These were the words, spoken by Credit Suisse analysts Hasan Tevfik and Damien Boey, that contributed to calls for a review of foreign investment protocol.

.jpg) The comment was part of a Credit Suisse report that estimated 18% of new homes in Sydney and 14% in Melbourne are being purchased by Chinese buyers.

The comment was part of a Credit Suisse report that estimated 18% of new homes in Sydney and 14% in Melbourne are being purchased by Chinese buyers.

The report showed that in the past seven years, Chinese buyers have invested $24 billion into the Australian property market, with $5.6 billion spent in NSW alone in 2013.

Credit Suisse also reported Chinese buyers were investing $5.4 billion per year in Australian real estate – buyers included investors, developers and temporary residents.

The recent report, which used data from the Australian Bureau of Statistics and the Foreign Investment Review Board, also predicted the Chinese could buy up to $44 billion worth of Australian real estate by 2020.

The report sparked calls for an inquiry into Australia’s current foreign investment framework to examine whether the objective of the policy – to create housing, was being met, or if an influx of Chinese and other foreign investors were squeezing local buyers out of the market.

Chair of the House Economics Committee Victorian Liberal MP Kelly O’Dwyer, told media the original mandate for foreign investment in residential real estate was to increase dwelling stocks and add jobs in the Australian construction industry and the inquiry will determine whether those aims are still being achieved.

"The Reserve Bank Governor made some comments in the recent parliamentary oversight hearing of the Economics Committee, where he said all foreign investment does have an effect on prices," she said.

"We want to know though whether or not the current laws and the current framework is being properly adhered to and whether it is a truly distorting impact.”

However, Australian China Business Council president Duncan Calder has shunned concern, saying Chinese investors have not squeezed out local buyers, but helped boost the Australian housing market – a sentiment backed by the Foreign Investment Review Board.

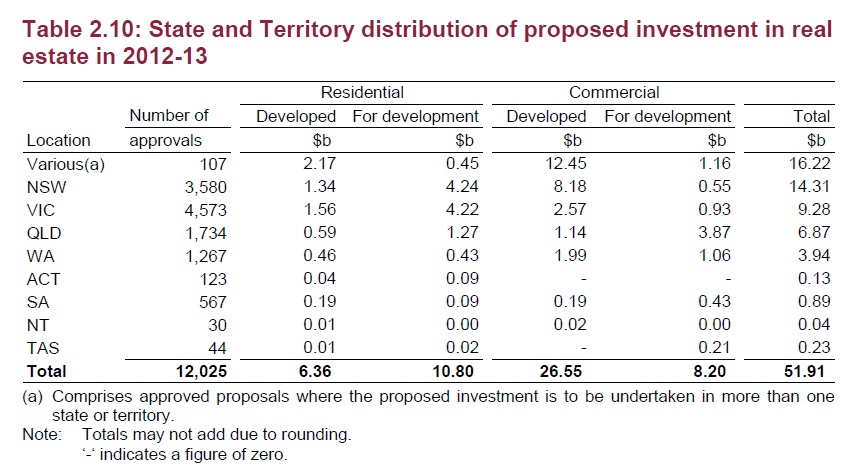

Recent Foreign Investment Review Boards statistics show a drop of 18% in overall foreign investment in the Australian property market in the past two years, prompting some to say concerns over foreign investment are being overblown.

The government will release the terms of reference for the inquiry tomorrow.

A snapshot of overseas investment:

Source:Foreign Investment Review Board.