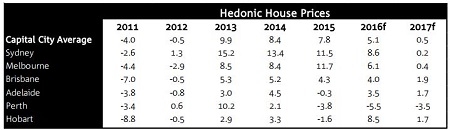

According to NAB’s Residential Property Survey for the June quarter, 2016 is set to see stronger than expected price growth, before a dramatic slowdown in growth eventuates in 2017.

The survey’s results show that NAB has revised its growth prediction for 2016 and expects house prices to grow by 5.1% during 2016 after their March quarter survey predicted growth of just 1.5%.

The increased growth expectations have been driven by continued strength in Sydney and Melbourne, which have seen double-digit growth in the year to June.

“Our upwards revisions in price forecasts reflects the strength in prices to date. Over the last six months, Sydney and Melbourne prices have increased by an annualised rate of nearly 19% and 12% respectively,” NAB chief economist Alan Oster said.

“However, while there is significant amount of uncertainty over the outlook for prices, we expect that this renewed momentum in the housing market is unlikely to be sustained over the longer term,” Oster said.

After prices grew 7.8% in 2015, 2016 looks to be close to the end of the growth cycle as house price growth of just 0.5% is predicted for 2017.

Source: NAB

According to NAB, affordability issues will impact demand from local buyers, while property tax increases will impact demand from foreign buyers, while construction levels indicate that there is likely to be strong supply of new housing in coming years.

Those factors, combined with a diminishing impact from low interest rates, will lead to the price growth slowdown.

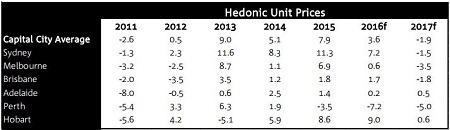

For the apartment market, the impact of those factors is set to be even more pronounced with price falls predicted for 2017.

An also revised 3.6% rate of growth nationally is expected for 2016, but only Adelaide (0.5%) and Hobart (0.6%) are predicted to see unit prices increase in 2017.

Nationally, apartment prices are predicted to fall 1.9% in 2017, with Perth the worst hit by a 5% decline.

Source: NAB

Melbourne is expected to see a 3.5% price fall in the multi-unit sector, while Sydney is predicted to see prices soften 1.9%.

There may be some chance Sydney’s price falls aren’t quite that pronounced, as its affordability issues in its house market pushes buyers into apartments.