Melbourne’s median house price rose by just under 2% during the final quarter of 2011, according to recently released figures from the REIV, while some of the state's regional house markets made significant gains.

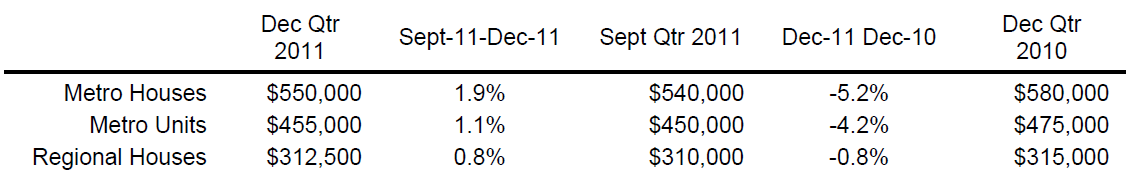

According to REIV December quarter data, Melbourne’s median house price rose by 1.9% to reach $550,000, while the regional Victorian median house in price saw a less spectacular rise of 0.8% ($312,500).

Melbourne’s unit market also saw a moderate improvement, with its median price increasing by 1.1% to reach $475,000.

While unspectacular, these quarterly results will come as welcome news to Victorian property investors following median price reductions in all three major market groups over the year.

According to the REIV, Melbourne’s housing market saw a -5.2% median price fall in the 12 months to December 2011, while units in the city saw a drop of -4.2%. The regional house market saw a gentler fall of -0.8% over the same period.

The improvement in Victoria’s property market was largely thanks to an increased demand for real estate and an improvement in housing affordability over the quarter, said REIV CEO Enzo Raimondo.

“As we head into 2012, there is no doubt that housing affordability has improved with the combination of lower house prices and two interest rate reductions,” said Raimondo.

He warned, however, that market conditions are not expected to pick up in the near future, with agents reporting that both buyers and sellers are holding out for improved economic conditions.

“REIV data confirmed that, overall, the median house price has not changed over the last six months. The key factors driving the current market are a combination of lower consumer confidence, a slowing state economy and an increase in supply,” said Raimondo.

Singling out some of Melbourne’s best performers, he noted that the strongest growth in demand for houses over the quarter was found in Kew, Prahran, Kensington, Mornington, Port Melbourne, Balwyn North, Blackburn, Wantirna South, West Footscray and Mount Waverley. However, “most of these suburbs recovered ground lost in the September quarter”.

In Melbourne’s unit market, the strongest demand was recorded in North Melbourne, Armadale and West Footscray.

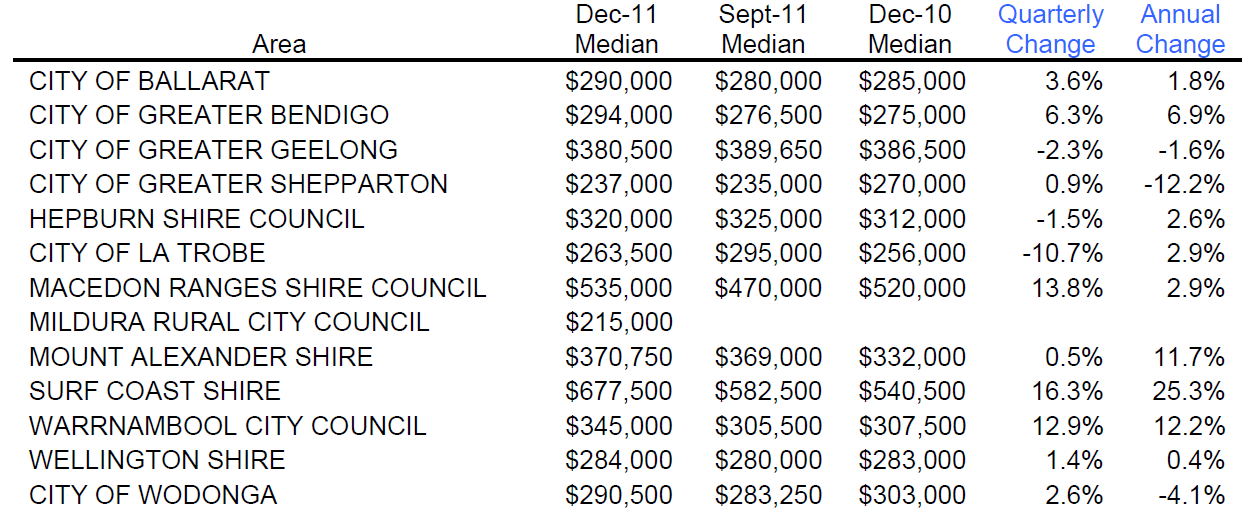

Regionally, the big winner was the Surf Coast Shire, with a quarterly median house price gain of 16.3% and an annual rise of 25.3%. The Macedon Ranges Shire Council area came in second, with a quarterly median house price rise of 13.8%.

“The corridor between Melbourne and Bendigo continues to record healthy demand, with prices increasing in Hepburn, Mount Alexander and Macedon Ranges,” said Raimondo.

He added that Victoria’s three major regional centres had mixed fortunes over the quarter, with Bendigo and Ballarat’s house markets recording gains of 6.3% and 3.6% respectively. This put Bendigo’s median house price at $294,000 and Ballarat’s at $290,000.

Geelong, however, saw a disappointing -2.3% fall, which brought its median house price down to $380,500.

Looking forward, the REIV predicts that the first quarter of 2012 won’t see any significant change in market conditions, as it’s traditionally the quarter when buying activity is at its quietest. However, Raimondo is cautiously optimistic that the second half of the year will bring better results.

“We are starting to see signs that the market may have bottomed in 2011 and, if there are improvements in economic conditions, we may see an improvement in transaction activity from the second quarter of this year,” he said.

The results

Source: REIV December 2011 quarter Property Update

Is Melbourne's property market bouncing back? Are Victoria’s regional hubs worth further investigation? Ask the property investment community on our property investment forum.

Related stories

Property to bounce back in 2012

Top factors that affected values in 2011

Housing becoming more affordable