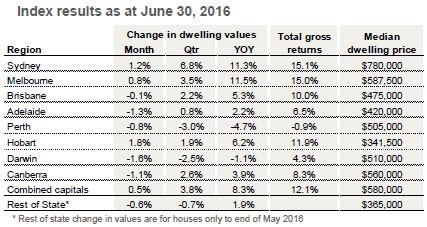

Released last week, CoreLogic’s June Home Value Index has revealed that Australia’s combined capital city median dwelling price rose 0.5% over the month to $580,000.

In the 12 months to the end of June, the combined capital city median is up 8.3%, however the June increase was modest compared to preceding months, something CoreLogic research head Tim Lawless said will be welcomed given continued concerns about the rate of house price growth in Australia.

“Importantly, the pace of capital gains in June was substantially lower than the April and May results when CoreLogic reported a 1.7%, and 1.6% month-on-month lift in capital city dwelling values,” Lawless said.

“The monthly growth rate reduction is likely to be very much welcomed by state and federal government policy makers and regulators who may be concerned about a sustained rebound in capital gains,” he said.

While June bought a rise in the combined capital city median price, conditions were not equal across the country with more evidence of a two-speed market in play.

Over June, prices rose 1.2% in Sydney, 0.8% in Melbourne and 1.8% in Hobart, while all over capital cities saw price falls over the month.

The biggest monthly fall was in Darwin where prices dipped 1.6%, followed by Adelaide hit with a 1.3% fall.

Prices dipped 1.1% in Canberra, while smaller falls 0.8% and 0.1% were seen in Perth and Brisbane respectively over the month.

Annual figures show an even further split with Sydney and Melbourne pulling even further ahead.

In the year to June, Melbourne’s median dwelling price has jumped 11.5%, while Sydney has seen a 11.3% year-on-year increase.

The next best yearly improvement is Hobart where the median dwelling price has improved 6.2%.

The yearly figures continue the bad news for Perth and Darwin, which are the only two markets where house prices are lower now than they were 12 months ago.

In Peth, the median dwelling price fell 4.7% in the year to June, while prices went backwards 1.1% in Darwin.

Source: CoreLogic

While Hobart is the surprise packet market over the past year, Lawless said that may be due to the Tasmanian capital’s affordability, rather than any real fundamental market change.

“While the higher rates of capital gains in Sydney and Melbourne can be tied back to strong economic conditions, and high rates of population growth, the same cannot be said for Hobart where economic conditions and migration rates are gradually improving from a low base,” he said.

“The strength in the Hobart market comes after a long period of underperformance, where home values in the city increased by only 1.4% per annum over the past ten years. Potentially, the Hobart housing market is being fuelled by the sheer affordability of housing and a renewed trend towards Melbourne and Sydney buyers unlocking their equity to make lifestyle housing purchases.”

But as affordability issues give Hobart a boost, they could soon have the opposite impact on the country’s strongest market.

“Some positive news for Sydney buyers is that there are early signs that Sydney’s housing market may be starting to turn in favour of the buyer,” Lawless said.

“We’re seeing homes in the city taking longer to sell and vendors are starting to offer larger discounts on their asking prices in order to make a sale. The typical Sydney home is now taking 40 days to sell compared with 26 days a year ago and discounting rates have risen from 5.5% a year ago to 5.6%.”

“In balance, Australia’s two largest cities are facing increased affordability challenges that are likely to negatively impact the trajectory of dwelling values and activity as more prospective buyers are blocked from the market.”