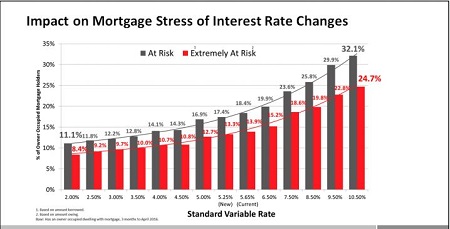

According to the latest State Of The Nation report from research house Roy Morgan, 18.4% of Australian mortgage holders are considered to be ‘at risk’, while 13.9% are considered to be at extreme risk.

Those ‘at risk’ are mortgage holders who face difficulty meeting their repayments based on their current income, while those who face difficulty meeting just their interest repayments are at ‘extreme risk.’

While those numbers may seem high, they do represent a decline since 2008 when mortgage stress levels were significantly higher.

In May 2008, 32.7% of Australian mortgage holders were classed as ‘at risk’, while 26.6% were considered at ‘extreme risk.’

Source: Roy Morgan

A decline in levels of mortgage stress may seem surprising given the fact that house prices in many markets have increased significantly in recent years; however Roy Morgan chief executive officer Michelle Levine said there has been one major reason as to why stress levels have declined.

“If we look at a comparison of household incomes and prices you can see that incomes haven’t kept up. Over the years from 2008 to about 2013 or 2014 you actually had incomes tracking, basically they were going up at the same rate,” Levine said.

“We’ve now got a situation where household incomes haven’t kept up with the value of homes. Obviously the median amount borrowed has also escalated,” she said.

“Interest rates coming down are the counterbalancing influence on the business of mortgage stress.”

Source: Roy Morgan

While mortgage stress is not too uncommon, it is not spread evenly across all households.

“Eighty-three per cent of people with a mortgage and a household income of $60,000 are at risk of being unable to pay their mortgage and 69% are at risk of being unable to pay their mortgage,” Levine said.

“It scales down very, very quickly to where for houses with an income of $150,000 plus mortgage stress is just not an issue.”

Source: Roy Morgan

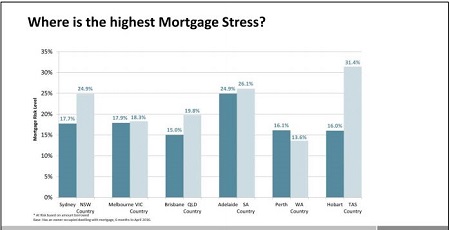

Across the country, regional Tasmania is home to the highest levels of mortgage stress.

Just under a third (31.4%) of households in regional Tasmania are experiencing mortgage stress according to the Roy Morgan figures, followed by regional South Australia where 26.1% of households are struggling to meet their commitments.

Of the capital cities, mortgage stress is most prevalent in Adelaide (24.9%), followed by Melbourne at 17.9%.

Source: Roy Morgan

.JPG)

.JPG)