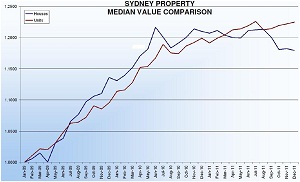

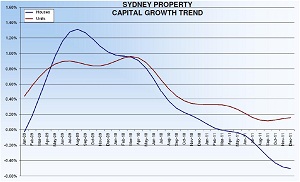

Property investors who plan to target Sydney would do well to avoid houses and focus on units, it has been claimed.

Commenting on the various sets of data that have recently been released regarding the Sydney market, Residex CEO John Edwards has advised investors to compare the performance of houses and units separately – rather than falling into the trap of looking at the entire market as a whole.

“Housing markets and unit markets grow at different rates, during different periods of time, and I cannot stress enough the importance of reviewing these markets separately. While one market produces good growth, the other may be in decline,” he said.

According to Residex’s December statistics, Sydney’s median house value fell by -0.24% during the month, -1.78% over the quarter and -2.54% over the year – and Edwards believes that affordability could be a major factor here.

“I am concerned that the public will not recognise the potential issue that may be developing in Sydney’s house and land market due to affordability issues. The result may be that people are simply reading press and believe they should be investing in houses because they are given the impression that the worst is over,” he says.

Units, on the other hand, saw positive growth according to Residex’s December figures – showing a monthly median price rise of 0.24%, a quarterly rise of 0.87% and an annual increase of 2.16%.

“At this stage, I think it would be sensible to take care and avoid the house and land market unless you are buying at basement bargain prices. The best investment class in Sydney property at this point in time, in my opinion, is established older style units,” said Edwards.

The results:

.jpg)

Source: Residex

Would you like to discuss where to go for your next investment? Visit the where to buy now section of our property investment forum.

More stories:

Sydney, Melbourne rents harbour mixed fortunes