility people should be ready for.

“If you’ve got a lot of properties that come online and struggle to sell and people end up discounting them to sell then that’s going to drag down prices.

“Hopefully those people that have bought those new properties haven’t borrowed on the breadline and all of a sudden we have a situation where they’re forced to sell, but I do think a lot of people are in for a reality check in the next couple of years.”