According to the 2016 State of the Land Report, released yesterday by the Urban Development Institute of Australia (UDIA), buyers in Australia are on average paying significantly more for land, despite the average lot size falling.

According to the report, the average lot size in Australia at the end of 2015 was 453 square metres, which is 4.3% smaller than the average size as of the end of 2014 and 12.2% smaller than it was in 2010.

At the same time, the average price per lot was $246,432, which is up 4.9% over the past 12 months and 30.9% since 2010.

Over the past year the greatest price movement was recorded in Sydney, where the median lot price rose by $100,975, an increase of 29.7% since February 2015.

South East Queensland saw the next highest price rise, though it paled in comparison to Sydney’s increase, with prices only rising by 4.5% to $255,750, the second highest price in the nation.

Melbourne’s price rise was even more subdued, with a 3.8% increase in 2015 to $211,500, while in Perth prices fell 3.1% in 2015 to $252,875.

Lot prices also dipped in Adelaide, down 2.3% to $159,156, which is lower than the average price in 2008.

Source: UDIA

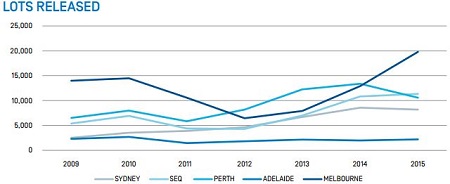

In terms of land release, the report shows a record 55,656 lots were released in 2015, a yearly increase of 9.9% and up 43.6% over the past five years.

The national increase was driven by conditions in Melbourne, where 6,874 lots were released in 2015, a yearly increase of 53.3%.

Adelaide saw releases increase by 11.4% to 2,202, while in South East Queensland release increased 4.8% to 11,344.

Releases plummeted 21% to 10,568 in Perth and dipped 4.6% to 8,174 in Sydney.

Source: UDIA

While the fact that lot releases broke record ground in 2015, the report claims land supply is likely to face issues from increased taxes and delays caused by planning and rezoning laws.

UDIA president Michael Corcoran said those issues need to be addressed by policy makers, especially given the increased importance the construction industry is playing in the economy.

“Changes made to the macroprudential regulations and foreign investment rules, and speculation over tax changes like the GST, negative gearing and capital gains tax, and talk of imposing ‘value capture’ have the potential to cause perverse effects in 2016 along the eastern seaboard, and highlights just how susceptible the property market is to uncertainty in the policy environment,” Corcoran said.

“At the state level, improvements have been made in recent years to allow the market to better respond to conditions. But delays and uncertainty in the rezoning, planning and approvals processes mean volatility remains in-built in the industry, as it remains difficult to respond quickly to changes in demand, while up-front charges and levies remain too high,” he said.

.JPG)